Spain Wireless Connectivity Market Overview

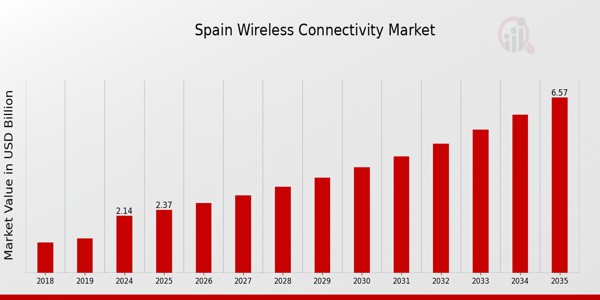

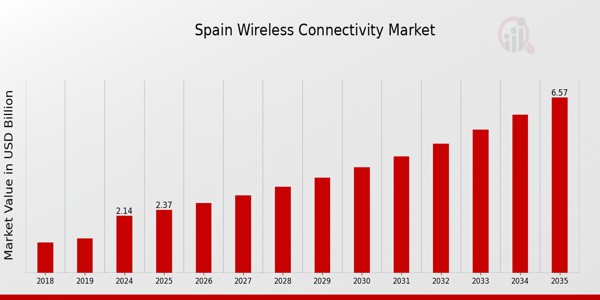

The Spain Wireless Connectivity Market Size was estimated at 1.89 (USD Billion) in 2024. The Spain Wireless Connectivity Market Industry is expected to grow from 2.14 (USD Billion) in 2025 to 6.58 (USD Billion) by 2035. The Spain Wireless Connectivity Market CAGR (growth rate) is expected to be around 10.738% during the forecast period (2025 - 2035)

Key Spain Wireless Connectivity Market Trends Highlighted

The Spain Wireless Connectivity Market is seeing notable trends driven by the growing demand for high-speed internet and the expansion of mobile technology. A key market driver is the Spanish government's push to enhance digital infrastructure, particularly in rural areas, as outlined in their digital agenda. This initiative aims to ensure that all citizens can access reliable wireless connectivity, supporting remote work and education. As more sectors embrace digital transformation, the demand for enhanced wireless services continues to rise, contributing to the growth of advanced technologies such as 5G networks.

Opportunities to be explored include the expansion of Internet of Things (IoT) applications across various industries, including agriculture, transportation, and smart cities. Spain has shown a commitment to integrating IoT solutions to improve efficiency and sustainability, particularly in urban areas. This creates a favorable environment for investment in wireless connectivity solutions that can support smart infrastructure. Trends in recent times highlight the increasing adoption of wireless connectivity solutions among small and medium-sized enterprises (SMEs) in Spain. These businesses are increasingly recognizing the value of robust connectivity to enhance operational capabilities and improve customer engagement.

Additionally, consumer behavior is shifting towards the use of wireless technology for everyday activities, driven by the widespread availability of smart devices. As a result, service providers are tailoring their offerings to meet the evolving preferences of users, demonstrating the dynamic nature of the market. With these trends, the Spain Wireless Connectivity Market presents a landscape rich with potential for growth and innovation.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Spain Wireless Connectivity Market Drivers

Increasing Demand for High-Speed Internet Access

In Spain, the push for digital transformation across various sectors has led to an increasing demand for high-speed internet access. According to the Spanish National Commission for Markets and Competition (Comisin Nacional de los Mercados y la Competencia), the number of fiber optic connections in Spain surpassed 8.5 million in 2021, reflecting a shift towards faster internet solutions. This trend is further supported by government initiatives aimed at achieving 100% fiber optic coverage by 2025.

The growth in high-speed internet access directly influences Spain Wireless Connectivity Market Industry as consumers and businesses seek robust wireless connectivity options to enhance online services and support the Internet of Things (IoT) proliferation. The increasing reliance on remote work and digital services, catalyzed by the COVID-19 pandemic, has further accelerated this demand, making it a significant driver for the growth of wireless connectivity in Spain.

Government Investments in Digital Infrastructure

The Spanish government has made substantial investments in enhancing the country's digital infrastructure, particularly through its Digital Spain 2025 plan. This initiative aims to increase the coverage and quality of wireless connectivity across the nation, highlighting the importance of technology in fostering economic growth. In 2021, the government allocated around 20 billion Euros for the digital transition, which includes advancements in wireless connectivity.

Such investments are aimed at Spain Wireless Connectivity Market Industry as they stimulate the growth of new technologies and services, which increases the consumption of wireless connectivity solutions by consumers and businesses.

Growth of Mobile Device Usage

The increasing penetration of mobile devices in Spain contributes significantly to the growth of the Spain Wireless Connectivity Market Industry. As of 2022, mobile device penetration was over 95%, with more than 42 million smartphones in use, according to data from the Spanish Telecommunications Market Association. This widespread adoption of mobile devices drives the demand for seamless wireless connectivity solutions, pushing telecommunications companies to enhance their infrastructure.

The rise in mobile-based applications, which require robust and reliable connectivity, creates continuous opportunities for service providers in the wireless connectivity sector.

The Rise of Internet of Things (IoT) Applications

The Spain Wireless Connectivity Market Industry is also driven by the rapid adoption of Internet of Things (IoT) applications across various sectors such as healthcare, manufacturing, and smart cities. The Spanish government's commitment to developing smart city initiatives and IoT ecosystems is evident in its recent investments in smart technologies, with over 60 municipalities involved in pilot projects incorporating IoT solutions as of 2022.

This corresponds to the forecasted installation of more than 30 million IoT devices in the country by 2025. As IoT devices continue to proliferate, there is a heightened need for wireless connectivity solutions, making it a critical driver for market growth in the region.

Spain Wireless Connectivity Market Segment Insights

Wireless Connectivity Market Technology Insights

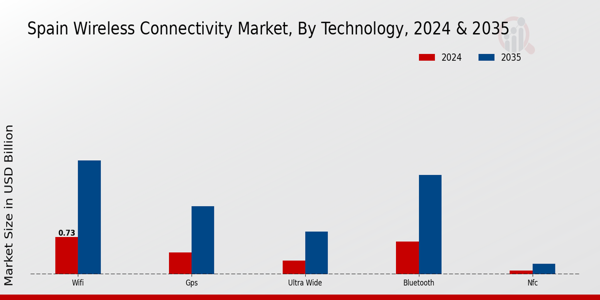

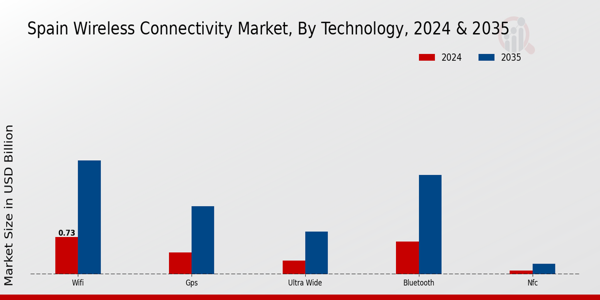

The Spain Wireless Connectivity Market is experiencing robust growth, driven by advancements in Technology that are transforming the landscape of connectivity solutions. As of 2024, the market is expected to witness substantial valuation, further driven by the escalating demand for seamless wireless communication across various sectors, from telecommunications to smart devices. Within this expansive market, several technologies such as Bluetooth, Wi-Fi, GPS, Ultra Wideband, Near Field Communication (NFC), Cellular technologies, ZigBee, SigFox, and LoRa are gaining traction, each catering to specific connectivity needs.

Bluetooth remains a key player, primarily facilitating short-range communications in devices such as smartphones, wearables, and connected home appliances, thus enhancing user convenience and promoting the Internet of Things (IoT) ecosystem. Wi-Fi continues to play a pivotal role, with increasing demands for high-speed internet connectivity, particularly in urban areas like Madrid and Barcelona, as individuals and businesses alike seek dependable and fast internet access for their digital operations. GPS technology is also vital for location-based services, supporting various applications, including navigation systems, fleet management, and logistics, which are crucial for efficient urban and regional planning in Spain.

Furthermore, Ultra Wideband technology is being recognized for its potential highly accurate positioning and data transfer capabilities, which is becoming increasingly essential in smart home applications and industrial automation. The emergence of NFC technology has enabled secure contactless transactions, a trend that is gaining popularity in retail and transportation sectors, allowing consumers to make quick and efficient payments while enhancing customer experiences.

Cellular technologies, particularly the adoption of 5G networks, are significantly transforming communication by providing faster speeds, lower latency, and enhanced capacity, which are critical for advanced applications like remote healthcare and smart city initiatives. ZigBee and SigFox technologies are important for low-power, wide-area network applications, mainly used in IoT devices for smart metering and industrial automation, reflecting a growing shift towards energy-efficient and cost-effective connectivity options.

LoRa technology is paving the way for long-range communication solutions, particularly in agricultural applications and environmental monitoring, underlining the diverse needs within the Spain Wireless Connectivity Market. The increasing emphasis on digital transformation across various sectors is expected to propel the continued development and integration of these technologies as businesses seek to optimize operations through enhanced connectivity solutions. With various sectors in Spain progressively embracing innovative technology, the ongoing evolution within the wireless connectivity segment appears promising, positioning Spain as a significant player in the global connectivity landscape.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Wireless Connectivity Market Type Insights

The Spain Wireless Connectivity Market has been categorized into various types, including WLAN, WPAN, Satellite, and Cellular M2M, each playing a pivotal role in shaping the country's connectivity ecosystem. Wireless Local Area Networks (WLAN) are crucial for providing high-speed internet access in both residential and commercial scenarios, driving the demand for seamless connectivity in urban areas. Wireless Personal Area Networks (WPAN) cater to short-range communication needs, supporting various consumer electronics and smart home devices, which have seen a surge in popularity across Spain.

Satellite connectivity serves as an essential service in remote and rural areas, bridging the digital divide and ensuring that even the most isolated regions can participate in the digital economy. Furthermore, Cellular Machine-to-Machine (M2M) communications are increasingly vital for industrial applications, facilitating real-time data transfer and automation in sectors such as transportation and logistics. The ongoing advancements in these types of wireless technologies continue to promote innovation and enhance user experiences, thus significantly impacting the overall Spain Wireless Connectivity Market industry.

Despite their unique propositions, all segments face challenges related to infrastructure, security, and evolving consumer demands, presenting opportunities for growth and expansion in the coming years.

Wireless Connectivity Market Application Insights

The Spain Wireless Connectivity Market is experiencing notable growth, driven by the increasing demand for wireless technology across various applications. The Application segment encompasses a diverse range of areas, reflecting the multifaceted nature of connectivity in everyday life. Healthcare stands out due to its reliance on remote monitoring and telemedicine solutions, which enhance patient care and streamline processes. Public safety applications are vital as they leverage wireless connectivity for quick communication and data sharing amongst emergency services, ensuring timely responses to incidents.

In the realm of wearable devices, the integration of connectivity fosters health tracking and fitness monitoring, increasingly gaining traction among consumers focused on wellness.

The Energy sector benefits from advanced metering and monitoring solutions powered by wireless technology, promoting efficiency and sustainability initiatives. Furthermore, the Automotive industry's shift towards connected vehicles underscores the importance of wireless systems in enhancing safety and user experience. Finally, consumer electronics continue to thrive as they incorporate wireless features, enhancing usability and interactivity. Overall, the Application segment of the Spain Wireless Connectivity Market is pivotal, reflecting broader trends in technology adoption and connectivity enhancement across various sectors, fueling market growth and innovation.

Spain Wireless Connectivity Market Key Players and Competitive Insights

The Spain Wireless Connectivity Market is characterized by rapid technological advancements and an increasingly competitive landscape. With a significant surge in demand for internet services and reliable connectivity, several key players have emerged, each striving to solidify their stake in the market. Competition in this sector is driven by factors such as the growing deployment of 5G networks, the rise in the adoption of smart devices, and the need for enhanced connectivity solutions. With evolving consumer preferences and digital transformation across various sectors, companies are investing heavily in innovative technologies and strategic partnerships to maintain a competitive edge.

Regulatory changes and the push for better service quality also play a pivotal role in shaping market dynamics as companies adapt to the regulatory environment while attempting to cater to a tech-savvy population. Samsung Electronics stands out in the Spain Wireless Connectivity Market as a dominant player, leveraging its extensive portfolio of devices and innovative technological capabilities. The company’s strengths lie in its robust product lineup includes smartphones, tablets, and other smart devices that are equipped with advanced connectivity features.

Samsung's reputation for quality and cutting-edge technology bolsters its market presence, allowing it to tap into various segments of the wireless connectivity market.

The brand's commitment to enhancing user experiences through consistent software updates and network optimization further enhances its appeal. Moreover, Samsung has established a reliable network of retail and distribution channels across Spain, ensuring that its products are widely accessible to consumers. By actively investing in research and development, Samsung constantly aims to push the envelope of functionality and connectivity, allowing it to maintain a strong competitive position in this fast-evolving landscape. Masmovil has also carved out a significant niche in the Spain Wireless Connectivity Market, positioning itself as a formidable competitor among telecom operators.

The company offers a range of services that include mobile and fixed-line telecommunications, as well as broadband connectivity solutions tailored to meet the needs of different consumer demographics.

Masmovil has leveraged strategic acquisitions to expand its market presence and enhance its service offerings. Notable is its focus on providing cost-effective packages that appeal to budget-conscious consumers while ensuring robust connectivity. The company's strengths include its nimble approach to market changes and ability to deploy advanced technologies efficiently. Through ongoing partnerships and network infrastructure development, Masmovil has optimized its operational capabilities, allowing it to deliver high-speed internet and mobile services effectively across Spain.

This proactive engagement in the market has allowed Masmovil to not only increase its customer base but also cement its reputation as a reliable provider in a competitive industry.

Key Companies in the Spain Wireless Connectivity Market Include

- Samsung Electronics

- Masmovil

- Ericsson

- Qualcomm

- Huawei Technologies

- Cellnex

- Orange S.A.

- Nokia

- Cisco Systems

- ZTE Corporation

- IBM

- Intel Corporation

- Vodafone Group

- Atos

Spain Wireless Connectivity Industry Developments

The Spain Wireless Connectivity Market has witnessed significant developments recently, particularly with leading companies enhancing their network capabilities. In October 2023, Masmovil announced an expansion of its 5G network, aiming to cover 80% of the Spanish population by mid-2024, which is expected to strengthen its competitiveness. Concurrently, Vodafone Group launched its high-speed broadband services in rural areas, contributing to digital inclusion efforts in Spain. Recent collaborations have also emerged, as Ericsson partnered with Telefonica to enhance IoT solutions across Spain.

In terms of mergers and acquisitions, Cellnex, a prominent player in telecommunications infrastructure, completed the acquisition of more than 1,000 towers from an unnamed operator in September 2023, enhancing its portfolio in the wireless connectivity domain. The market has been positively influenced by the growth of mobile data traffic, projected to increase by 45% in the next two years, largely driven by remote work and digital services demand.

Over the past few years, major players like Huawei Technologies and Samsung Electronics have accelerated their Research and Development initiatives to enhance network reliability and speed, which is crucial for upcoming urban 5G deployments.

Spain Wireless Connectivity Market Segmentation Insights

Wireless Connectivity Market Technology Outlook

- Bluetooth

- Wi-Fi

- GPS

- Ultra Wide

- NFC

- Cellular

- ZigBee

- SigFox

- Lora

- Others

Wireless Connectivity Market Type Outlook

- WLAN

- WPAN

- Satellite

- Cellular M2M.

Wireless Connectivity Market Application Outlook

- Healthcare

- Public safety

- wearable devices

- Energy

- Automotive

- consumer electronics

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

1.89 (USD Billion) |

| MARKET SIZE 2024 |

2.14 (USD Billion) |

| MARKET SIZE 2035 |

6.58 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

10.738% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Samsung Electronics, Masmovil, Ericsson, Qualcomm, Huawei Technologies, Cellnex, Orange S.A., Nokia, Cisco Systems, ZTE Corporation, IBM, Intel Corporation, Vodafone Group, Atos |

| SEGMENTS COVERED |

Technology, Type, Application |

| KEY MARKET OPPORTUNITIES |

5G network expansion, Internet of Things integration, Smart city infrastructure development, Increased remote work connectivity, Enhanced automotive connectivity solutions |

| KEY MARKET DYNAMICS |

increased mobile data demand, 5G network expansion, IoT device proliferation, government regulatory support, competitive pricing strategies |

| COUNTRIES COVERED |

Spain |

Frequently Asked Questions (FAQ):

The Spain Wireless Connectivity Market is expected to be valued at 2.14 billion USD in 2024.

By 2035, the overall market size is anticipated to reach 6.58 billion USD.

The market is projected to grow at a compound annual growth rate of 10.738% from 2025 to 2035.

The Bluetooth technology segment is projected to have a market value of 1.95 billion USD in 2035.

The WiFi segment is expected to reach a market value of 2.24 billion USD by 2035.

Major players include Samsung Electronics, Ericsson, Qualcomm, Huawei Technologies, and Vodafone Group.

Key challenges include rapid technological advancements and the need for infrastructure development.

Drivers include rising demand for smart devices and increased reliance on wireless communication technologies.

The competitive landscape has intensified with the emergence of new players and evolving technology standards.

Applications in sectors like IoT, smart homes, and telecommunications are driving significant growth in the market.