Expansion of Health and Wellness Programs

The proliferation of health and wellness programs across South America significantly influences the vitamin test market. Organizations, including corporations and educational institutions, are increasingly implementing wellness initiatives aimed at improving employee and student health. These programs often incorporate regular health screenings, including vitamin tests, to monitor nutritional status and promote overall well-being. As a result, the demand for vitamin testing services is expected to rise, with an estimated increase of 15% in corporate wellness spending projected for the upcoming year. This trend not only enhances awareness of vitamin deficiencies but also encourages individuals to take proactive steps towards better health, thereby driving growth in the vitamin test market.

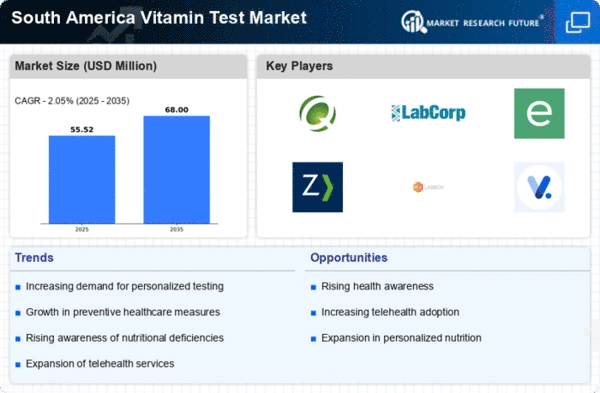

Increasing Demand for Preventive Healthcare

The vitamin test market in South America experiences a notable surge in demand driven by a growing emphasis on preventive healthcare. Consumers are increasingly aware of the importance of maintaining optimal health and preventing diseases through regular health assessments. This trend is reflected in the rising number of individuals seeking vitamin testing services, as they aim to identify deficiencies and tailor their dietary habits accordingly. According to recent data, the preventive healthcare sector in South America is projected to grow at a CAGR of approximately 8% over the next five years. This growth is likely to bolster the vitamin test market, as healthcare providers and laboratories expand their offerings to meet the needs of health-conscious consumers.

Rising Incidence of Nutritional Deficiencies

The vitamin test market in South America is significantly impacted by the rising incidence of nutritional deficiencies among the population. Factors such as changing dietary patterns, urbanization, and economic disparities contribute to a growing prevalence of vitamin deficiencies, particularly in vulnerable groups. Recent studies indicate that approximately 30% of the population in certain regions may suffer from vitamin D deficiency, while others face similar challenges with vitamins A and B12. This alarming trend has prompted healthcare professionals to advocate for regular vitamin testing as a means of identifying and addressing these deficiencies. Consequently, the vitamin test market is likely to expand as more individuals seek testing services to ensure adequate nutrient intake and overall health.

Technological Innovations in Testing Methods

Technological advancements play a crucial role in shaping the vitamin test market in South America. Innovations in testing methods, such as the development of at-home testing kits and mobile health applications, are making vitamin testing more accessible and convenient for consumers. These technologies allow individuals to monitor their vitamin levels without the need for extensive laboratory visits, thereby increasing the likelihood of regular testing. The market for at-home health testing is projected to grow by 20% in the next two years, indicating a shift towards more consumer-friendly testing solutions. As these innovations continue to evolve, they are expected to drive the vitamin test market forward, catering to the needs of a tech-savvy population.

Government Initiatives Promoting Nutritional Awareness

Government initiatives aimed at promoting nutritional awareness significantly influence the vitamin test market in South America. Various health departments are launching campaigns to educate the public about the importance of vitamins and minerals in maintaining health. These initiatives often include free or subsidized vitamin testing programs, particularly in underserved communities, to encourage individuals to assess their nutritional status. As a result, there is a growing awareness of the need for regular vitamin testing, which is likely to drive demand in the market. Recent reports suggest that government spending on public health initiatives is expected to increase by 10% in the coming year, further supporting the growth of the vitamin test market.