Market Trends

Key Emerging Trends in the Soy Based Chemicals Market

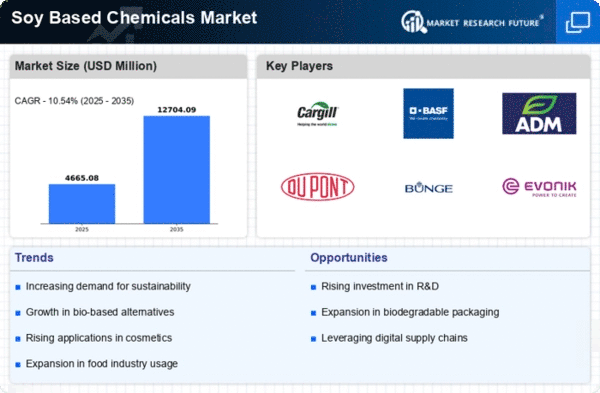

The Soy-Based Chemicals Market is experiencing remarkable trends caused by variables including the growing interest in economical and plant-based alternatives, the growing bio-based chemicals sector, and the growing emphasis on eco-friendly arrangements. Inexhaustible and biodegradable soybean-based compounds are used in plastics, cements, and greases.

The bio-based and viable synthetic pattern drives Soy-Based Chemicals Market patterns. Alternatives to petrochemicals include soybean-based compounds, which are readily available and sustainable. Bio-based chemicals align with global efforts to reduce petroleum derivative use and mitigate compound formation.

The plastics industry is crucial to soy-based chemical interest. Polyurethane froths are made from soybean oil polyols. These froths find development, auto, and bundling uses. Soy-based polyols' ability to improve polyurethane material presentation is increasing their use in plastics.

For its role in providing sustainable cements and sealants, the Soy-Based Chemicals Market is gaining attention. Although less environmentally friendly, soy-based cements perform similarly to glues. Soy-based cements are becoming more popular as companies seek eco-friendly alternatives due to their limitless supply and minimal emissions.

Technological advances in handling and purifying soy-based compounds are shaping market trends. Improved extraction and washing cycles boost soy-based chemical output and performance. Innovative effort is improving the quality and usability of soy-based products, expanding their usage in many industries.

The consumer trend toward sustainable and plant-based products also affects the Soy-Based Chemicals Market. Practical, non-exhaustible products are becoming more popular as purchasers grow more mindful of their environmental impact. Soy-based chemicals, which are plant-based and biodegradable, appeal to eco-conscious consumers.

The circular economy, which emphasizes waste reduction and reuse, is boosting the Soy-Based Chemicals Market. Biodegradable, unlimited soy-based chemicals meet circular economy guidelines by providing options that may be reused or returned to the environment without harming.

Market fluctuations reflect global economic factors on the Soy-Based Chemicals Market. Economic factors including growth, production, and consumer spending affect soy-based chemical demand throughout end-use applications. Financial fluctuations can affect market aspects, forcing producers to adapt and provide market opportunities.

Leave a Comment