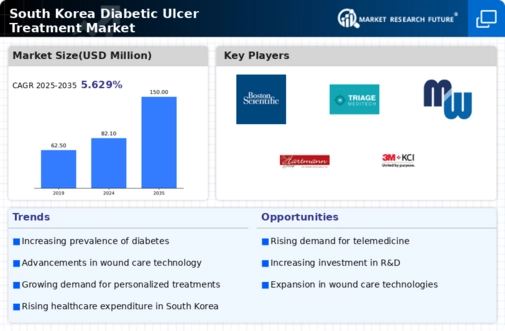

Rising Healthcare Expenditure

The diabetic ulcer-treatment market is significantly influenced by the rising healthcare expenditure in South Korea. As the government allocates more funds towards healthcare, the availability of advanced treatment options increases. In 2023, healthcare spending in South Korea reached approximately $200 billion, with a notable portion directed towards chronic disease management, including diabetes-related complications. This financial commitment facilitates the development and accessibility of new therapies and technologies in the diabetic ulcer-treatment market. Additionally, increased patient awareness and demand for better treatment options further contribute to the market's expansion, as individuals seek effective solutions for managing their conditions.

Supportive Regulatory Framework

A supportive regulatory framework in South Korea positively impacts the diabetic ulcer treatment market. The government has implemented policies that encourage research and development in the healthcare sector, particularly for chronic diseases like diabetes. Regulatory bodies are streamlining the approval processes for new treatments, which facilitates quicker access to innovative therapies for patients. This supportive environment not only fosters the growth of the diabetic ulcer-treatment market but also attracts investments from pharmaceutical companies looking to develop effective solutions for diabetic complications. As a result, the market is likely to see a surge in new product launches and treatment options.

Advancements in Wound Care Technologies

Advancements in wound care technologies are propelling the diabetic ulcer treatment market. Innovations such as bioengineered skin substitutes and advanced dressings are transforming the treatment landscape for diabetic ulcers. In South Korea, the introduction of these technologies has shown promising results in improving healing rates and reducing infection risks. For instance, the use of hydrocolloid dressings has been associated with a 30% faster healing time compared to traditional methods. As these technologies continue to evolve, they are expected to play a pivotal role in enhancing treatment outcomes within the diabetic ulcer-treatment market.

Growing Awareness and Education Programs

The diabetic ulcer-treatment market is benefiting from enhanced awareness and education programs aimed at both healthcare professionals and patients. Initiatives by various health organizations in South Korea focus on educating individuals about diabetes management and the importance of early intervention for foot ulcers. These programs have reportedly increased patient engagement and adherence to treatment protocols, which is crucial for preventing complications. As awareness grows, the demand for specialized treatment options in the diabetic ulcer-treatment market is likely to rise, leading to a more informed patient population that actively seeks out effective therapies.

Increasing Prevalence of Diabetic Foot Complications

The diabetic ulcer-treatment market is experiencing growth due to the rising prevalence of diabetic foot complications in South Korea. Statistics indicate that approximately 15% of individuals with diabetes develop foot ulcers, which can lead to severe health issues if not treated promptly. This alarming trend necessitates effective treatment options, thereby driving demand within the diabetic ulcer-treatment market. Furthermore, the aging population in South Korea, which is projected to reach 40% by 2060, exacerbates the situation as older adults are more susceptible to diabetes and its complications. Consequently, healthcare providers are increasingly focusing on innovative treatment solutions to address this growing concern.