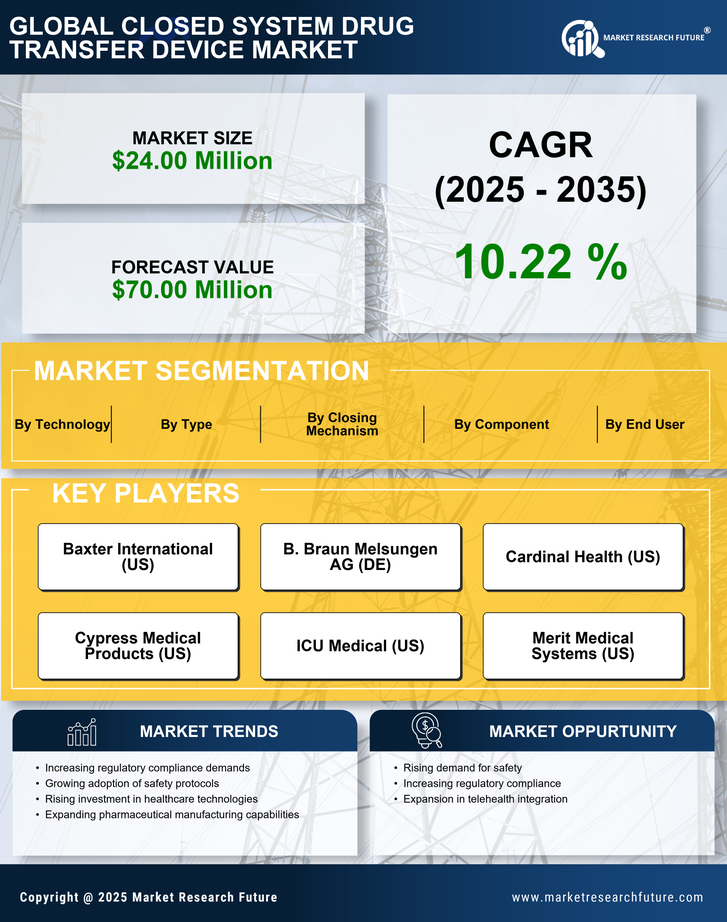

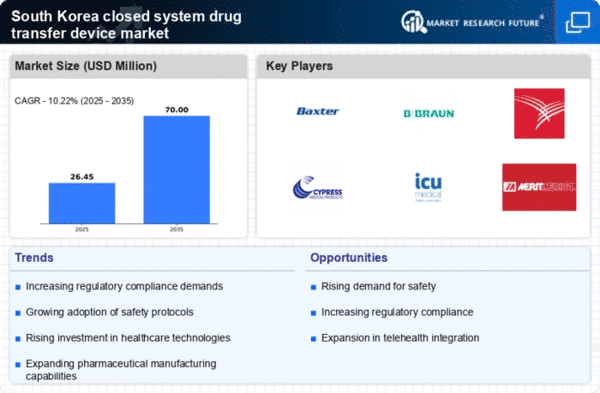

The closed system-drug-transfer-device market in South Korea is characterized by a competitive landscape that is increasingly shaped by innovation, regulatory compliance, and strategic partnerships. Key players such as Baxter International (US), B. Braun Melsungen AG (DE), and ICU Medical (US) are actively pursuing strategies that emphasize technological advancements and market expansion. Baxter International (US) has focused on enhancing its product portfolio through continuous innovation, while B. Braun Melsungen AG (DE) has prioritized regional expansion to strengthen its market presence. ICU Medical (US) appears to be leveraging strategic partnerships to enhance its distribution capabilities, thereby influencing the competitive dynamics of the market.

The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The market structure is moderately fragmented, with several players vying for market share. However, the collective influence of these key players is significant, as they drive advancements in product development and regulatory compliance, which are crucial for maintaining competitive advantage.

In October 2025, Baxter International (US) announced the launch of a new closed system-drug-transfer-device designed to enhance safety and efficiency in drug administration. This strategic move is likely to reinforce Baxter's position as a leader in innovation within the market, catering to the growing demand for safer drug delivery systems. The introduction of this device may also serve to address regulatory pressures and improve patient outcomes, thereby solidifying Baxter's competitive edge.

In September 2025, B. Braun Melsungen AG (DE) expanded its manufacturing capabilities in South Korea by investing in a new facility dedicated to the production of closed system-drug-transfer-devices. This investment not only signifies B. Braun's commitment to the South Korean market but also enhances its ability to meet local demand more effectively. The establishment of this facility is expected to streamline operations and reduce lead times, which could be pivotal in a market that values efficiency and reliability.

In August 2025, ICU Medical (US) entered into a strategic partnership with a local distributor to enhance its market reach in South Korea. This collaboration is anticipated to improve ICU Medical's distribution network, allowing for better access to healthcare providers and hospitals. By aligning with a local partner, ICU Medical may effectively navigate regulatory challenges and cultural nuances, thereby positioning itself more favorably in the competitive landscape.

As of November 2025, the closed system-drug-transfer-device market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence (AI) in product development. Strategic alliances are increasingly shaping the competitive environment, as companies seek to leverage complementary strengths. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is becoming evident. Moving forward, competitive differentiation will likely hinge on the ability to innovate and adapt to evolving market demands, ensuring that companies remain at the forefront of this dynamic industry.