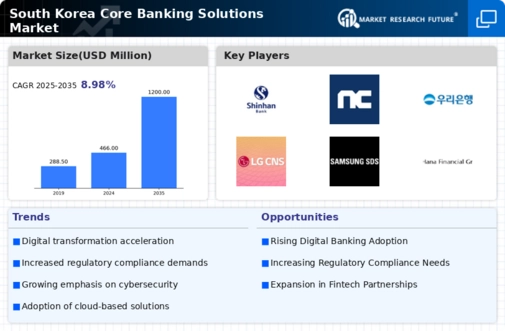

The quick digital transformation of the financial industry is driving notable changes in the South Korea Core Banking Solutions Market. Banks have modernized their fundamental banking systems as a result of the nation's strong emphasis on implementing cutting-edge technology and improving the client experience. The South Korean government's efforts to support fintech innovation, which incentivize financial institutions to modernize their IT infrastructure, have a significant impact on this change. Customers' preference for smooth and immediate banking services is driving up demand for real-time processing capabilities.

Additionally, banks are making significant investments in robust and secure core banking systems in response to the increase in cybersecurity risks, guaranteeing both regulatory compliance and the safety of consumer data. As demands for mobile and digital banking solutions are fueled by the expanding middle class and rising smartphone adoption, there are several opportunities in the South Korean industry. Banks are being pressured to provide more individualized services and user-friendly interfaces due to the growing number of younger, tech-savvy customers.

Additionally, the government's assistance for SMEs gives core banking providers more leeway to customize their offerings to satisfy these companies' fintech requirements. Customization is a trend that banks can use to improve their services and better serve their wide range of customers. Utilizing the advantages of scalability and cost-effectiveness, South Korean banks have recently been more prominent in their transition to cloud-based core banking systems.

South Korean banks are putting themselves in a position to quickly incorporate cutting-edge solutions as more fintech alliances form. A collaborative atmosphere is also being fostered by the adoption of open banking legislation, allowing outside developers to produce apps that improve conventional banking services. All things considered, these patterns show how a dynamic market is adjusting to changing consumer preferences and technical realities, paving the way for a more integrated financial ecosystem in South Korea.