Technological Innovations

Technological innovations play a pivotal role in shaping the Subsea Production Processing System Market. The advent of advanced subsea processing technologies, such as subsea separation and boosting systems, has revolutionized the way oil and gas are extracted from deepwater environments. These innovations not only enhance recovery rates but also minimize environmental impact, aligning with the industry's sustainability goals. The market is witnessing a shift towards automation and digitalization, with companies investing in smart technologies that enable real-time monitoring and predictive maintenance. This trend is expected to drive the market's growth, as operators seek to optimize their subsea operations and reduce downtime. As a result, the subsea production processing systems market is likely to see a significant increase in adoption rates, further solidifying its importance in the energy sector.

Increasing Demand for Energy

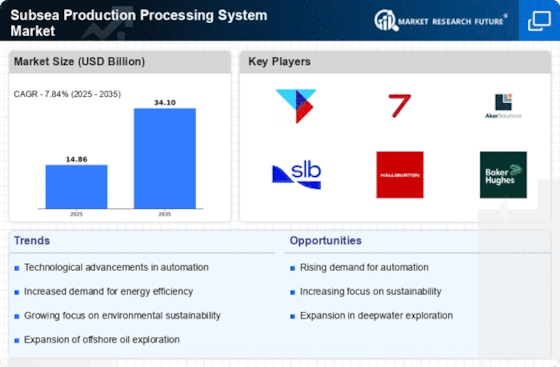

The Subsea Production Processing System Market is experiencing a surge in demand for energy, driven by the growing global population and industrialization. As countries strive to meet their energy needs, subsea production systems are becoming essential for accessing untapped offshore oil and gas reserves. According to recent estimates, the subsea production systems market is projected to reach USD 30 billion by 2026, reflecting a compound annual growth rate of approximately 5.5%. This increasing demand for energy is prompting investments in subsea technologies, which are crucial for enhancing production efficiency and reducing operational costs. Furthermore, the need for reliable energy sources is pushing companies to adopt advanced subsea processing systems that can operate in challenging environments, thereby expanding the market's potential.

Regulatory Support and Policies

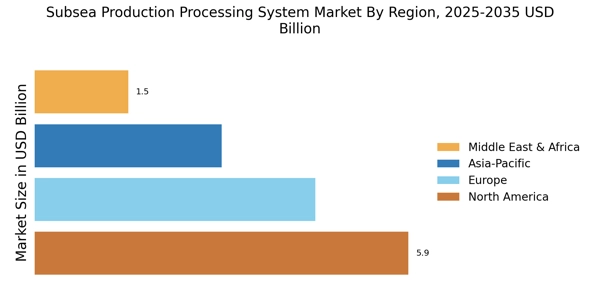

Regulatory support and policies are crucial drivers for the Subsea Production Processing System Market. Governments worldwide are implementing favorable regulations to encourage offshore exploration and production activities. These policies often include tax incentives, streamlined permitting processes, and investment in infrastructure development. For instance, several countries have established frameworks that promote the use of subsea technologies to enhance energy security and reduce reliance on imported fuels. This supportive regulatory environment is likely to stimulate investments in subsea production systems, as companies seek to comply with environmental standards while maximizing their operational efficiency. As a result, the subsea production processing systems market is expected to benefit from increased governmental backing, fostering growth and innovation in the sector.

Focus on Environmental Sustainability

The focus on environmental sustainability is becoming increasingly prominent within the Subsea Production Processing System Market. As concerns about climate change and environmental degradation grow, oil and gas companies are under pressure to adopt more sustainable practices. Subsea production systems are being designed with a focus on reducing emissions and minimizing ecological impact. Innovations such as subsea processing technologies that reduce the need for surface facilities are gaining traction, as they contribute to lower carbon footprints. Furthermore, regulatory bodies are encouraging the adoption of environmentally friendly technologies, which is likely to drive investments in subsea production systems that align with sustainability goals. This emphasis on environmental responsibility is expected to shape the future of the subsea production processing systems market, as companies strive to balance profitability with ecological stewardship.

Rising Offshore Exploration Activities

The Subsea Production Processing System Market is significantly influenced by the rising offshore exploration activities. As onshore reserves become depleted, oil and gas companies are increasingly turning to offshore fields to meet their production targets. This shift is driving the demand for advanced subsea production systems that can operate efficiently in deepwater and ultra-deepwater environments. Recent reports indicate that offshore exploration investments are projected to exceed USD 20 billion by 2025, highlighting the industry's commitment to tapping into these resources. The need for sophisticated subsea processing technologies is paramount, as they enable operators to extract hydrocarbons from challenging locations while ensuring safety and environmental protection. Consequently, the subsea production processing systems market is poised for substantial growth as exploration activities intensify.