Rising Health Consciousness

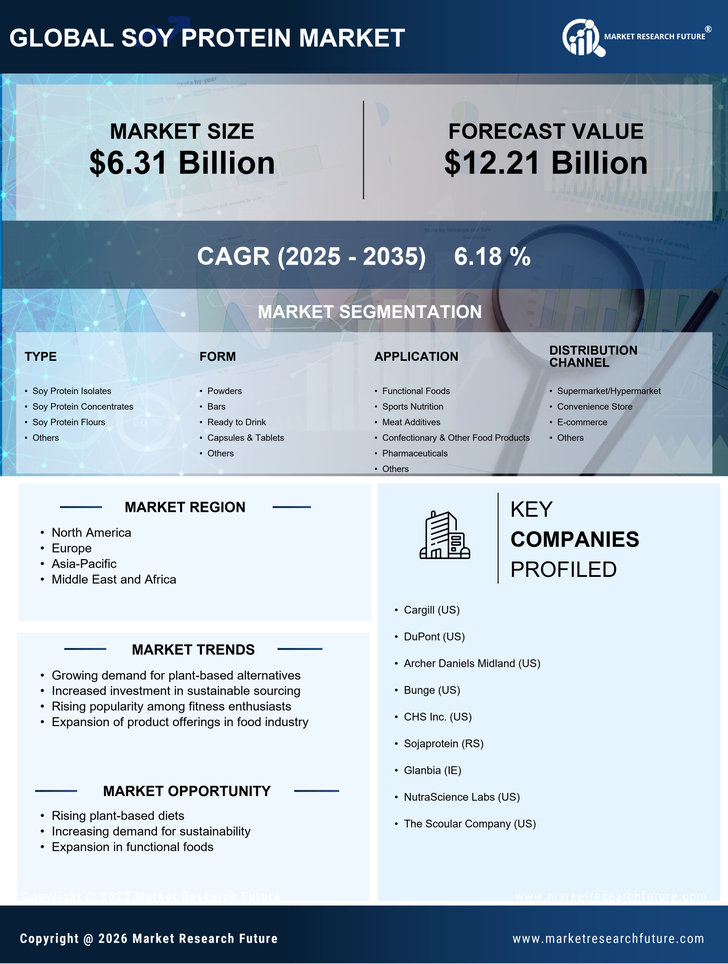

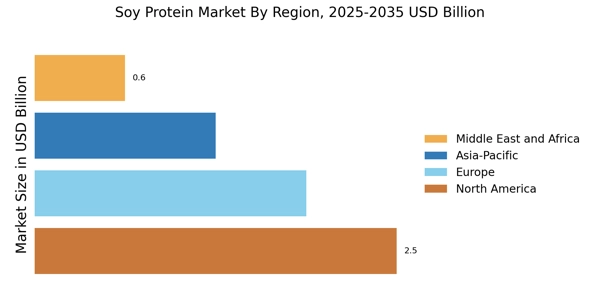

The increasing awareness of health and wellness among consumers appears to be a pivotal driver for the Soy Protein Market. As individuals seek healthier dietary options, the demand for plant-based proteins, particularly soy protein, has surged. Research indicates that soy protein is rich in essential amino acids and offers various health benefits, including cholesterol reduction and improved heart health. In 2025, the market for soy protein is projected to reach approximately 2.5 billion USD, reflecting a compound annual growth rate of around 6.5%. This trend suggests that consumers are gravitating towards soy protein as a viable alternative to animal-based proteins, thereby propelling the growth of the Soy Protein Market.

Increased Adoption in Food Products

The incorporation of soy protein into a diverse array of food products is likely to bolster the Soy Protein Market. Manufacturers are increasingly utilizing soy protein in snacks, dairy alternatives, and meat substitutes, catering to the evolving preferences of health-conscious consumers. For instance, the plant-based meat segment has witnessed a remarkable growth rate, with soy protein serving as a primary ingredient in many formulations. This trend is indicative of a broader shift towards plant-based diets, which is expected to continue driving the demand for soy protein. In 2025, the soy protein market is anticipated to account for a substantial share of the overall plant-based protein market, further solidifying its position within the Soy Protein Market.

Technological Advancements in Processing

Technological innovations in the processing of soy protein are anticipated to enhance the quality and functionality of soy protein products, thereby benefiting the Soy Protein Market. Advances in extraction and processing techniques have led to the development of high-quality soy protein isolates and concentrates that offer improved taste and texture. These innovations are likely to attract a broader consumer base, including those who may have previously been hesitant to adopt soy protein due to taste concerns. As processing technologies continue to evolve, the Soy Protein Market may witness an influx of new product offerings that cater to diverse consumer preferences, further driving market growth.

Sustainability and Environmental Concerns

The growing emphasis on sustainability and environmental stewardship is influencing consumer choices, thereby impacting the Soy Protein Market. As awareness of the environmental impact of animal agriculture rises, many consumers are seeking sustainable protein sources. Soy protein, being plant-based, is perceived as a more environmentally friendly option compared to traditional animal proteins. This shift in consumer behavior is likely to drive the demand for soy protein, as it aligns with the values of eco-conscious consumers. Furthermore, the Soy Protein Market is expected to benefit from initiatives aimed at promoting sustainable agricultural practices, which could enhance the appeal of soy protein as a responsible dietary choice.

Regulatory Support for Plant-Based Proteins

Regulatory frameworks that support the development and marketing of plant-based proteins are likely to play a crucial role in shaping the Soy Protein Market. Governments and regulatory bodies are increasingly recognizing the benefits of plant-based diets and are implementing policies that promote the consumption of plant proteins. This support may include funding for research and development, as well as initiatives aimed at educating consumers about the advantages of plant-based nutrition. As these regulatory measures take effect, the Soy Protein Market could experience accelerated growth, as consumers are encouraged to explore soy protein as a nutritious and sustainable dietary option.