Rising Demand for Digital Content

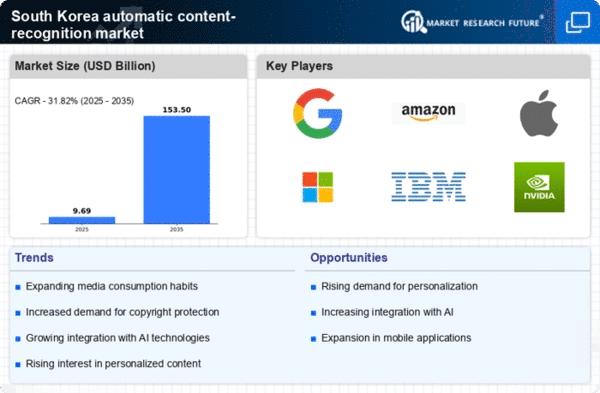

The increasing consumption of digital content in South Korea is a primary driver for the automatic content-recognition market. With a significant rise in online streaming platforms and social media usage, the need for effective content identification and management solutions has surged. In 2025, the digital content market in South Korea is projected to reach approximately $10 billion, indicating a robust growth trajectory. This demand necessitates advanced technologies that can accurately recognize and manage content across various platforms, thereby enhancing user experience and compliance with copyright regulations. As more businesses and content creators seek to protect their intellectual property, the automatic content-recognition market is likely to expand, providing essential tools for content identification and rights management.

Government Initiatives and Regulations

Government policies and regulations in South Korea are increasingly focusing on the protection of intellectual property rights, which significantly impacts the automatic content-recognition market. The South Korean government has implemented various initiatives aimed at combating copyright infringement and promoting fair use of digital content. These regulations create a favorable environment for the adoption of automatic content-recognition technologies, as businesses seek to comply with legal requirements. In 2025, it is estimated that compliance-related expenditures in the media and entertainment sector will account for over 15% of total operational costs. Consequently, the automatic content-recognition market is positioned to benefit from these regulatory frameworks, as companies invest in solutions that ensure adherence to copyright laws.

Increased Focus on Data Privacy and Security

The heightened emphasis on data privacy and security in South Korea is influencing the automatic content-recognition market. With the implementation of stricter data protection regulations, businesses are compelled to adopt technologies that ensure compliance while safeguarding user information. The automatic content-recognition market is likely to see increased demand for solutions that not only recognize content but also protect sensitive data. In 2025, it is anticipated that spending on data security measures will rise by over 25% across various sectors. This focus on privacy and security may drive innovation within the automatic content-recognition market, as companies seek to develop solutions that align with regulatory requirements while maintaining user trust.

Technological Advancements in Machine Learning

Technological advancements in machine learning and artificial intelligence are propelling the automatic content-recognition market forward in South Korea. Innovations in algorithms and data processing capabilities enable more accurate and efficient content recognition, which is crucial for various applications, including media monitoring and copyright enforcement. In 2025, the machine learning sector in South Korea is expected to grow by approximately 20%, reflecting the increasing integration of these technologies into business operations. As companies leverage machine learning to enhance their content-recognition capabilities, the demand for sophisticated solutions in the automatic content-recognition market is likely to rise, fostering a competitive landscape that encourages continuous improvement and innovation.

Growth of E-commerce and User-Generated Content

The expansion of e-commerce platforms and the proliferation of user-generated content in South Korea are driving the automatic content-recognition market. As more consumers engage with online shopping and share content on social media, businesses face challenges in managing and recognizing this vast array of digital assets. In 2025, the e-commerce market in South Korea is projected to exceed $100 billion, highlighting the need for effective content management solutions. Automatic content-recognition technologies can assist businesses in identifying and categorizing user-generated content, thereby enhancing marketing strategies and customer engagement. This trend suggests a growing reliance on automatic content-recognition solutions to navigate the complexities of digital content in the e-commerce landscape.