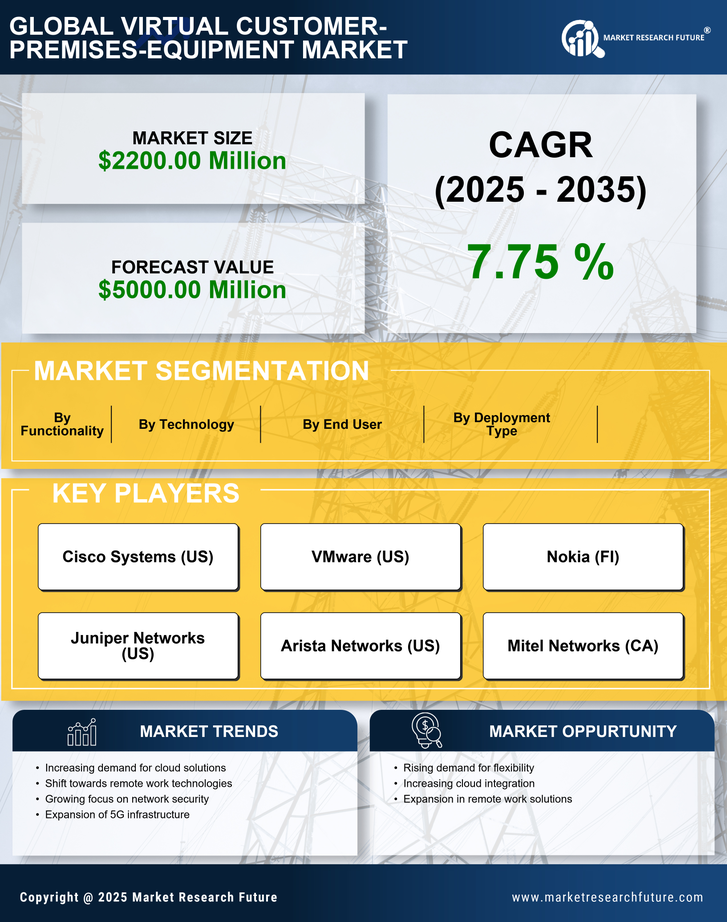

Rising Focus on Customer Experience

In an increasingly competitive landscape, businesses are placing a heightened emphasis on customer experience, which is influencing the virtual customer-premises-equipment market. Companies are recognizing that superior customer service can differentiate them from competitors, prompting investments in virtual solutions that enhance customer interactions. By 2025, it is projected that organizations will allocate up to 25% of their IT budgets towards improving customer experience through virtual customer-premises-equipment. This focus on customer satisfaction is likely to drive innovation and the development of tailored solutions, further propelling market growth.

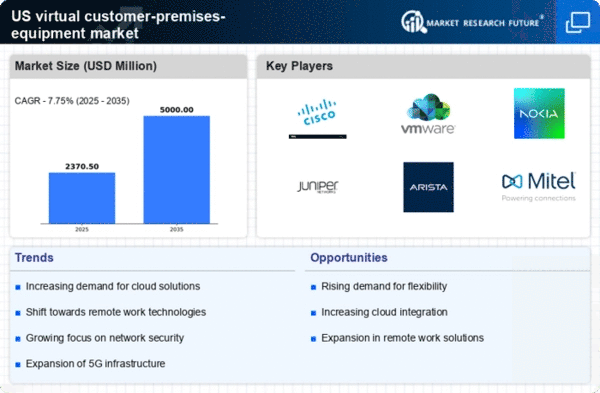

Advancements in Network Infrastructure

The continuous evolution of network infrastructure is a pivotal driver for the virtual customer-premises-equipment market. With the rollout of 5G technology and improvements in broadband connectivity, businesses are experiencing enhanced data transmission speeds and reduced latency. This technological advancement is expected to boost the adoption of virtual customer-premises-equipment, as organizations leverage these capabilities to optimize their operations. By 2025, it is projected that 5G will cover over 50% of the US population, creating a fertile ground for the growth of virtual solutions. Enhanced network infrastructure not only supports existing applications but also enables the development of new services, further propelling market expansion.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into virtual customer-premises-equipment is emerging as a transformative driver in the market. AI technologies enhance the functionality of virtual solutions by enabling predictive analytics, automated troubleshooting, and improved customer interactions. As organizations increasingly adopt AI-driven tools, the virtual customer-premises-equipment market is expected to expand significantly. By 2025, it is anticipated that AI will be integrated into over 60% of new virtual solutions, providing businesses with advanced capabilities to streamline operations and enhance user experiences. This trend indicates a shift towards more intelligent and responsive virtual environments.

Growing Demand for Remote Work Solutions

The shift towards remote work has catalyzed a growing demand for efficient communication and collaboration tools. This trend is particularly evident in the virtual customer-premises-equipment market, where organizations seek to enhance their operational capabilities. As of 2025, approximately 30% of the workforce in the US is expected to work remotely at least part-time, necessitating robust virtual solutions. Companies are increasingly investing in virtual customer-premises-equipment to facilitate seamless connectivity and ensure business continuity. This demand is likely to drive innovation and competition within the market, as providers strive to offer advanced features that cater to the evolving needs of remote teams.

Cost Efficiency and Operational Flexibility

Cost efficiency remains a critical consideration for businesses, driving the adoption of virtual customer-premises-equipment. Organizations are increasingly recognizing the financial benefits associated with virtual solutions, which often require lower upfront investments compared to traditional hardware. By 2025, it is estimated that companies can save up to 40% on operational costs by transitioning to virtual customer-premises-equipment. This shift allows for greater operational flexibility, enabling businesses to scale their services according to demand. As firms seek to optimize their budgets while maintaining high service levels, the virtual customer-premises-equipment market is likely to witness sustained growth.