Advancements in Medical Technology

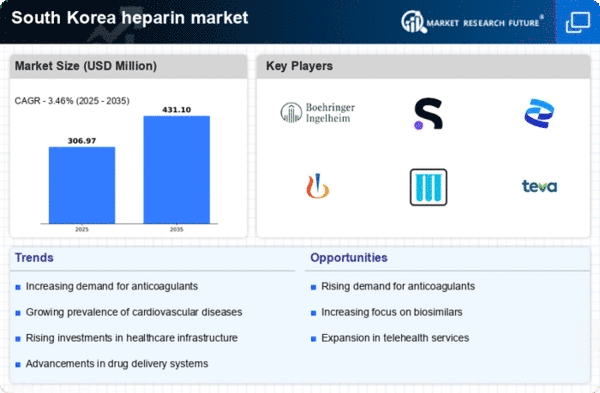

Technological advancements in the medical field are influencing the heparin market in South Korea. Innovations in drug delivery systems and monitoring devices enhance the efficacy and safety of heparin administration. For instance, the development of low molecular weight heparins has improved patient outcomes and compliance. The South Korean healthcare system is increasingly adopting these advanced technologies, which may lead to a higher utilization of heparin products. Furthermore, the integration of digital health solutions, such as telemedicine and electronic health records, facilitates better management of anticoagulant therapies, potentially driving the heparin market forward. As healthcare providers embrace these innovations, the demand for heparin is expected to grow.

Increasing Cardiovascular Diseases

The prevalence of cardiovascular diseases in South Korea is on the rise, which appears to be a significant driver for the heparin market. According to health statistics, cardiovascular diseases account for a substantial portion of mortality rates, leading to an increased demand for anticoagulants like heparin. As healthcare providers seek effective treatments, the heparin market is likely to experience growth. The South Korean government has also initiated various health programs aimed at reducing cardiovascular risks, which may further boost the market. With an aging population and lifestyle changes contributing to these health issues, the heparin market is positioned to expand as more patients require anticoagulant therapies.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in South Korea is a crucial driver for the heparin market. With the government investing in new hospitals and clinics, access to healthcare services is improving, which may lead to increased patient consultations and treatments. Enhanced healthcare facilities are likely to adopt advanced anticoagulant therapies, including heparin, to manage various medical conditions effectively. Furthermore, the integration of specialized cardiovascular units within hospitals may facilitate the use of heparin in clinical settings. As the healthcare infrastructure continues to develop, the heparin market is expected to benefit from a growing patient base and enhanced treatment capabilities.

Rising Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among the South Korean population, which appears to be influencing the heparin market. As individuals become more informed about the risks associated with thromboembolic disorders, the demand for preventive anticoagulant therapies is likely to increase. Public health campaigns and educational initiatives are promoting the importance of early intervention, which may lead to higher prescriptions of heparin. This trend is further supported by healthcare professionals advocating for proactive management of cardiovascular health. Consequently, the heparin market may experience growth as more patients seek preventive treatments to mitigate their risk of developing serious health conditions.

Regulatory Support for Anticoagulant Therapies

Regulatory frameworks in South Korea are becoming more supportive of anticoagulant therapies, which could positively impact the heparin market. The Ministry of Food and Drug Safety has streamlined the approval process for new heparin formulations, encouraging pharmaceutical companies to invest in research and development. This regulatory environment may lead to an influx of innovative heparin products, catering to diverse patient needs. Additionally, the government’s focus on improving healthcare access and affordability may further stimulate the market. As more healthcare providers adopt heparin therapies, the heparin market is likely to witness substantial growth, driven by both regulatory support and increased patient access.