Growing Demand for Outsourcing

The preclinical cro market is witnessing a notable shift towards outsourcing among pharmaceutical and biotechnology companies in South Korea. This trend is largely attributed to the need for cost efficiency and access to specialized expertise. By outsourcing preclinical research, companies can focus on their core competencies while leveraging the advanced capabilities of CROs. In 2025, it is estimated that around 60% of preclinical studies will be outsourced, reflecting a significant increase from previous years. This growing demand for outsourcing is expected to drive the expansion of the preclinical cro market, as organizations seek to optimize their research processes and reduce time-to-market for new therapies.

Advancements in Research Technologies

Technological advancements are playing a pivotal role in shaping the preclinical cro market in South Korea. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and high-throughput screening is revolutionizing the way preclinical studies are conducted. These innovations enable CROs to enhance the accuracy and efficiency of their research, thereby reducing the time and costs associated with drug development. In 2025, it is projected that the adoption of advanced research technologies will contribute to a 30% increase in the productivity of preclinical studies. This trend not only benefits CROs but also accelerates the overall drug discovery process, making it a crucial driver for the preclinical cro market.

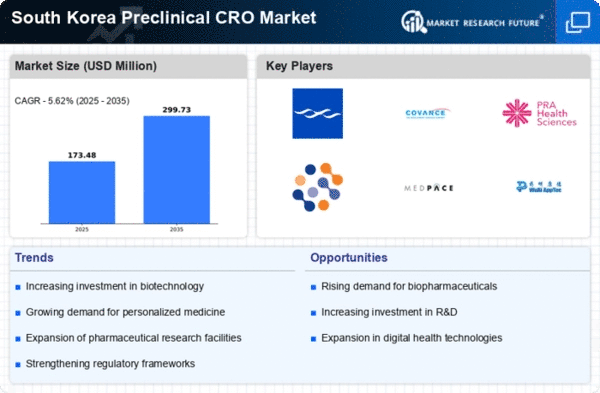

Rising Investment in Biopharmaceuticals

The preclinical cro market in South Korea is experiencing a surge in investment, particularly in the biopharmaceutical sector. This trend is driven by the increasing demand for innovative therapies and the need for efficient drug development processes. In 2025, the biopharmaceutical market in South Korea is projected to reach approximately $10 billion, indicating a robust growth trajectory. As companies seek to expedite their research and development efforts, the reliance on preclinical contract research organizations (CROs) is likely to intensify. This investment influx not only enhances the capabilities of preclinical CROs but also fosters collaborations between academic institutions and industry players, thereby enriching the overall ecosystem of the preclinical cro market.

Increased Focus on Regulatory Compliance

Regulatory compliance remains a critical driver for the preclinical cro market in South Korea. As the regulatory landscape evolves, companies are compelled to adhere to stringent guidelines to ensure the safety and efficacy of their products. The South Korean government has implemented various initiatives to streamline the approval process for new drugs, which in turn influences the operations of preclinical CROs. In 2025, it is anticipated that compliance-related services will constitute approximately 25% of the total revenue generated by the preclinical cro market. This emphasis on regulatory compliance not only enhances the credibility of CROs but also instills confidence among stakeholders in the drug development process.

Emergence of Startups and Innovation Hubs

The preclinical cro market in South Korea is witnessing the emergence of numerous startups and innovation hubs, which are fostering a dynamic research environment. These entities are often focused on niche areas of drug development, providing specialized services that cater to the unique needs of clients. The proliferation of startups is indicative of a vibrant entrepreneurial ecosystem, which is expected to contribute to the growth of the preclinical cro market. By 2025, it is estimated that startups will account for approximately 15% of the total market share, highlighting their increasing influence. This influx of innovative companies not only enhances competition but also drives advancements in research methodologies and practices within the preclinical cro market.