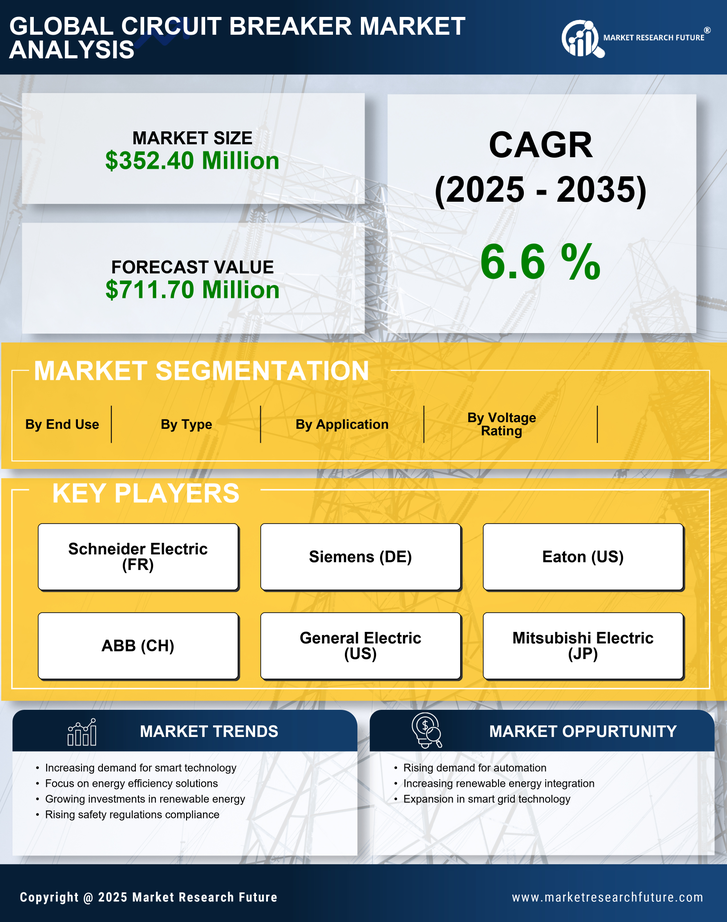

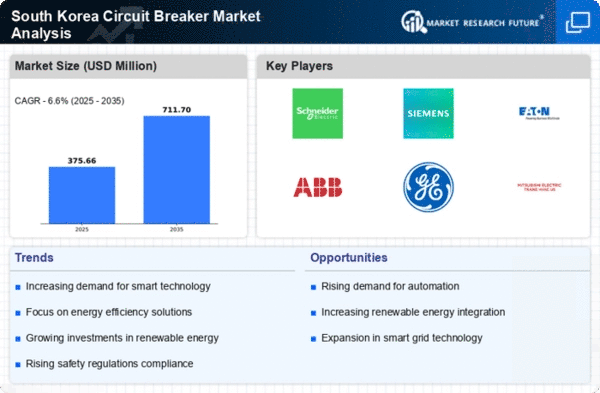

Growing Renewable Energy Sector

The burgeoning renewable energy sector in South Korea is significantly influencing the circuit breaker market. As the country aims to increase its reliance on renewable sources, such as solar and wind energy, the demand for specialized circuit breakers that can handle variable loads and ensure system stability is on the rise. This shift is projected to contribute to a market growth of around 9% as new installations and upgrades to existing systems become necessary. The circuit breaker market is responding by developing products tailored for renewable applications, ensuring compatibility with diverse energy sources. This trend not only supports the transition to sustainable energy but also enhances the overall reliability of electrical systems in the face of fluctuating energy inputs.

Increased Focus on Safety Standards

The circuit breaker market in South Korea is witnessing a heightened emphasis on safety standards, driven by both regulatory bodies and consumer expectations. Recent updates to safety regulations have mandated stricter compliance for electrical installations, compelling manufacturers to innovate and enhance their product offerings. This shift is likely to result in a market growth of around 6% as companies invest in research and development to meet these new standards. The circuit breaker market is adapting by introducing products that not only comply with regulations but also exceed safety expectations, thereby gaining consumer trust. Furthermore, the increasing incidence of electrical fires and accidents has raised awareness about the importance of reliable circuit breakers, further propelling market growth.

Rising Demand for Energy Efficiency

The circuit breaker market in South Korea is experiencing a notable surge in demand for energy-efficient solutions. As industries and consumers alike become increasingly aware of energy consumption, the need for advanced circuit breakers that minimize energy loss is paramount. This trend is further supported by government initiatives aimed at promoting energy efficiency, which could potentially lead to a market growth rate of approximately 8% annually. The circuit breaker market is thus adapting to these demands by innovating products that not only enhance safety but also contribute to lower energy bills for users. Furthermore, the integration of smart technologies into circuit breakers is likely to enhance their appeal, as they offer real-time monitoring and control, aligning with the broader push for sustainable energy practices.

Infrastructure Development Initiatives

In South Korea, ongoing infrastructure development initiatives are significantly impacting the circuit breaker market. The government has allocated substantial budgets for upgrading electrical grids and expanding urban infrastructure, which necessitates the installation of reliable circuit breakers. This investment is projected to reach approximately $10 billion over the next five years, creating a robust demand for circuit breakers that can support new construction and modernization projects. The circuit breaker market is poised to benefit from this trend, as new installations and retrofitting of existing systems require advanced circuit protection solutions. Additionally, the focus on enhancing grid resilience against natural disasters further emphasizes the need for high-quality circuit breakers, ensuring safety and reliability in electrical systems.

Technological Integration in Electrical Systems

The integration of advanced technologies into electrical systems is reshaping the circuit breaker market in South Korea. The rise of smart grids and IoT-enabled devices necessitates circuit breakers that can communicate and operate seamlessly within these systems. This technological evolution is expected to drive a market expansion of approximately 7% as manufacturers develop circuit breakers that offer enhanced functionalities, such as remote monitoring and automated fault detection. The circuit breaker market is thus focusing on creating products that not only provide traditional protection but also integrate with modern electrical infrastructure. This trend reflects a broader shift towards smarter, more efficient energy management solutions, aligning with global technological advancements.