Focus on Core Competencies

In the Spain business process as a service market, there is a growing emphasis on allowing organizations to concentrate on their core competencies. By outsourcing peripheral functions, companies can redirect their focus towards strategic initiatives that drive growth and innovation. This trend is particularly evident in sectors such as finance and healthcare, where firms are increasingly relying on specialized service providers to handle routine tasks. Data suggests that organizations that adopt business process as a service solutions experience a 25% improvement in productivity. This shift not only enhances operational efficiency but also fosters a culture of innovation within organizations. As more companies in Spain recognize the benefits of this approach, the business process as a service market is poised for continued growth.

Growing Demand for Cost Efficiency

The Spain business process as a service market is experiencing a notable surge in demand for cost efficiency among organizations. Companies are increasingly seeking to optimize their operational expenditures by outsourcing non-core functions to specialized service providers. This trend is driven by the need to reduce overhead costs while maintaining service quality. According to recent data, businesses in Spain have reported a 20% reduction in operational costs after adopting business process as a service solutions. This shift not only allows firms to allocate resources more effectively but also enhances their competitive edge in a rapidly evolving market. As organizations continue to prioritize financial prudence, the Spain business process as a service market is likely to expand further, catering to the needs of cost-conscious enterprises.

Enhanced Focus on Customer Experience

The Spain business process as a service market is witnessing a heightened focus on enhancing customer experience. Organizations are increasingly recognizing that superior customer service is a key differentiator in a competitive landscape. By leveraging business process as a service solutions, companies can streamline customer interactions and improve service delivery. Data indicates that businesses that prioritize customer experience through these solutions have seen a 35% increase in customer satisfaction scores. This trend reflects a broader shift towards customer-centric business models, where organizations aim to create seamless and personalized experiences. As the demand for exceptional customer service continues to grow, the Spain business process as a service market is likely to evolve, offering innovative solutions that cater to this need.

Regulatory Compliance and Risk Management

The Spain business process as a service market is significantly influenced by the increasing need for regulatory compliance and effective risk management. As businesses face stringent regulations, particularly in sectors like finance and healthcare, the demand for compliant business process solutions is on the rise. Service providers are now offering tailored solutions that ensure adherence to local and international regulations, thereby mitigating risks associated with non-compliance. Recent statistics indicate that companies utilizing business process as a service solutions have reduced compliance-related penalties by up to 40%. This trend underscores the importance of integrating compliance into business processes, positioning the Spain business process as a service market as a critical partner in risk management strategies.

Technological Advancements and Integration

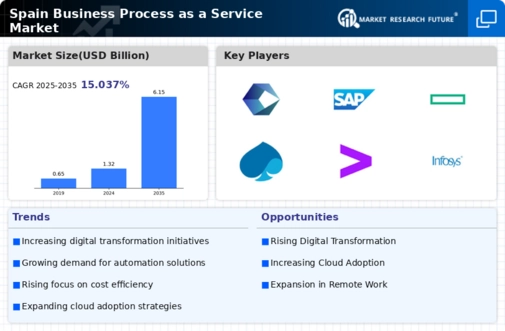

Technological advancements play a pivotal role in shaping the Spain business process as a service market. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and cloud computing is transforming traditional business processes. These innovations enable service providers to offer more efficient and scalable solutions, thereby attracting a wider client base. For instance, companies leveraging AI-driven analytics have reported a 30% increase in process efficiency. As organizations in Spain increasingly recognize the potential of these technologies, the demand for business process as a service solutions is expected to rise. This trend indicates a shift towards more sophisticated service offerings, positioning the Spain business process as a service market at the forefront of digital transformation.