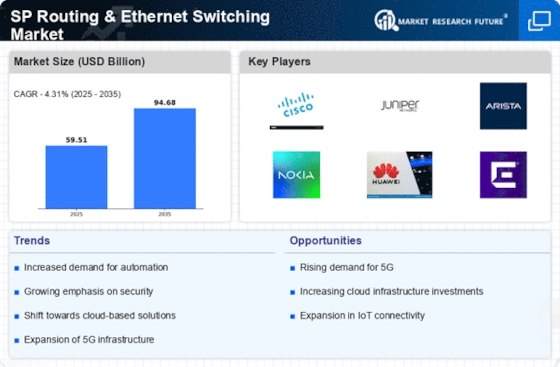

Adoption of 5G Technology

The rollout of 5G technology is significantly influencing the SP Routing & Ethernet Switching Market. With its promise of ultra-low latency and high-speed connectivity, 5G is expected to transform various sectors, including telecommunications, healthcare, and transportation. This technological advancement necessitates the deployment of advanced routing and switching solutions to manage the increased data traffic effectively. As service providers upgrade their infrastructure to support 5G networks, the demand for sophisticated Ethernet switches and routing equipment is likely to rise. This shift presents a substantial opportunity for growth within the SP Routing & Ethernet Switching Market, as companies strive to leverage the benefits of next-generation connectivity.

Emergence of Smart Cities

The development of smart cities is driving innovation within the SP Routing & Ethernet Switching Market. As urban areas increasingly integrate technology to enhance public services and infrastructure, the demand for reliable and efficient networking solutions intensifies. Smart city initiatives often rely on interconnected devices and systems, which require robust routing and switching capabilities to ensure seamless communication. The investment in smart city projects is expected to reach significant levels, further propelling the need for advanced Ethernet switching and routing technologies. This trend indicates a promising avenue for growth in the SP Routing & Ethernet Switching Market, as municipalities seek to modernize their infrastructure.

Increased Demand for Bandwidth

The SP Routing & Ethernet Switching Market is experiencing a surge in demand for bandwidth due to the proliferation of data-intensive applications. As organizations increasingly rely on cloud services, video streaming, and IoT devices, the need for robust network infrastructure becomes paramount. According to recent data, the global data traffic is projected to grow exponentially, necessitating advanced routing and switching solutions. This trend compels service providers to invest in high-capacity Ethernet switches and routing technologies to accommodate the escalating data flow. Consequently, the SP Routing & Ethernet Switching Market is poised for growth as businesses seek to enhance their network capabilities to meet consumer expectations.

Growing Focus on Network Security

In an era where cyber threats are becoming more sophisticated, the SP Routing & Ethernet Switching Market is witnessing a heightened focus on network security. Organizations are increasingly prioritizing the protection of their data and infrastructure, leading to the adoption of advanced security features in routing and switching solutions. This trend is reflected in the growing market for secure Ethernet switches, which are designed to mitigate risks associated with unauthorized access and data breaches. As businesses recognize the importance of safeguarding their networks, the demand for secure routing and switching technologies is likely to escalate, thereby driving growth in the SP Routing & Ethernet Switching Market.

Shift Towards Software-Defined Networking (SDN)

The transition to Software-Defined Networking (SDN) is reshaping the SP Routing & Ethernet Switching Market. SDN offers enhanced flexibility and control over network resources, allowing organizations to optimize their operations and reduce costs. As businesses seek to streamline their network management processes, the adoption of SDN solutions is expected to increase. This shift not only facilitates better resource allocation but also enables rapid deployment of new services. The growing interest in SDN is likely to drive demand for compatible routing and switching technologies, positioning the SP Routing & Ethernet Switching Market for substantial growth as organizations embrace this innovative approach to networking.