Rising Consumer Expectations

The 5g fixed-wireless-access market in Europe is experiencing a surge in consumer expectations for high-speed internet connectivity. As digital services proliferate, users demand faster and more reliable connections. This trend is evident in the increasing number of households seeking alternatives to traditional broadband, with a reported 30% of consumers expressing dissatisfaction with their current internet speeds. The 5g fixed-wireless-access market is positioned to meet these demands by offering enhanced speeds and lower latency, which are critical for applications such as streaming, gaming, and remote work. As consumers become more tech-savvy, their expectations continue to rise, driving the need for innovative solutions in the 5g fixed-wireless-access market.

Shift Towards Remote Work and Learning

The shift towards remote work and learning is a notable driver for the 5g fixed-wireless-access market in Europe. As organizations and educational institutions increasingly adopt flexible work and learning models, the demand for reliable and high-speed internet access has intensified. Reports indicate that approximately 40% of the workforce in Europe is now engaged in remote work, necessitating robust connectivity solutions. The 5g fixed-wireless-access market is well-positioned to cater to this growing need, providing the necessary bandwidth and low latency required for seamless video conferencing, online collaboration, and digital learning. This trend is expected to sustain demand for 5g fixed-wireless-access solutions in the foreseeable future.

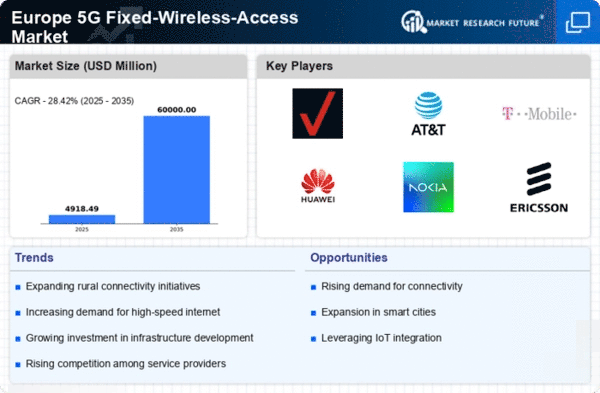

Competitive Landscape and Market Dynamics

The competitive landscape and market dynamics within the 5g fixed-wireless-access market in Europe are evolving rapidly. With numerous players entering the market, competition is intensifying, leading to innovative service offerings and pricing strategies. This competitive environment is likely to drive down costs for consumers while enhancing service quality. Additionally, partnerships between telecommunications companies and technology providers are becoming more common, facilitating the development of integrated solutions. The 5g fixed-wireless-access market is thus experiencing a transformation, as companies strive to differentiate themselves through unique value propositions. This dynamic could result in increased market penetration and a broader customer base, further fueling growth in the sector.

Investment in Telecommunications Infrastructure

Investment in telecommunications infrastructure is a key driver for the 5g fixed-wireless-access market in Europe. Governments and private entities are allocating substantial funds to enhance network capabilities. For instance, the European Commission has set a target to invest €20 billion in digital infrastructure by 2025, which includes 5g technologies. This financial commitment is likely to accelerate the deployment of 5g fixed-wireless-access solutions, enabling broader coverage and improved service quality. The 5g fixed-wireless-access market stands to benefit from these investments, as they facilitate the expansion of networks into underserved areas, thereby increasing market penetration and user adoption.

Technological Advancements in Wireless Communication

Technological advancements in wireless communication are propelling the 5g fixed-wireless-access market in Europe. Innovations such as beamforming, massive MIMO, and advanced antenna technologies are enhancing the efficiency and performance of 5g networks. These developments enable service providers to deliver higher data rates and improved reliability, which are essential for meeting the demands of modern applications. The 5g fixed-wireless-access market is likely to see a significant uptick in adoption as these technologies become more prevalent. Furthermore, the integration of artificial intelligence and machine learning in network management could optimize performance and reduce operational costs, making 5g fixed-wireless-access solutions more attractive to consumers and businesses alike.