Rising Construction Activities

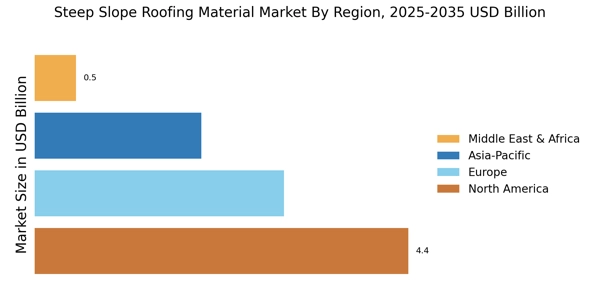

The Steep Slope Roofing Material Market is benefiting from a resurgence in construction activities across residential and commercial sectors. With urbanization and population growth driving new housing developments, the demand for steep slope roofing materials is expected to rise. According to recent data, the construction sector has seen a steady increase in investments, particularly in regions where housing shortages are prevalent. This growth is likely to stimulate the market for steep slope roofing materials, as builders and contractors seek durable and aesthetically pleasing options to meet consumer preferences.

Growing Awareness of Aesthetic Value

The Steep Slope Roofing Material Market is increasingly influenced by the growing awareness of aesthetic value among consumers. Homeowners and builders are recognizing that roofing materials significantly impact the overall appearance of a property. As a result, there is a rising demand for visually appealing options that complement architectural styles. Materials such as slate, tile, and architectural shingles are gaining popularity due to their aesthetic versatility and ability to enhance curb appeal. This trend suggests that manufacturers who prioritize design and aesthetics in their product offerings may capture a larger share of the market.

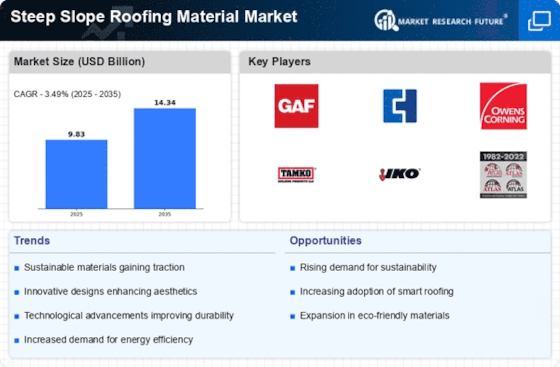

Increased Demand for Energy Efficiency

The Steep Slope Roofing Material Market is experiencing a notable surge in demand for energy-efficient roofing solutions. As energy costs continue to rise, homeowners and commercial property owners are increasingly seeking materials that enhance insulation and reduce energy consumption. This trend is supported by various government initiatives promoting energy efficiency in building designs. For instance, materials such as metal and asphalt shingles are being favored for their reflective properties, which can significantly lower cooling costs. The market is projected to grow as more consumers prioritize sustainability and energy savings, indicating a shift towards eco-friendly roofing options.

Technological Innovations in Roofing Materials

The Steep Slope Roofing Material Market is witnessing a wave of technological innovations that are transforming traditional roofing materials. Advancements in manufacturing processes and material science are leading to the creation of lighter, more durable, and weather-resistant roofing options. For example, the introduction of synthetic roofing materials and advanced coatings is enhancing the performance and longevity of steep slope roofs. These innovations are not only improving the functionality of roofing systems but also expanding design possibilities, making them more appealing to architects and builders. This trend is likely to drive market growth as stakeholders seek cutting-edge solutions.

Regulatory Support for Sustainable Building Practices

The Steep Slope Roofing Material Market is influenced by increasing regulatory support for sustainable building practices. Governments are implementing stricter building codes and standards that encourage the use of environmentally friendly materials. This regulatory environment is fostering innovation in roofing technologies, leading to the development of materials that not only meet performance standards but also contribute to sustainability goals. As a result, manufacturers are investing in research and development to create products that comply with these regulations, thereby enhancing their market position and appealing to environmentally conscious consumers.