Top Industry Leaders in the Starch Derivatives Market

Strategies Adopted by Starch Derivatives Key Players

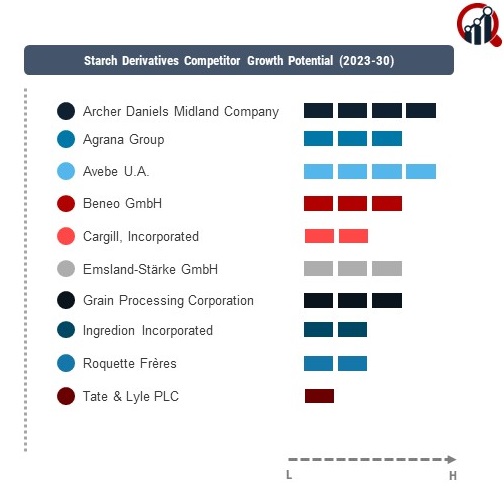

The starch derivatives market is witnessing intense competition, driven by evolving consumer preferences, technological advancements, and the pursuit of sustainable solutions. Key players in this dynamic landscape have been strategically positioning themselves to gain a competitive edge, employing various strategies to navigate the ever-changing market conditions.

Prominent players dominating the starch derivatives market include

- Archer Daniels Midland Company (US)

- Agrana Group (Austria)

- Avebe U.A. (The Netherlands)

- Beneo GmbH (Germany)

- Cargill Incorporated (US)

- Emsland-Stärke GmbH (Germany)

- Grain Processing Corporation (US)

- Ingredion Incorporated (US)

- Roquette Frères (France)

- Tate & Lyle PLC (UK) among others

Strategies adopted by these key players encompass a mix of organic growth, collaborations, mergers, and acquisitions. For instance, Cargill has consistently focused on expanding its product offerings through innovative solutions and investing in research and development to stay ahead in the competitive curve. Archer Daniels Midland Company has pursued a strategy of diversification, entering new markets and enhancing its presence across different regions.

Market Share Analysis Factors:

Market share analysis in the starch derivatives sector is influenced by several factors, with product innovation and sustainability at the forefront. Companies are increasingly emphasizing the development of eco-friendly alternatives and cleaner production processes to align with changing consumer expectations. The ability to adapt to these environmental considerations is proving crucial in gaining and maintaining market share.

New and emerging companies are making their mark in the starch derivatives market, challenging established players by bringing innovative solutions to the table. Companies like Avebe U.A., Tereos S.A., and Grain Processing Corporation have been gaining traction, disrupting the market with novel approaches and agile business models. These players are capitalizing on niche segments and addressing specific consumer demands, contributing to the diversification of the competitive landscape.

Industry Trends:

Industry news and current company investment trends indicate a heightened focus on sustainable practices and technological advancements. Companies are increasingly investing in research and development to create starch derivatives with improved functionalities and reduced environmental impact. Additionally, strategic collaborations and partnerships are on the rise, facilitating knowledge exchange and resource optimization.

Competitive Scenario:

The overall competitive scenario in the starch derivatives market is marked by a balance between established industry leaders and nimble, innovative entrants. The landscape is evolving as companies navigate the challenges posed by regulatory changes, volatile commodity prices, and shifting consumer preferences. The ability to adapt to these factors and capitalize on emerging opportunities will be crucial for sustained success in this competitive environment.

Recent Development

The starch derivatives market witnessed significant advancements. Companies across the board continued to invest in sustainable practices, with a notable emphasis on reducing carbon footprints. Tate & Lyle PLC, for instance, announced a comprehensive sustainability roadmap, outlining its commitment to achieving net-zero emissions by 2030. This move not only reflects the growing importance of sustainability in the industry but also indicates a strategic approach to align with global environmental goals.

Furthermore, there were notable mergers and acquisitions that reshaped the competitive landscape. Ingredion Incorporated successfully acquired a leading player in the specialty ingredients space, expanding its product portfolio and strengthening its position in key markets. This strategic move is indicative of the ongoing trend of industry consolidation, where companies seek synergies to enhance their market presence and streamline operations.