Rising Demand for Automation

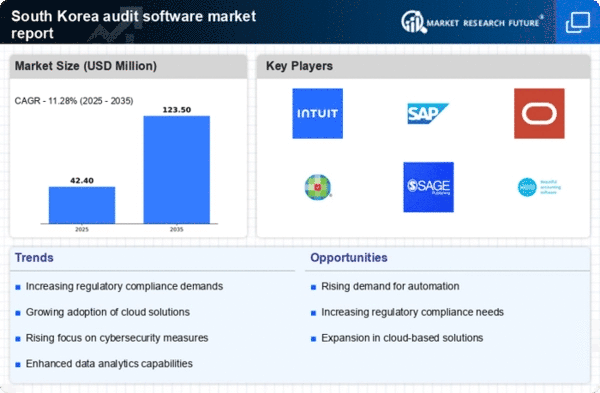

the audit software market is experiencing a notable surge in demand for automation tools, driven by the need for efficiency and accuracy in financial reporting. Organizations in South Korea are increasingly adopting automated solutions to streamline their auditing processes, thereby reducing human error and enhancing productivity. According to recent data, the automation segment is projected to grow at a CAGR of 15% over the next five years. This trend indicates a shift towards more sophisticated software that can handle complex data analysis and reporting tasks. As businesses seek to optimize their operations, the audit software market is likely to benefit from this growing preference for automated solutions.

Regulatory Compliance Pressures

In South Korea, the audit software market is significantly influenced by stringent regulatory compliance requirements. Companies are compelled to adhere to various financial regulations, which necessitates the use of advanced auditing tools to ensure compliance. The increasing complexity of regulations, such as the International Financial Reporting Standards (IFRS), has led to a heightened demand for software that can facilitate accurate reporting and compliance checks. It is estimated that the compliance segment of the audit software market will account for approximately 30% of total market revenue by 2026. This driver underscores the critical role of audit software in helping organizations navigate the evolving regulatory landscape.

Increased Focus on Cybersecurity

the audit software market is influenced by the growing emphasis on cybersecurity in South Korea. With the rise in cyber threats, organizations are prioritizing the protection of sensitive financial data. This focus on cybersecurity drives the demand for audit software that includes robust security features, such as encryption and access controls. Companies are seeking solutions that not only facilitate auditing but also ensure the integrity and confidentiality of their data. As a result, the cybersecurity aspect of audit software is expected to gain traction, potentially accounting for 20% of the market share by 2026. This trend highlights the dual role of audit software in enhancing both compliance and security.

Technological Advancements in Data Analytics

Technological advancements in data analytics are reshaping the audit software market, particularly in South Korea. The integration of artificial intelligence (AI) and machine learning (ML) into auditing tools enhances the ability to analyze large datasets efficiently. This capability allows auditors to identify anomalies and trends that may not be apparent through traditional methods. As organizations increasingly recognize the value of data-driven insights, the demand for sophisticated audit software that incorporates these technologies is likely to grow. It is projected that the data analytics segment will represent a substantial portion of the market, potentially reaching 25% of total sales by 2027.

Growth of Small and Medium Enterprises (SMEs)

The proliferation of small and medium enterprises (SMEs) in South Korea is a significant driver for the audit software market. As SMEs continue to expand, their need for robust financial management and auditing solutions becomes increasingly apparent. These businesses often lack the resources for extensive in-house auditing teams, making audit software an attractive option. Recent statistics indicate that SMEs contribute to over 50% of the national GDP, highlighting their importance in the economy. Consequently, the demand for user-friendly and cost-effective audit software solutions tailored for SMEs is expected to rise, further propelling market growth.