Expansion of Smart Cities

The development of smart cities in South Korea is a critical driver for the 5g industrial-iot market. As urban areas increasingly integrate technology to improve infrastructure and services, the demand for connected devices and systems is expected to rise. The South Korean government has committed substantial investments, estimated at over $2 billion, to enhance urban connectivity and implement smart solutions. This initiative includes the deployment of 5G networks, which are essential for supporting the vast number of IoT devices required for smart city applications. The integration of 5G technology into urban planning is likely to create new opportunities for the 5g industrial-iot market, as it enables efficient traffic management, energy consumption monitoring, and public safety enhancements.

Rising Demand for Automation

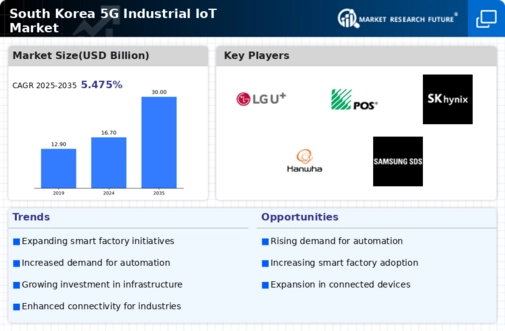

The 5g industrial-iot market in South Korea is experiencing a notable surge in demand for automation across various sectors. Industries are increasingly adopting automated solutions to enhance operational efficiency and reduce labor costs. This trend is driven by the need for real-time data processing and analytics, which 5G technology facilitates. According to recent estimates, the automation market in South Korea is projected to grow at a CAGR of approximately 15% over the next five years. This growth is likely to propel the adoption of 5G industrial-iot solutions, as businesses seek to integrate advanced technologies such as AI and machine learning into their operations. Consequently, the 5g industrial-iot market is poised to benefit significantly from this rising demand for automation, as companies strive to remain competitive in an evolving landscape.

Growing Cybersecurity Concerns

As the 5g industrial-iot market expands, so do the concerns regarding cybersecurity. The increasing interconnectivity of devices raises the potential for cyber threats, prompting industries to prioritize security measures. In South Korea, the government has recognized the importance of cybersecurity in the context of industrial IoT and has initiated various programs to enhance security protocols. Investments in cybersecurity solutions are expected to reach approximately $1 billion by 2027, reflecting the growing awareness of the need to protect critical infrastructure. This focus on cybersecurity is likely to drive the demand for secure 5G industrial-iot solutions, as companies seek to mitigate risks associated with data breaches and cyberattacks.

Increased Focus on Industry 4.0

The 5g industrial-iot market is significantly influenced by the growing emphasis on Industry 4.0 in South Korea. This paradigm shift towards digital transformation in manufacturing is characterized by the integration of IoT, AI, and big data analytics. As industries strive to optimize production processes and enhance supply chain management, the role of 5G technology becomes increasingly vital. The South Korean manufacturing sector is projected to invest approximately $5 billion in digital transformation initiatives by 2026. This investment is likely to drive the adoption of 5G industrial-iot solutions, as companies seek to leverage real-time data for decision-making and operational improvements. The alignment of Industry 4.0 with 5G capabilities presents a promising landscape for the growth of the 5g industrial-iot market.

Advancements in Telecommunications Infrastructure

The ongoing advancements in telecommunications infrastructure in South Korea are a pivotal driver for the 5g industrial-iot market. The country has made significant strides in deploying 5G networks, with coverage reaching over 90% of urban areas. This robust infrastructure is essential for supporting the high-speed, low-latency communication required for industrial IoT applications. As businesses increasingly rely on connected devices for monitoring and control, the availability of reliable 5G connectivity is likely to enhance the adoption of industrial IoT solutions. Furthermore, the South Korean government has set ambitious goals to expand 5G coverage to rural areas, which could further stimulate the growth of the 5g industrial-iot market by enabling more industries to leverage advanced connectivity.