Spain 5G Fixed Wireless Access Market Overview

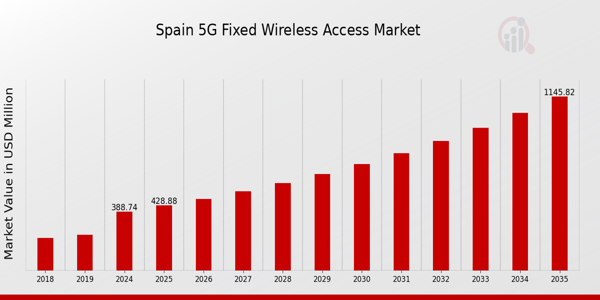

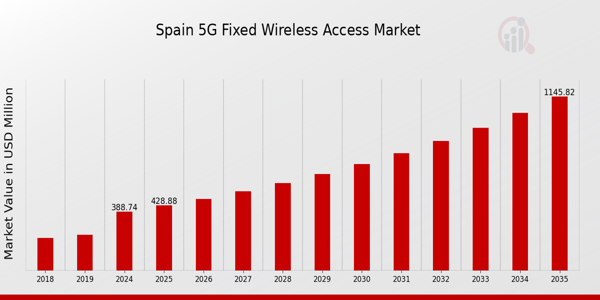

As per MRFR analysis, the Spain 5G Fixed Wireless Access Market Size was estimated at 292.6 (USD Million) in 2023. The Spain 5G Fixed Wireless Access Market Industry is expected to grow from 388.74(USD Million) in 2024 to 1,145.87 (USD Million) by 2035. The Spain 5G Fixed Wireless Access Market CAGR (growth rate) is expected to be around 10.326% during the forecast period (2025 - 2035).

Key Spain 5G Fixed Wireless Access Market Trends Highlighted

Significant trends are being driven by a number of important market factors in the Spain 5G Fixed Wireless Access Market. High-speed internet demand is rising, especially in underserved and rural areas, and this is forcing service providers to increase the range of fixed wireless options they offer.

As seen by initiatives like the National 5G Plan, which aims to improve broadband access nationwide, the Spanish government has made digital connectivity a top priority.

By facilitating the rollout of 5G infrastructure, this government program fosters the growth of fixed wireless services. This industry offers substantial opportunities, particularly in areas with a deficiency of standard broadband infrastructure.

In order to maximize their current resources and expedite the deployment of 5G Fixed Wireless Access, telecom providers should investigate forming alliances with nearby municipalities.

Additionally, the need for specialized solutions that cater to particular client needs is expanding as more and more companies and educational institutions rely on dependable high-speed internet. Recent patterns show that Spain's use of smart devices and mobile data consumption is increasing, which is fueling the need for better connectivity options.

Furthermore, consumers are becoming more aware of the benefits of 5G technology, which makes them more open to embracing innovations for improved connectivity.

Reliable connectivity solutions are now more important than ever due to the trend toward remote work and the demand for strong internet services. In general, the Spanish market for 5G fixed wireless access is anticipated to develop, tackling issues with connectivity and seizing the changes brought about by the new digital environment.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Spain 5G Fixed Wireless Access Market Drivers

Growing Demand for High-Speed Internet

The Spain 5G Fixed Wireless Access Market Industry is significantly driven by the increasing demand for high-speed internet services, especially in rural and underserved areas. According to a report by the Spanish Government's Ministry of Economic Affairs and Digital Transformation, approximately 25% of rural households in Spain lack access to adequate broadband services.

This gap presents a substantial opportunity for providers of Fixed Wireless Access services leveraging 5G technology, offering faster internet speeds and improved connectivity.

Established telecommunications companies like Telefonica and Vodafone are investing heavily in expanding their 5G infrastructure, which will further support the growing demand for seamless digital services across urban and rural regions.

As these advancements continue, the market is poised for exponential growth, with the need for high-speed internet becoming a fundamental requirement for both consumers and businesses alike.

Government Initiatives and Funding Support

The Spanish government has been proactive in implementing initiatives and providing funding to promote digitalization across the country, which directly influences the Spain 5G Fixed Wireless Access Market Industry. The national plan Digital Spain 2025 aims to increase connectivity and ensure that citizens benefit from digital services.

According to the Spanish Ministry of Economic Affairs, the government has allocated over 4 billion EUR to promote technologies like 5G and Fixed Wireless Access in rural areas.

This funding is set to enhance infrastructure and encourage private sector investments, facilitating the deployment of 5G networks. Such initiatives will not only lead to an expansion of service coverage but will also drive competitive pricing, making fixed wireless access more accessible to the wider population, thereby boosting market growth.

Rising Internet of Things (IoT) Applications

The increasing adoption of Internet of Things (IoT) applications in various sectors such as agriculture, manufacturing, and transportation is also a vital driver for the Spain 5G Fixed Wireless Access Market Industry. A study by the Spanish Association for the Digital Economy indicates that over 70% of Spanish companies are exploring IoT technologies to optimize operations and enhance productivity.

The deployment of 5G technology facilitates low latency and high-speed connectivity, which is essential for the successful implementation of IoT solutions.

Major companies like Siemens and Acciona are leading IoT development in Spain, leveraging 5G networks to improve operational efficiencies in their processes. This trend will likely push the demand for reliable Fixed Wireless Access services to support these IoT ecosystems, thereby contributing to market growth.

Spain 5G Fixed Wireless Access Market Segment Insights

5G Fixed Wireless Access Market Offerings Insights

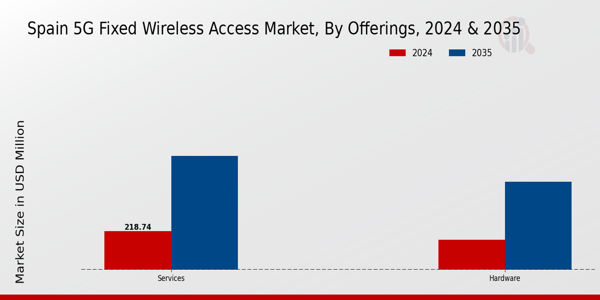

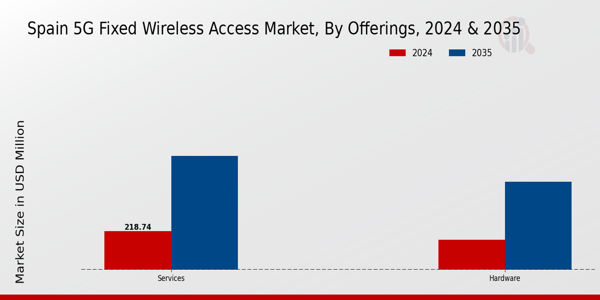

The Spain 5G Fixed Wireless Access Market is evolving rapidly, driven by advancements in technology and the growing demand for high-speed connectivity. Within the offerings segment, the landscape is primarily divided into Hardware and Services. The Hardware category includes essential components such as routers, antennas, and network equipment that are critical for establishing and maintaining robust 5G connectivity.

As the deployment of 5G infrastructure expands across Spain, the need for advanced hardware solutions is increasingly significant, enabling reliable internet access in urban and rural areas alike. On the other hand, the Services segment encompasses installation, maintenance, and support services that play a vital role in ensuring seamless connectivity for users.

These services are essential for both residential and business applications, facilitating efficient network management and service delivery. The combination of Hardware and Services in the offerings segment highlights the intricate relationship between physical infrastructure and customer support, which is crucial for sustaining market growth.

Notably, the ongoing digital transformation in Spain is fueling the adoption of 5G services across various sectors, including education, healthcare, and entertainment, underscoring the importance of both hardware solutions and comprehensive service offerings.

As the Spanish government pushes for digital infrastructure improvements, the integration of 5G technology is set to reshape connectivity patterns nationwide, enhancing productivity and innovation.

This dynamic offerings segment thus forms a cornerstone of the Spain 5G Fixed Wireless Access Market, catering to the demands of a connected society while driving economic growth factors in numerous industries.

The strategic investments in both Hardware and Services signify an emerging trend where organizations prioritize reliable connectivity as a key driver for operational success. Hence, the offerings in this market segment are not just vital components but also represent the backbone of the 5G Fixed Wireless Access ecosystem in Spain.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

5G Fixed Wireless Access Market Application Insights

The Application segment of the Spain 5G Fixed Wireless Access Market plays a crucial role in shaping the overall market landscape. This segment encompasses various domains such as Residential, Commercial, Industrial, and Government, each contributing uniquely to the market dynamics.

The demand for high-speed internet access in residential areas is driving significant growth, providing consumers with reliable connectivity for various online activities, including remote work and online education. In the commercial sector, businesses increasingly rely on robust connectivity solutions to enhance operational efficiency, foster innovation, and improve customer experiences.

Industrial applications are gaining traction due to the potential for smart manufacturing and automation, with 5G enabling real-time data analytics and improved productivity. Government initiatives to enhance digital infrastructure and promote smart city projects are further propelling the growth of this segment as sustainable and efficient technologies become a priority.

Together, these applications highlight the versatility and importance of the Spain 5G Fixed Wireless Access Market, where each sector represents significant opportunities for advancements in communication and connectivity.

5G Fixed Wireless Access Market Territory Insights

The Territory segment of the Spain 5G Fixed Wireless Access Market is distinguished by its division into Urban, Semi-Urban, and Rural areas, each catering to unique demands and presenting distinct challenges.

Urban areas, characterized by their high population density, are increasingly adopting 5G technology, driven by the need for high-speed internet and improved connectivity for businesses and households alike.

In contrast, Semi-Urban regions showcase a blend of urban and rural challenges, requiring tailored solutions to meet the rising expectations for bandwidth and reliability without overwhelming existing infrastructure.

Meanwhile, Rural areas are crucial for expanding broadband access, as they often face challenges like limited connectivity and infrastructure. Bridging the digital divide in these regions is significant, as it enhances economic opportunities and access to essential services.

Overall, the Spain 5G Fixed Wireless Access Market segmentation highlights the diverse needs of different territories, emphasizing market growth opportunities and the necessity for targeted strategies to address each area's specific requirements in the evolving landscape of telecommunications.

Spain 5G Fixed Wireless Access Market Key Players and Competitive Insights

The Spain 5G Fixed Wireless Access Market has been evolving rapidly, shaped by advances in technology, increased demand for high-speed internet, and the proliferation of connected devices. With the global transition towards 5G, various telecom operators have commenced leveraging fixed wireless access (FWA) to deliver high-capacity broadband services.

This market is characterized by intense competition, with several key players striving to innovate and provide enhanced connectivity solutions to consumers and businesses.

The deployment of 5G technology is expected to significantly improve the performance and reliability of internet services in both urban and rural areas of Spain, paving the way for new applications and services that can benefit from high bandwidth and lower latency. Vodafone has established a strong foothold in the Spain 5G Fixed Wireless Access Market by capitalizing on its robust infrastructure and extensive experience in telecommunications.

The company has been at the forefront of launching comprehensive 5G solutions that cater to the diverse needs of its customers. Vodafone's market presence is bolstered by its aggressive rollout strategy for 5G technology, along with its existing customer base and brand reputation. It excels in providing seamless internet connectivity and is known for its competitive pricing and customer-centric services.

With the integration of cutting-edge technology and a focus on innovation, Vodafone is effectively positioned to capitalize on the growing demand for fixed wireless access solutions in Spain. Airties, known for its innovative offerings in the realm of home connectivity, is actively contributing to the Spain 5G Fixed Wireless Access Market through its advanced wireless technologies.

The company specializes in providing smart Wi-Fi solutions, which are essential for optimizing the performance of 5G networks and ensuring reliable connectivity. Airties has gained traction in Spain due to its commitment to enhancing user experience and its partnerships with local telecom operators.

Its strength lies in its unique offerings, like intelligent mesh technology and adaptive Wi-Fi, which are pivotal in managing network traffic efficiently. Although Airties may not be as prominent as larger telecom operators, its specialized solutions and focus on improving home connectivity, coupled with potential mergers and acquisitions in the technology sector, position it well for future growth in the Spanish market.

Key Companies in the Spain 5G Fixed Wireless Access Market Include

- Vodafone

- Airties

- CommScope

- Nokia

- Telefonica

- Huawei

- NEC

- Cisco

- Samsung

- Qualcomm

- Ericsson

- MasMovil

- Orange

- ZTE

- Intel

Spain 5G Fixed Wireless Access Market Industry Developments

The Spain 5G Fixed Wireless Access Market has witnessed significant developments as telecommunications companies accelerate their network rollouts. Vodafone and Telefonica are prominently expanding their 5G coverage, enhancing internet connectivity across urban and rural areas.

Recently, in October 2023, Orange announced plans to invest in enhancing its infrastructure to boost 5G FWA services, aiming to improve connectivity options for residential users.

In terms of mergers and acquisitions, Airties acquired a stake in a strategic partnership with a local provider to enhance its service offerings in September 2023. The competitive landscape has intensified as companies like Ericsson and Nokia also compete to modernize networks.

Furthermore, the market is experiencing growth in valuation, driven by increasing demand for high-speed internet and the push towards digital transformation across various sectors in Spain.

Major players like Qualcomm are also making strides in developing advanced technology for 5G, which aligns with the Spanish government's initiatives to enhance broadband access as part of their national recovery plan. Notably, in early 2022, ZTE partnered with local operators to implement advanced 5G solutions, fostering enhanced connectivity throughout the country.

Spain 5G Fixed Wireless Access Market Segmentation Insights

5G Fixed Wireless Access Market Offerings Outlook

5G Fixed Wireless Access Market Application Outlook

- Residential

- Commercial

- Industrial

- Government

5G Fixed Wireless Access Market Territory Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

292.6(USD Million) |

| MARKET SIZE 2024 |

388.74(USD Million) |

| MARKET SIZE 2035 |

1145.87(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

10.326% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Vodafone, Airties, CommScope, Nokia, Telefonica, Huawei, NEC, Cisco, Samsung, Qualcomm, Ericsson, MasMovil, Orange, ZTE, Intel |

| SEGMENTS COVERED |

Offerings, Application, Territory |

| KEY MARKET OPPORTUNITIES |

Rural connectivity advancements, Enterprise network solutions, Smart city infrastructure development, Enhanced broadband competition, IoT connectivity expansion |

| KEY MARKET DYNAMICS |

growing demand for high-speed internet, expansion of network infrastructure, increased adoption of IoT devices, competitive service pricing, regulatory support for 5G deployment |

| COUNTRIES COVERED |

Spain |

Frequently Asked Questions (FAQ):

The Spain 5G Fixed Wireless Access Market is expected to be valued at 388.74 million USD in 2024.

By 2035, the expected market size is anticipated to reach 1,145.87 million USD.

The expected CAGR for the Spain 5G Fixed Wireless Access Market from 2025 to 2035 is 10.326%.

In 2024, the services segment has a higher valuation at 218.74 million USD compared to the hardware segment at 170.0 million USD.

The market value for the hardware segment is projected to reach 500.0 million USD by 2035.

The services segment is expected to grow to 645.87 million USD by 2035.

Key players in the market include Vodafone, Nokia, Telefonica, Huawei, and Ericsson.

The market is expected to experience significant growth driven by increasing demand for high-speed internet and connectivity.

The competitive landscape features several major players striving for market dominance and innovation.

Opportunities include expanding infrastructure development and rising consumer demand for advanced wireless technologies.