Structural Sealant Size

Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 0.0 Billion |

| CAGR (2016-2023) | 0.0 % |

Note – Market size depicts the revenue generated over the financial year

The Structural Sealant Market is currently going through a stagnant phase, with a market value of $0 billion in 2023, and a forecast of the same value. The CAGR from 2016 to 2023 is 0%, indicating a lack of significant growth during this period. The market stagnation is due to a number of factors, such as the aforementioned market saturation, the lack of innovation in product offerings, and the global economic uncertainty that has affected the construction and manufacturing sectors. Despite these factors, a number of technological trends are set to have an impact on the future of the market. A growing need for energy-efficient buildings and sustainable construction practices has led to a demand for advanced sealants that offer superior performance and longer-lasting solutions. The leading manufacturers, such as Dow, Sika, and BASF, are investing in research and development to create high-performance sealants that meet stringent regulatory requirements. Strategic initiatives, such as M&A, collaborations, and investments in R&D, are necessary for these companies to enhance their product offerings and capture new market opportunities.

Regional Market Size

Regional Deep Dive

The market for structural sealants is experiencing a dynamic growth, driven by increasing construction activities, technological advancements, and the growing emphasis on energy efficiency. In North America, the market is characterized by the demand for high-performance sealants in commercial and residential construction, while in Europe the market is experiencing a shift towards the concept of sustainable building. The Asia-Pacific region is expanding rapidly due to the development of urbanization and the construction of public works. In the Middle East and Africa, the growth is driven by the implementation of large-scale construction projects. Latin America, which is still developing, is beginning to adopt advanced sealant technology as its construction industry matures. Each region offers its own opportunities and challenges, which are influenced by regulations, economic conditions, and cultural aspects.

Europe

- The European Union's Green Deal is pushing for sustainable construction practices, leading to increased demand for structural sealants that meet energy efficiency standards, thus driving innovation in the market.

- Companies such as Henkel and BASF are focusing on developing bio-based sealants, aligning with the region's sustainability goals and responding to consumer preferences for environmentally friendly products.

Asia Pacific

- Rapid urbanization in countries like China and India is leading to a surge in construction projects, significantly boosting the demand for structural sealants, particularly in high-rise buildings and infrastructure.

- Local manufacturers are increasingly collaborating with international firms to enhance product quality and expand their market reach, as seen in partnerships between Asian companies and global leaders like Momentive.

Latin America

- The construction sector in Brazil is gradually recovering, with government initiatives aimed at boosting infrastructure development, which is expected to increase the demand for structural sealants.

- Local companies are beginning to adopt advanced technologies and formulations, influenced by international standards, to improve product performance and meet the evolving needs of the construction industry.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced stricter regulations on volatile organic compounds (VOCs) in sealants, prompting manufacturers to innovate with low-VOC and eco-friendly products, enhancing market competitiveness.

- Key players like Dow, Sika, and 3M are investing heavily in R&D to develop advanced structural sealants that offer superior adhesion and durability, catering to the growing demand in the construction sector.

Middle East And Africa

- The UAE's Vision 2021 initiative is driving significant investments in infrastructure, resulting in a heightened demand for advanced structural sealants in construction projects across the region.

- Companies like Bostik and Mapei are actively participating in major construction projects, leveraging their expertise to provide innovative sealing solutions that meet the unique climatic challenges of the region.

Did You Know?

“Did you know that structural sealants can significantly improve the energy efficiency of buildings by reducing air leakage, which can account for up to 30% of energy loss?” — U.S. Department of Energy

Segmental Market Size

The Structural Sealant Market is a growing market with increasing demand from the construction and automobile industries. There is an increasing need for energy-efficient buildings and the stricter government regulations regarding the safety and integrity of structures. Also, the advancements in the adhesive industry have made it possible to produce more effective and durable sealants, which also contribute to the growth of the market. The structural sealant market is currently in its mature phase, with the leading companies such as Dow and Sika taking the lead in the development of new applications. There are several large projects that involve the use of structural sealants in high-rise buildings and bridges, where they are used to ensure waterproofing and load bearing. Among the most important applications are the construction of residential and commercial buildings, the automobile industry, and the aeronautics industry, where the sealants are critical to the performance and safety of the structures. The market is mainly driven by the growing need for energy-efficient buildings, the increasing trend of green buildings, and the development of new technologies such as polyurethanes and silanes.

Future Outlook

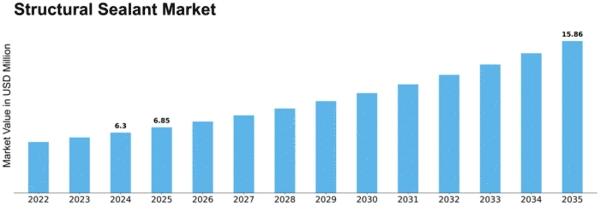

The Structural Sealants Market is estimated to grow at a substantial CAGR from 2023 onwards, owing to the increasing demand from the construction, automobile, and aerospace industries. The penetration of structural sealants is expected to rise significantly, especially in the emerging economies where the construction industry is booming. A CAGR of 0.0% is expected to be seen in the near future, with innovation and sustainable development as the main focus areas. The key technological advancements, such as the introduction of high-performance sealants with enhanced strength and weather resistance, are expected to further drive the market growth. The stricter regulations with respect to energy conservation and reduction of the carbon footprint are also expected to propel the adoption of advanced sealant solutions. The rising trend of using smart materials and the integration of IoT in construction are also expected to transform the structural sealants landscape and ensure the market remains dynamic and responsive to the changing needs of the end-use industries.

Leave a Comment