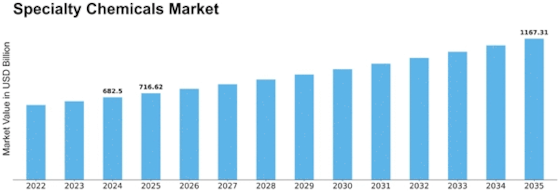

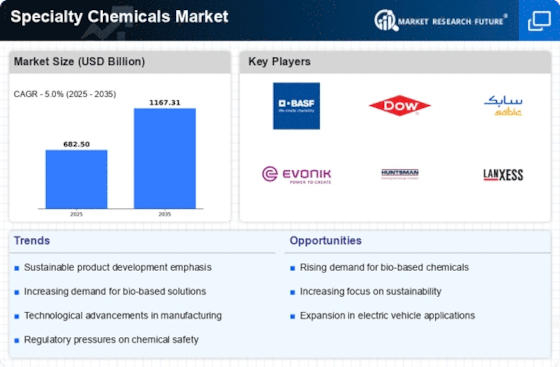

Specialty Chemicals Size

Specialty Chemicals Market Growth Projections and Opportunities

Automotive industry accounted for substantial part of the global GDP and is also offering a promising future to specialty chemicals. The industry is in a growing phase of its life cycle and is witnessing a high consumption trend for specialty material, especially, in Asia Pacific. The emergence of electronic vehicle and trend for a lightweight vehicle have changed the growth dynamics in this industry. The penetration of specialty chemicals in lightweight vehicle applications as plastic energy absorbers, fenders, front-end modules, instrument panels, steering wheels, headlamp assemblies, throttle bodies has grown gradually and is anticipated to gather pace over the next decade. Average plastic weight in a vehicle has increased by 25% in 2016 as compared to 2010, as a result of numerous incentives and programmes initiated by government and environment concerning agencies across the globe.

On the other hand, plastic is being a game changer in weight reduction process of a lightweight vehicle and is evolved in an application such as glazing, and tailgates, as well as exterior components such as roof racks, wipers, door handles, and rearview mirror assemblies. The trend is expected to continue over the next decade and is likely to gather rapid pace in terms of plastic consumption, which, in turn, is supporting consumption of specialty chemicals

Leave a Comment