Market Share

Stainless Steel Cable Ties Market Share Analysis

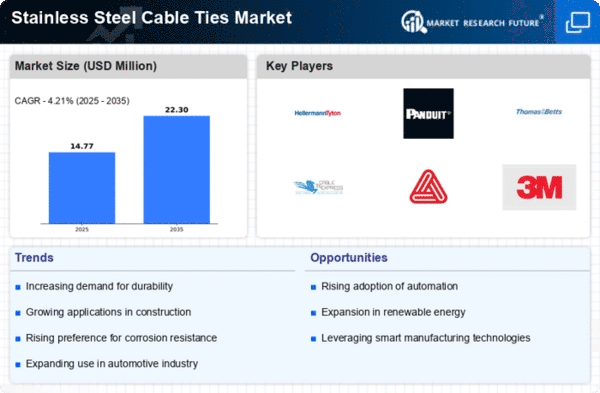

The global market for stainless-steel cable ties reached a value of USD 184,736.6 thousand in 2017, and it's anticipated to grow to USD 220,990.5 thousand by 2023, with a yearly growth rate of 3.12%. In terms of volume, the market was 124,157 thousand tons in 2017, and it's estimated to have a 2.18% yearly growth during the forecast period. This growth is driven by increased use in transportation, securing exhaust heat wrap in vehicles, and applications in the oil & gas industry. Uncoated stainless-steel ties held the larger market share in 2017, while coated ties are expected to register a higher growth rate due to increased demand for corrosion protection. In applications, transportation had the largest share in 2017 and is predicted to grow steadily, fueled by its use in various automotive components. Asia-Pacific dominated the market in 2017 and is expected to continue leading, driven by rapid industrialization. The stainless-steel cable ties market, valued at USD 184,736.6 thousand in 2017, is poised to expand to USD 220,990.5 thousand by 2023, demonstrating a 3.12% annual growth rate. The forecasted increase is underpinned by growing utilization in transportation, including the securing of exhaust heat wrap in vehicles and applications within the oil & gas sector. Uncoated stainless-steel ties, commanding a significant market share in 2017, are expected to maintain their dominance, while coated ties show promise with a higher projected growth rate due to increased demand for corrosion protection. With transportation as the leading application in 2017, the market's steady rise is further propelled by the ongoing rapid industrialization in the Asia-Pacific region.

The stainless-steel cable ties market's growth trajectory is reinforced by the dominance of uncoated stainless-steel ties, which, due to their cost-effectiveness, are anticipated to maintain a significant share. In contrast, coated stainless-steel cable ties, benefiting from a higher protection level against corrosion, exhibit potential for increased demand, projecting a 3.26% CAGR during the forecast period. The transportation sector, spearheading the market in 2017, is anticipated to continue this trend, driven by the ties' role in fastening and securing vital components in automobiles. Asia-Pacific, with its ongoing rapid industrialization, remains a crucial driver, poised to retain its market dominance.

Leave a Comment