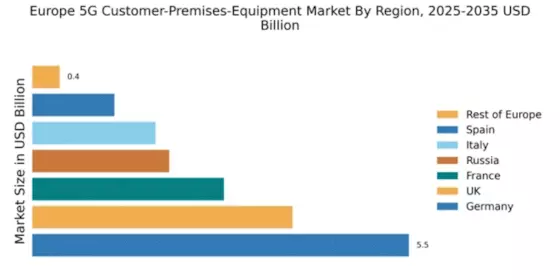

Germany : Strong Infrastructure and Innovation Hub

Key markets include major cities like Berlin, Munich, and Frankfurt, where the competitive landscape is dominated by players such as Deutsche Telekom, Nokia, and Ericsson. The local business environment is characterized by a strong emphasis on R&D and collaboration between tech firms and universities. Industries such as automotive, manufacturing, and healthcare are increasingly adopting 5G solutions to enhance operational efficiency and enable smart technologies.

UK : 5G Adoption Accelerates in Urban Areas

Key markets include London, Manchester, and Birmingham, where major players like BT, Ericsson, and Huawei are actively competing. The competitive landscape is vibrant, with a focus on innovation and customer-centric solutions. The local business environment is conducive to tech startups and collaborations, particularly in sectors like fintech, healthcare, and entertainment, which are increasingly leveraging 5G technology for enhanced services.

France : Innovation and Regulation Drive Expansion

Key markets include Paris, Lyon, and Marseille, where major players like Orange, Nokia, and Ericsson are establishing a strong presence. The competitive landscape is marked by collaboration between telecom operators and technology firms, fostering innovation. Industries such as transportation, healthcare, and smart cities are increasingly adopting 5G applications, enhancing operational efficiency and service delivery in urban environments.

Russia : Government Initiatives Fuel Growth

Key markets include Moscow, St. Petersburg, and Kazan, where major players like MTS, Rostelecom, and Ericsson are competing for market share. The competitive landscape is evolving, with a focus on partnerships and collaborations to drive innovation. Local industries such as energy, transportation, and public safety are increasingly leveraging 5G technology to enhance operational capabilities and improve service delivery.

Italy : Infrastructure Development Drives Adoption

Key markets include Milan, Rome, and Turin, where major players like Telecom Italia, Ericsson, and Huawei are actively competing. The competitive landscape is characterized by a focus on innovation and customer-centric solutions. Local industries, particularly in manufacturing and logistics, are increasingly adopting 5G technology to enhance operational efficiency and enable smart manufacturing practices.

Spain : Regulatory Support Enhances Market Growth

Key markets include Madrid, Barcelona, and Valencia, where major players like Telefónica, Ericsson, and Nokia are competing for market share. The competitive landscape is vibrant, with a focus on innovation and collaboration between telecom operators and technology firms. Local industries such as tourism, healthcare, and smart cities are increasingly leveraging 5G technology to enhance service delivery and operational efficiency.

Rest of Europe : Diverse Opportunities Across Regions

Key markets include smaller countries and regions where local players and international firms like Nokia and Ericsson are establishing a presence. The competitive landscape is fragmented, with varying levels of investment and technological adoption. Local industries, including agriculture, logistics, and public services, are exploring 5G applications to enhance efficiency and service delivery, although challenges remain in terms of infrastructure and investment.

Leave a Comment