Rising Demand in End-User Industries

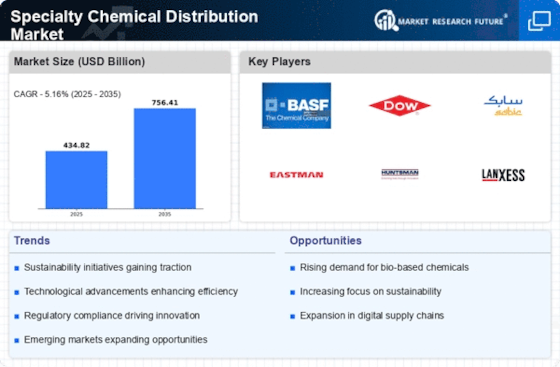

The Specialty Chemical Distribution Market is experiencing a notable increase in demand from various end-user sectors, including automotive, construction, and electronics. As these industries expand, the need for specialized chemicals, such as adhesives, coatings, and performance additives, intensifies. For instance, the automotive sector is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next few years, driving the demand for specialty chemicals that enhance vehicle performance and sustainability. This trend indicates a robust market potential for distributors who can effectively cater to the evolving needs of these industries.

Regulatory Compliance and Safety Standards

The Specialty Chemical Distribution Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are imposing more rigorous guidelines to ensure the safe handling and distribution of specialty chemicals. This trend necessitates that distributors invest in compliance measures and safety training, which can be costly but essential for maintaining market access. The increasing focus on safety and environmental regulations is likely to drive demand for specialty chemicals that meet these standards, thereby creating opportunities for distributors who can navigate this complex landscape.

Growth of E-commerce in Chemical Distribution

The rise of e-commerce is transforming the Specialty Chemical Distribution Market, providing new avenues for reaching customers. Online platforms enable distributors to streamline their operations, reduce overhead costs, and enhance customer engagement. According to recent data, e-commerce sales in the chemical sector are expected to grow by over 20% in the coming years. This shift towards digital channels allows distributors to offer a wider range of specialty chemicals, improve order fulfillment, and provide better customer service, ultimately driving market growth.

Technological Advancements in Chemical Processing

Technological innovations are playing a pivotal role in shaping the Specialty Chemical Distribution Market. Advancements in chemical processing technologies, such as green chemistry and bioprocessing, are enabling manufacturers to produce specialty chemicals more efficiently and sustainably. These innovations not only reduce production costs but also align with the increasing regulatory pressures for environmentally friendly practices. As a result, distributors who leverage these technologies can offer a competitive edge, meeting the growing demand for sustainable products while enhancing their operational efficiency.

Increased Focus on Sustainability and Eco-Friendly Products

Sustainability is becoming a central theme in the Specialty Chemical Distribution Market. As consumers and businesses alike prioritize eco-friendly products, distributors are increasingly sourcing and promoting specialty chemicals that align with these values. The market for sustainable chemicals is projected to grow significantly, with estimates suggesting a CAGR of around 6% over the next decade. This trend not only reflects changing consumer preferences but also presents an opportunity for distributors to differentiate themselves by offering innovative, sustainable solutions that meet the demands of environmentally conscious customers.