Growing Aging Population

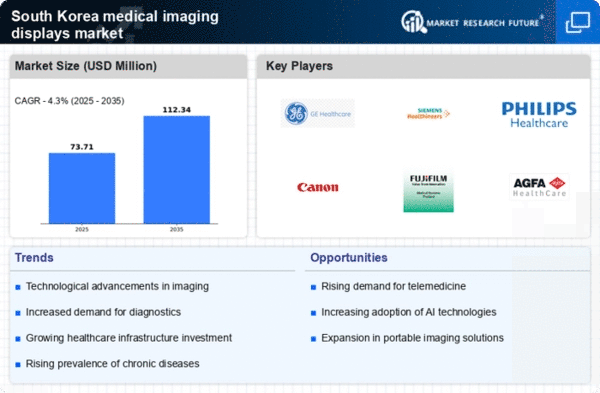

The demographic shift towards an aging population in South Korea is significantly impacting the medical imaging-displays market. As the population aged 65 and over is expected to reach 20% by 2025, there is a corresponding increase in the prevalence of age-related health issues. This demographic trend necessitates enhanced diagnostic capabilities, leading to a higher demand for advanced imaging displays. Hospitals and healthcare facilities are likely to invest in superior imaging technologies to cater to the needs of older patients, who often require more frequent medical evaluations. Consequently, the medical imaging-displays market is poised for growth as healthcare providers seek to improve diagnostic accuracy and patient care for this expanding demographic.

Rising Healthcare Expenditure

The medical imaging-displays market in South Korea is experiencing growth due to the increasing healthcare expenditure. The South Korean government has been investing heavily in healthcare infrastructure, which includes advanced imaging technologies. In 2025, healthcare spending is projected to reach approximately 9.5% of the GDP, indicating a robust commitment to enhancing medical services. This financial support facilitates the acquisition of high-quality imaging displays, which are essential for accurate diagnostics. Furthermore, as hospitals and clinics upgrade their facilities, the demand for state-of-the-art imaging displays is likely to rise, thereby driving market growth. The emphasis on improving patient outcomes through better imaging solutions aligns with the overall trend of increasing healthcare investments in the region.

Expansion of Telemedicine Services

The expansion of telemedicine services in South Korea is emerging as a key driver for the medical imaging-displays market. With the rise of remote consultations and digital health platforms, there is a growing need for high-quality imaging displays that can facilitate accurate remote diagnostics. Telemedicine allows healthcare providers to reach patients in remote areas, thereby increasing the demand for imaging technologies that can be utilized in virtual consultations. As of 2025, it is estimated that telemedicine services will account for approximately 15% of all healthcare consultations in South Korea. This trend suggests a significant opportunity for the medical imaging-displays market, as healthcare providers invest in technologies that support telehealth initiatives.

Technological Integration in Healthcare

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into the medical imaging-displays market is transforming the landscape of healthcare in South Korea. These technologies enhance the capabilities of imaging displays, allowing for improved image analysis and interpretation. As healthcare providers increasingly adopt AI-driven solutions, the demand for high-resolution imaging displays that can support these technologies is likely to grow. In 2025, it is anticipated that the market for AI in medical imaging will reach approximately $2 billion, further driving the need for compatible imaging displays. This trend indicates a shift towards more sophisticated diagnostic tools, which could potentially enhance patient outcomes and operational efficiency in healthcare settings.

Increased Focus on Preventive Healthcare

The medical imaging-displays market is benefiting from a growing emphasis on preventive healthcare in South Korea. As awareness of health issues rises, individuals are more inclined to undergo regular health screenings and diagnostic imaging. This shift towards preventive measures is prompting healthcare facilities to invest in advanced imaging technologies that provide clearer and more accurate results. The South Korean government has also been promoting initiatives aimed at early detection of diseases, which further fuels the demand for high-quality imaging displays. As a result, the market is likely to see an uptick in sales as healthcare providers seek to meet the increasing demand for preventive diagnostic services.