Rising Fuel Cell Applications

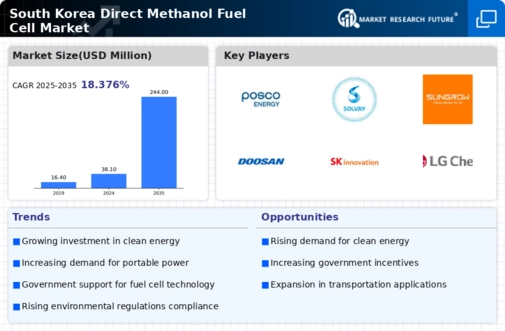

The direct methanol-fuel-cell market is bolstered by the increasing applications of fuel cells across various sectors in South Korea. Industries such as transportation, portable electronics, and stationary power generation are increasingly integrating fuel cell technologies. For instance, the transportation sector is projected to grow at a CAGR of 15% through 2027, with direct methanol fuel cells being a viable option for electric vehicles. This diversification of applications not only enhances market penetration but also encourages research and development in the direct methanol-fuel-cell market, leading to improved efficiency and cost-effectiveness.

Increasing Environmental Regulations

The direct methanol-fuel-cell market is experiencing growth due to stringent environmental regulations in South Korea. The government has implemented policies aimed at reducing greenhouse gas emissions, which has led to a heightened demand for cleaner energy solutions. As industries face pressure to comply with these regulations, the adoption of direct methanol fuel cells, known for their low emissions, becomes more appealing. In 2025, the South Korean government aims to reduce emissions by 30% from 2018 levels, which could drive investments in this technology. Thus, the direct methanol-fuel-cell market is positioned to benefit from these regulatory frameworks as companies seek to innovate and transition towards sustainable energy sources.

Growing Investment in Renewable Energy

The direct methanol-fuel-cell market is likely to benefit from the increasing investment in renewable energy sources in South Korea. The government has set ambitious targets for renewable energy, aiming for 20% of the energy mix by 2030. This shift towards renewables is expected to create a favorable environment for the adoption of direct methanol fuel cells, which can utilize renewable methanol as a fuel source. As investments in renewable infrastructure grow, the direct methanol-fuel-cell market may see enhanced opportunities for collaboration and development, potentially leading to a more sustainable energy landscape.

Technological Innovations in Fuel Cell Design

Technological advancements play a crucial role in the direct methanol-fuel-cell market, particularly in South Korea. Innovations in fuel cell design, such as improved catalysts and membrane technologies, are enhancing the performance and efficiency of direct methanol fuel cells. These advancements are expected to reduce production costs and increase the overall viability of fuel cells as a competitive energy source. In 2025, the market anticipates a 20% reduction in manufacturing costs due to these innovations, which could significantly boost adoption rates across various industries. The direct methanol-fuel-cell market stands to gain from these technological breakthroughs, making it a more attractive option for energy solutions.

Consumer Awareness and Demand for Sustainable Solutions

Consumer awareness regarding environmental issues is rising in South Korea, which is positively impacting the direct methanol-fuel-cell market. As individuals and businesses become more conscious of their carbon footprints, there is a growing demand for sustainable energy solutions. This shift in consumer behavior is prompting companies to explore cleaner alternatives, including direct methanol fuel cells. Market Research Future indicates that 65% of consumers in South Korea are willing to pay a premium for eco-friendly products, which could drive the adoption of direct methanol fuel cells in various applications. The direct methanol-fuel-cell market is thus likely to thrive as it aligns with the evolving preferences of environmentally conscious consumers.