Space Food Size

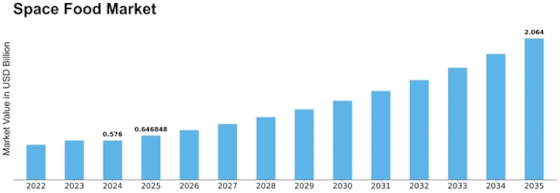

Space Food Market Growth Projections and Opportunities

The space food market is impelled by the raising financing from privately owned businesses and legislative organizations that upholds the development of room investigation missions. The requirement for creative food answers for help space explorers all through expanded missions, including long-length visits to the Moon and Mars, propels the improvement of trustworthy and powerful food situation equipped for enduring the afflictions of room conditions while at the same time satisfying space explorers' dietary necessities. Mechanical progressions are affecting the space food industry through the upgrade of bundling, safeguarding, and food handling techniques. Mechanical progressions, for example, 3D printing empower the arrangement of customized dinners for space explorers, while environmental practices like aqua-farming and bioreactors relate to the rising accentuation on independence in space and the decrease of reliance on Earth-based assets. The improvement of room food items that are healthfully thick, lightweight, and minimal is being changed by these turns of events. Quality, dietary benefit, and wellbeing apply a significant effect on the space food industry. It is essential to guarantee the safeguarding and wellbeing of food under outrageous circumstances like microgravity and radiation openness. To keep up with dietary trustworthiness, this requires broad testing, examination concerning improved bundling materials, and food safeguarding procedures. Keeping a harmony among nourishment and flavour while complying with wellbeing guidelines is the main impetus behind development in this market. The assembling of specific nourishment for space travellers and the cost concentrated nature of room missions present monetary deterrents for the space food industry. Both public and confidential associations are pursuing the advancement of financially savvy food creation methods that don't think twice about, dietary benefit, or quality. Partner joint efforts — including those between research organizations, aviation organizations, food makers, and space offices — advance advancement in the space food industry. For space food arrangements, public-private organizations work with innovation move and speed up development. Market factors are impacted by customer inclinations and a human-driven way to deal with space food. It is basic to understand many social foundations and dietary inclinations to foster menus that advance the psychological prosperity of space explorers and guarantee the progress of their missions. The space food industry is dependent upon different determinants, including the extension of investigation, mechanical advancement, security concerns, monetary impediments, and a human-driven approach. Thus, there is a continuous requirement for inventive arrangements that are economical, nutritious, and strong.

Leave a Comment