Rising Need for Enhanced Security Solutions

The virtual customer-premises-equipment market is increasingly driven by the rising need for enhanced security solutions. With the growing prevalence of cyber threats, businesses in the UK are prioritizing the implementation of robust security measures within their network infrastructures. Virtual customer-premises equipment offers advanced security features that can be integrated into existing systems, providing organizations with the necessary tools to safeguard their data. Recent surveys indicate that approximately 70% of UK businesses consider cybersecurity a top priority, which is likely to propel the demand for virtual customer-premises equipment. This market driver underscores the critical role of security in shaping the future of networking solutions.

Advancements in Cloud Computing Technologies

The virtual customer-premises-equipment market is significantly influenced by advancements in cloud computing technologies. As businesses in the UK increasingly migrate to cloud-based solutions, the demand for virtual customer-premises equipment is expected to rise. The integration of cloud services allows for enhanced data management, improved security, and cost-effective scalability. Recent statistics indicate that cloud adoption in the UK has reached approximately 80%, which correlates with a growing reliance on virtual customer-premises equipment to facilitate seamless connectivity and service delivery. This trend suggests that the virtual customer-premises-equipment market will continue to thrive as organizations seek to leverage cloud capabilities for operational efficiency and innovation.

Increased Investment in Digital Transformation

The virtual customer-premises-equipment market is benefiting from increased investment in digital transformation initiatives across various sectors in the UK. Organizations are recognizing the importance of modernizing their IT infrastructure to remain competitive in a rapidly evolving digital landscape. This investment trend is reflected in a reported 25% increase in IT spending aimed at digital transformation projects. As companies allocate more resources towards upgrading their networking capabilities, the demand for virtual customer-premises equipment is likely to surge. This market driver indicates a strong alignment between digital transformation efforts and the adoption of virtual customer-premises equipment, positioning the market for sustained growth.

Growing Demand for Flexible Networking Solutions

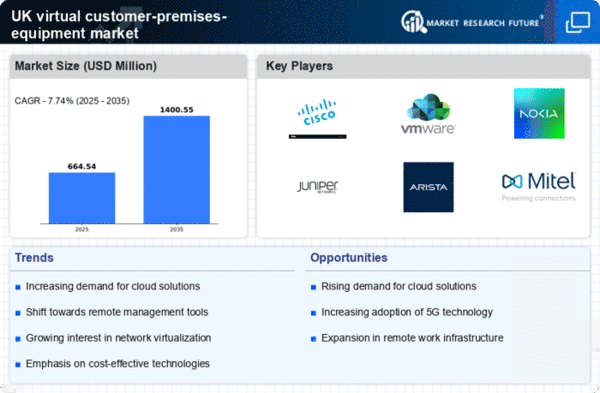

The virtual customer-premises-equipment market is experiencing a notable increase in demand for flexible networking solutions. Businesses in the UK are increasingly seeking to adapt their network infrastructures to accommodate remote work and dynamic operational needs. This shift is driven by the necessity for scalable and agile solutions that can be deployed rapidly. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader trend where companies prioritize flexibility in their networking capabilities, thereby enhancing their competitive edge. The virtual customer-premises-equipment market is well-positioned to meet these evolving requirements, offering innovative solutions that align with the changing landscape of business operations.

Supportive Government Policies for Digital Infrastructure

The virtual customer-premises-equipment market is positively impacted by supportive government policies aimed at enhancing digital infrastructure in the UK. The government has initiated various programs to promote the adoption of advanced technologies, including virtual customer-premises equipment, as part of its broader digital strategy. These initiatives are designed to improve connectivity, foster innovation, and stimulate economic growth. Recent reports suggest that government funding for digital infrastructure projects has increased by 30% over the past year, indicating a strong commitment to advancing the digital landscape. This supportive environment is likely to encourage further investment in the virtual customer-premises-equipment market, facilitating its growth and development.