Market Share

Soy Based Chemicals Market Share Analysis

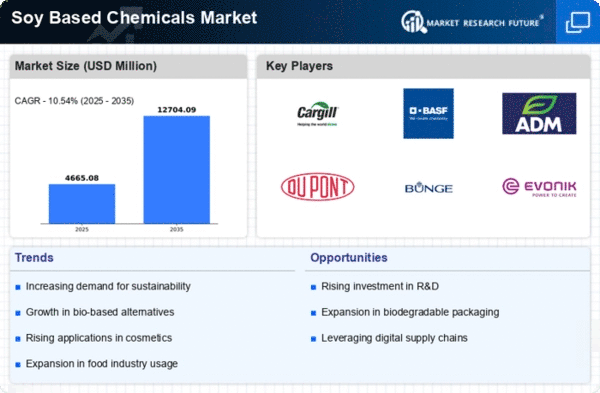

The Soy-Based Chemicals Market, a large bio-based chemicals market, uses a variety of market share positioning methods to establish a strong presence in a competitive landscape. A main strategy is to highlight soy-based compounds' eco-friendliness and inexhaustibility. Companies in this sector emphasize using soy as a sustainable feedstock for chemicals, polymers, and glues. These companies attract new customers and gain market share by positioning themselves as prominent proponents of bio-based alternatives.

Development and technological advancements affect Soy-Based Chemicals market share. To boost soy-based synthetic production productivity, cleanliness, and flexibility, companies innovate. Innovative extraction and maturation methods, atomic modification methods, and soy-based chemical applications may be created. By staying ahead of mechanical progress, companies may fulfill customers' changing needs and lead in providing cutting-edge solutions, increasing their market share.

Another crucial mechanism involves coordinated activities and partnerships with buyer product manufacturers, rural associations, and exploration organizations. Shaping alliances allows companies to share assets, access complementary skills, and address obstacles in the emergence and reception of soy-based synthetic arrangements. These organizations promote industry standards and allow market pioneers to shape the market. Companies strengthen their market position and gain an edge through collaboration, increasing market share.

Maintenance and eco-friendly practices are crucial to Soy-Based Chemicals market share. Organizations that promote sustainable purchasing, production, and bio-based solutions attract naturally aware customers and organizations. This method supports the global focus on maintainability and positions companies as industry leaders, increasing their market share.

Market share is affected by effective marketing and communication of soy-based chemical benefits. Companies that effectively communicate their goods' benefits, such as reduced petroleum use, carbon footprint, and biodegradability, can stand out in a competitive market. Establishing a character's strengths like reliability, adaptability, and manageability builds customer trust and loyalty, increasing market share.

Geological extension and item contribution expansion are key Soy-Based Chemicals market share positioning factors. Organizations investigate local and corporate opportunities to capitalize on the growing need for affordable choices. This recalls approaching new markets with a focus on green innovations and establishing a strong presence in high-reception regions. Growing their market reach allows companies to capitalize on varied customer bases and adapt to changing market factors, gaining market share.

Leave a Comment