Consumer Privacy Concerns

Consumer privacy concerns are increasingly influencing the big data-pharmaceutical-advertising market. In South Korea, heightened awareness regarding data privacy has prompted pharmaceutical companies to adopt more transparent data collection practices. This shift is essential for maintaining consumer trust and compliance with regulations. Companies that prioritize consumer privacy are likely to see improved brand loyalty and customer retention. Research suggests that 70% of consumers are more inclined to engage with brands that demonstrate a commitment to protecting their personal information. As privacy concerns continue to shape consumer behavior, the pharmaceutical advertising strategies must adapt accordingly to remain effective.

Technological Advancements

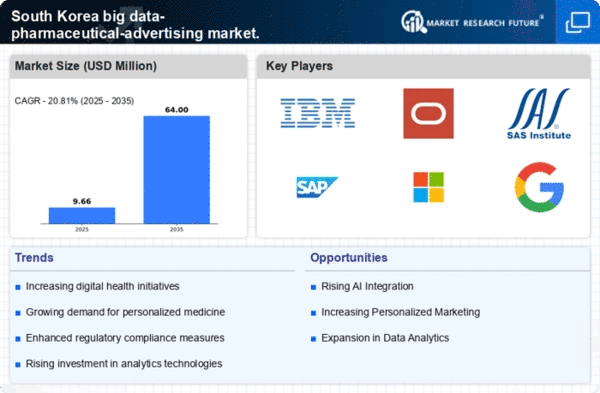

Technological advancements play a crucial role in the evolution of the big data-pharmaceutical-advertising market. Innovations in artificial intelligence (AI) and machine learning are enabling pharmaceutical companies in South Korea to analyze vast amounts of data more efficiently. These technologies facilitate the identification of trends and patterns that inform advertising strategies. For instance, AI-driven tools can predict consumer behavior, allowing for more targeted marketing efforts. The integration of these technologies is expected to enhance the effectiveness of advertising campaigns, potentially leading to a market growth rate of 15% annually. As technology continues to advance, its impact on the advertising landscape will likely intensify.

Competitive Market Dynamics

The competitive dynamics within the pharmaceutical sector are a significant driver of the big data-pharmaceutical-advertising market. In South Korea, numerous pharmaceutical companies are vying for market share, leading to increased investment in advertising strategies that leverage big data. This competition compels companies to innovate and differentiate their offerings, often resulting in more effective marketing campaigns. As firms strive to capture consumer attention, the use of big data analytics becomes essential for understanding market trends and consumer preferences. The competitive landscape is expected to intensify, with companies that effectively utilize data analytics likely to gain a competitive edge.

Data-Driven Decision Making

The increasing reliance on data-driven decision making is a pivotal driver in the big data-pharmaceutical-advertising market. Pharmaceutical companies in South Korea are leveraging advanced analytics to enhance their marketing strategies. By utilizing big data, these companies can identify consumer preferences and tailor their advertising efforts accordingly. This approach not only improves customer engagement but also optimizes marketing expenditures. Reports indicate that companies employing data analytics in their advertising strategies have seen a return on investment (ROI) increase of up to 30%. As the market continues to evolve, the emphasis on data-driven insights is likely to grow, further solidifying its role in shaping advertising campaigns.

Regulatory Compliance and Adaptation

Regulatory compliance and adaptation are critical factors influencing the big data-pharmaceutical-advertising market. In South Korea, stringent regulations govern the advertising practices of pharmaceutical companies, necessitating a careful approach to data usage. Companies must navigate these regulations while still leveraging big data to inform their marketing strategies. This balancing act can drive innovation, as firms develop new methods to comply with regulations while maximizing the effectiveness of their advertising efforts. The ability to adapt to regulatory changes is likely to become a key differentiator in the market, influencing how companies approach their advertising strategies.