Market Growth Projections

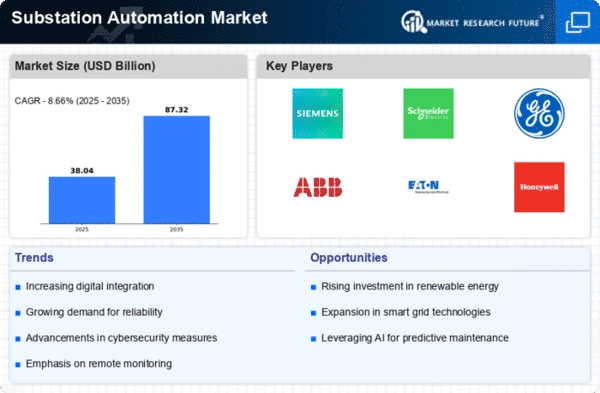

The Global Substation Automation Market Industry is projected to experience substantial growth over the next decade. With a market value of 35.0 USD Billion in 2024, it is anticipated to reach 87.3 USD Billion by 2035. This growth represents a compound annual growth rate of 8.66% from 2025 to 2035. Such projections underscore the increasing importance of automation technologies in the energy sector, driven by factors such as renewable energy integration, regulatory support, and the need for operational efficiency. The market's trajectory reflects a broader trend towards modernization and innovation in electrical infrastructure.

Rising Focus on Operational Efficiency

The Global Substation Automation Market Industry is witnessing a rising focus on operational efficiency among utility companies. Automation solutions enable utilities to optimize their operations, reduce maintenance costs, and enhance overall performance. By implementing automated systems, utilities can achieve real-time monitoring and control, leading to improved decision-making and resource allocation. This emphasis on efficiency is particularly relevant as utilities face increasing pressure to deliver reliable services while managing costs. As a result, the demand for substation automation technologies is expected to grow, contributing to the market's expansion.

Advancements in Smart Grid Technologies

The Global Substation Automation Market Industry is significantly influenced by advancements in smart grid technologies. These innovations enhance the reliability and efficiency of electricity distribution systems. Smart grids utilize digital communication and automation to monitor and manage the flow of electricity, thereby reducing outages and improving service quality. The increasing adoption of smart meters and advanced distribution management systems is indicative of this trend. As utilities invest in modernizing their infrastructure, the demand for substation automation solutions is expected to rise, further propelling market growth.

Growing Demand for Renewable Energy Integration

The Global Substation Automation Market Industry is experiencing a notable shift towards the integration of renewable energy sources. As countries strive to meet their carbon reduction targets, the need for efficient management of renewable energy generation becomes paramount. Substation automation technologies facilitate the seamless integration of solar, wind, and other renewable sources into the grid. This trend is expected to drive substantial investments in automation solutions, contributing to the market's projected growth from 35.0 USD Billion in 2024 to 87.3 USD Billion by 2035, reflecting a compound annual growth rate of 8.66% from 2025 to 2035.

Regulatory Support for Modernization Initiatives

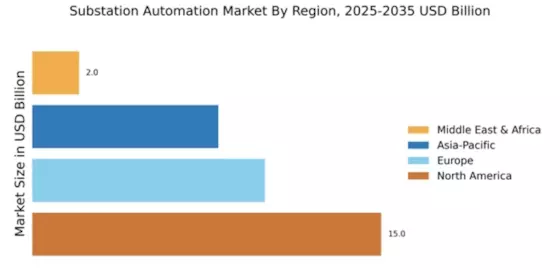

Regulatory frameworks across various regions are increasingly supporting modernization initiatives within the Global Substation Automation Market Industry. Governments are implementing policies that encourage the adoption of advanced technologies to enhance grid resilience and reliability. For instance, initiatives aimed at reducing greenhouse gas emissions often include provisions for upgrading substations with automated systems. This regulatory support not only fosters investment in automation technologies but also aligns with broader energy transition goals. Consequently, the market is likely to benefit from these favorable policies, driving growth and innovation.

Increased Investment in Infrastructure Development

The Global Substation Automation Market Industry is benefiting from increased investment in infrastructure development globally. Many countries are prioritizing the enhancement of their electrical infrastructure to support economic growth and energy demands. This investment often includes the modernization of substations with advanced automation technologies. As governments and private entities allocate funds for infrastructure projects, the demand for substation automation solutions is likely to rise. This trend is expected to play a crucial role in driving the market's growth trajectory over the coming years.