Rising Energy Demand

The increasing energy demand in South Korea is a pivotal driver for the floating solar-panels market. As the nation continues to industrialize and urbanize, the need for sustainable energy sources becomes more pressing. The floating solar-panels market is poised to benefit from this trend, as these systems can be deployed on water bodies, thus conserving land while generating electricity. According to recent data, South Korea's energy consumption is projected to rise by approximately 2.5% annually, necessitating innovative solutions. Floating solar panels, with their ability to harness solar energy efficiently, could potentially contribute to meeting this growing demand, thereby enhancing energy security and reducing reliance on fossil fuels.

Technological Innovations

Technological innovations are transforming the floating solar-panels market, making it more efficient and cost-effective. Advances in photovoltaic technology, such as bifacial solar panels and improved floating structures, are enhancing energy output and reducing installation costs. The floating solar-panels market is witnessing a shift towards more sophisticated designs that can withstand harsh weather conditions and optimize energy capture. As these technologies continue to evolve, they are expected to attract greater investment and interest from both public and private sectors. The potential for increased efficiency and lower costs could significantly boost the market's growth trajectory in South Korea.

Water Resource Management

The management of water resources is increasingly becoming a priority in South Korea, particularly in the context of climate change and urbanization. The floating solar-panels market can play a significant role in this regard, as these systems can be installed on reservoirs and lakes, thereby reducing evaporation and improving water quality. By utilizing existing water bodies for energy generation, floating solar panels can contribute to sustainable water management practices. This dual benefit of energy production and water conservation is likely to resonate with policymakers and stakeholders, further driving the adoption of floating solar technologies in the region.

Government Support and Policies

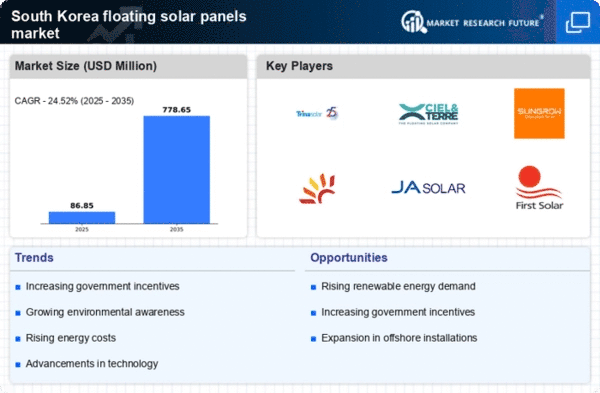

Government support plays a crucial role in the development of the floating solar-panels market. South Korea's commitment to renewable energy is evident through various policies and incentives aimed at promoting clean energy technologies. The floating solar-panels market is likely to benefit from subsidies, tax incentives, and grants that encourage investment in renewable energy projects. For instance, the government has set ambitious targets to increase the share of renewables in the energy mix to 20% by 2030. This supportive regulatory framework not only fosters innovation but also attracts private investments, thereby accelerating the deployment of floating solar technologies across the nation.

Environmental Awareness and Sustainability

Growing environmental awareness among consumers and businesses is driving the floating solar-panels market. In South Korea, there is a heightened focus on sustainability and reducing carbon footprints. The floating solar-panels market aligns well with these values, as it offers a clean energy solution that minimizes land use and preserves natural habitats. Public sentiment is increasingly favoring renewable energy sources, and this shift is likely to influence corporate strategies and investment decisions. As more organizations commit to sustainability goals, the demand for floating solar technologies is expected to rise, further propelling market growth.