Rising Demand for Durable Materials

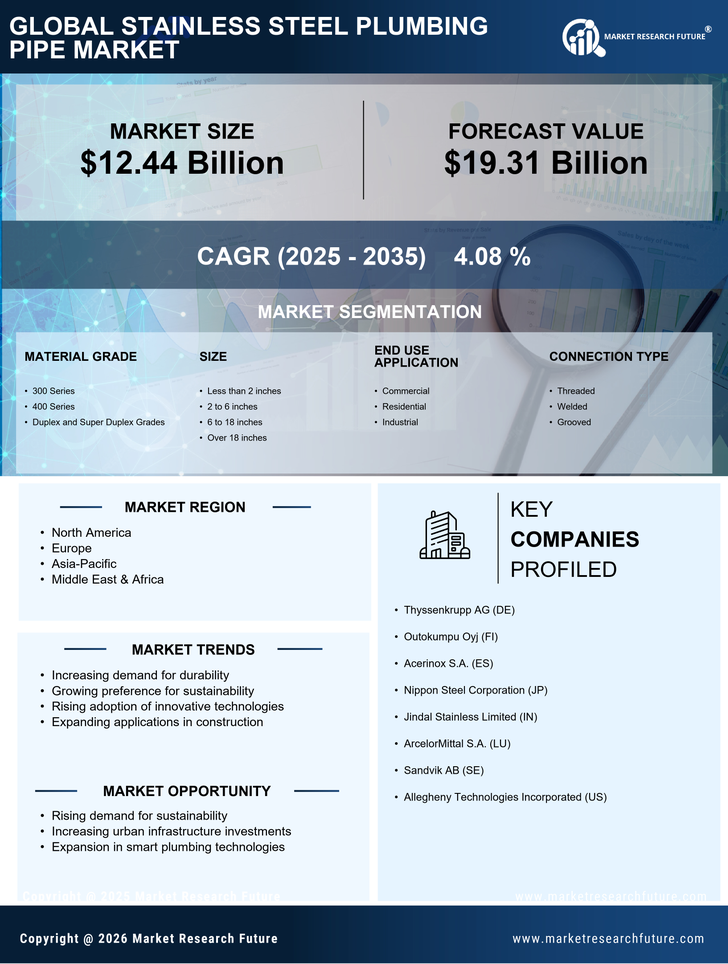

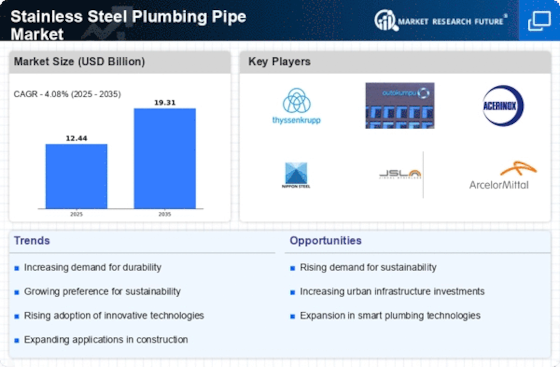

The Stainless Steel Plumbing Pipe Market is experiencing a notable increase in demand for durable and long-lasting materials. Stainless steel pipes are favored for their resistance to corrosion, high temperatures, and pressure, making them ideal for various plumbing applications. This trend is particularly evident in regions where infrastructure development is on the rise, as stainless steel pipes are increasingly utilized in both residential and commercial projects. According to recent data, the market for stainless steel plumbing pipes is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is driven by the need for reliable plumbing solutions that can withstand harsh environmental conditions, thereby enhancing the overall longevity of plumbing systems.

Increased Investment in Infrastructure

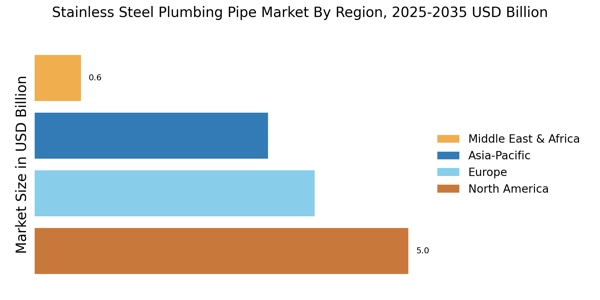

Investment in infrastructure development is a key driver for the Stainless Steel Plumbing Pipe Market. Governments and private entities are allocating substantial funds towards upgrading and expanding existing plumbing systems, particularly in urban areas. This investment is often directed towards sustainable and efficient materials, with stainless steel being a preferred choice due to its longevity and low maintenance requirements. Recent reports indicate that infrastructure spending is expected to rise significantly, with many countries prioritizing the replacement of outdated plumbing systems. This trend not only boosts the demand for stainless steel pipes but also encourages innovation in manufacturing processes, further enhancing the market's growth potential.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are significantly impacting the Stainless Steel Plumbing Pipe Market. Innovations such as automated production lines and improved welding techniques are enhancing the efficiency and quality of stainless steel pipes. These advancements not only reduce production costs but also improve the overall performance of the pipes, making them more appealing to consumers. Furthermore, the integration of smart technologies in plumbing systems is creating new opportunities for stainless steel pipes, as they can be easily integrated into modern plumbing solutions. As manufacturers continue to adopt these technologies, the market is likely to witness increased competition and a broader range of product offerings.

Sustainability and Environmental Considerations

Sustainability is becoming a crucial factor in the Stainless Steel Plumbing Pipe Market. As environmental concerns grow, there is a shift towards materials that are recyclable and have a lower carbon footprint. Stainless steel is inherently sustainable, as it can be recycled without losing its properties, making it an attractive option for eco-conscious consumers and businesses. This trend is further supported by government initiatives promoting sustainable building practices and materials. The increasing focus on green construction is expected to drive demand for stainless steel plumbing pipes, as they align with the principles of sustainability and environmental responsibility. This shift not only benefits the environment but also positions stainless steel as a leading material in the plumbing industry.

Growing Awareness of Health and Safety Standards

The Stainless Steel Plumbing Pipe Market is increasingly influenced by heightened awareness of health and safety standards. Stainless steel pipes are recognized for their hygienic properties, making them suitable for applications in food and beverage industries, healthcare facilities, and residential plumbing. As regulations surrounding water quality and safety become more stringent, the demand for materials that meet these standards is likely to rise. The use of stainless steel pipes can help mitigate risks associated with contamination, thereby ensuring compliance with health regulations. This growing emphasis on safety is expected to drive market growth, as industries seek reliable plumbing solutions that adhere to these evolving standards.