Increased Focus on Patient Safety

Patient safety remains a paramount concern within the drug infusion-system market in South Korea. The rise in medication errors and adverse drug events has prompted healthcare providers to adopt more stringent safety protocols. As a result, infusion systems that incorporate safety features, such as dose error reduction systems and alarm functionalities, are gaining traction. Regulatory bodies are also emphasizing the need for enhanced safety measures, which is likely to drive the adoption of advanced infusion systems. In 2025, it is estimated that around 30% of healthcare facilities in South Korea will implement new safety protocols related to drug infusion systems. This focus on patient safety not only enhances treatment outcomes but also fosters trust in healthcare providers, thereby positively impacting the drug infusion-system market.

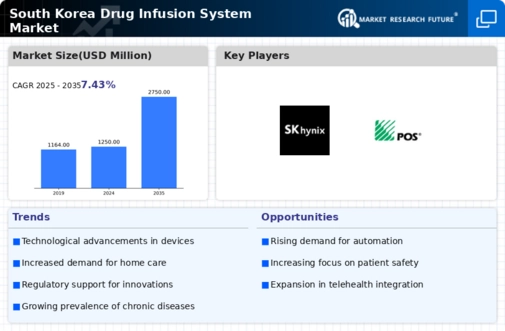

Advancements in Infusion Technology

Technological advancements are significantly influencing the drug infusion-system market in South Korea. Innovations such as smart infusion pumps, which offer enhanced precision and safety features, are becoming increasingly prevalent. These devices are equipped with advanced software that allows for real-time monitoring and data collection, thereby reducing the risk of medication errors. The infusion technology segment is expected to account for over 40% of the market share by 2026, reflecting the growing reliance on sophisticated devices in clinical settings. Furthermore, the integration of IoT capabilities into infusion systems is anticipated to facilitate better patient management and streamline workflows in healthcare facilities. As hospitals and clinics seek to improve operational efficiency, the demand for advanced infusion technologies is likely to surge, propelling growth in the drug infusion-system market.

Rising Prevalence of Chronic Diseases

The drug infusion-system market in South Korea is significantly impacted by the rising prevalence of chronic diseases. Conditions such as diabetes, cancer, and cardiovascular diseases are becoming increasingly common, necessitating effective management strategies that often involve infusion therapies. As of 2025, it is estimated that over 25% of the population is living with at least one chronic condition, leading to a higher demand for drug infusion systems. This trend is likely to drive innovation in infusion technologies, as healthcare providers seek to offer more effective and personalized treatment options. Furthermore, the increasing burden of chronic diseases is expected to prompt healthcare systems to invest in advanced infusion solutions, thereby fostering growth in the drug infusion-system market.

Rising Demand for Home Healthcare Solutions

The drug infusion-system market in South Korea is experiencing a notable increase in demand for home healthcare solutions. This trend is driven by an aging population and a growing preference for at-home treatments. As of 2025, approximately 15% of the population is aged 65 and older, leading to a higher incidence of chronic diseases that require continuous medication. Home infusion systems provide patients with the convenience of receiving treatment in their own environment, which is often associated with improved patient satisfaction and adherence to therapy. The market for home healthcare is projected to grow at a CAGR of 8% over the next five years, indicating a robust opportunity for drug infusion-system manufacturers to innovate and cater to this segment. This shift towards home-based care is likely to reshape the landscape of the drug infusion-system market in South Korea.

Growing Investment in Healthcare Infrastructure

The drug infusion-system market in South Korea is benefiting from increased investment in healthcare infrastructure. The government has allocated substantial funds to enhance healthcare facilities and expand access to advanced medical technologies. In 2025, healthcare expenditure is projected to reach approximately $200 billion, with a significant portion directed towards upgrading medical equipment, including drug infusion systems. This investment is expected to improve the quality of care and increase the availability of modern infusion technologies in hospitals and clinics. Additionally, the establishment of specialized infusion centers is likely to create new opportunities for market players. As healthcare infrastructure continues to evolve, the drug infusion-system market is poised for growth, driven by enhanced capabilities and improved patient care.