Market Analysis

In-depth Analysis of Substation Monitoring Market Industry Landscape

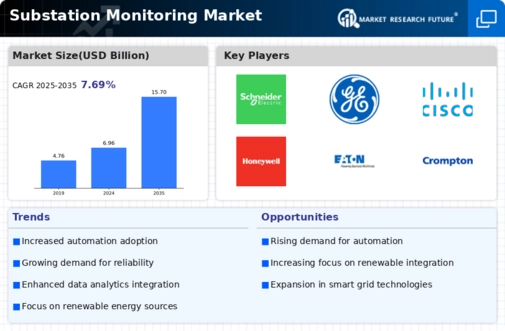

Several variables drive the growth and development of the Substation Monitoring market, a vital electric power industry sector. Rising need for dependable and efficient power is a major factor. As the world population grows, urbanizes, and adopts technology, power consumption increases. Substation monitoring systems ensure the proper functioning of power grid substations, which convert and distribute electrical energy. Increasing grid stability and resilience also shapes the Substation Monitoring industry. With increased severe weather events and the need for a more robust power infrastructure, utilities and grid operators are investing in substation monitoring technologies to improve situational awareness. Real-time monitoring improves grid dependability by detecting problems early and responding quickly. Regions prone to natural catastrophes and bad weather need this resilience emphasis. Technological advances and smart grid integration are driving Substation Monitoring market innovation. Modern monitoring systems offer substation health and performance data using sophisticated sensors, communication networks, and data analytics. These modern technologies allow remote monitoring and predictive maintenance, minimizing downtime and improving power grid efficiency. The Substation Monitoring market adapts to grid operators' demands as the power sector digitizes. Substation Monitoring market is influenced by regulations and compliance criteria. Governments and regulators set electrical infrastructure dependability, safety, and security standards. Utilities and operators must comply with these criteria, therefore they create monitoring systems that surpass regulations. Market solutions improve business efficiency and help satisfy regulatory requirements. Substation Monitoring is affected by the worldwide shift to renewable energy. The grid integration of renewable energy like solar and wind power brings unpredictability and intermittency issues. Real-time data on power quality, grid stability, and load control from substation monitoring systems helps integrate renewable energy. This trend supports lowering carbon emissions and switching to a greener energy mix. Competition affects the Substation Monitoring market. Competing for market share encourages innovation and various monitoring systems. Market players spend in R&D to deliver increased features, scalability, and grid management system interoperability. This competitive environment gives end-users more alternatives, improving product performance and functionality. Investment and economic factors affect the Substation Monitoring market. Economic expansion frequently boosts electricity infrastructure investments, including monitoring systems. Utility expenditures, government efforts, and the economy affect market dynamics. Modernizing and upgrading old power infrastructure drives need for superior Substation Monitoring systems. In conclusion, the Substation Monitoring market is dynamic and evolving due to factors such as rising demand for reliable electricity, grid reliability and resilience, technological advances, regulatory requirements, the transition to renewable energy, market competition, and economic conditions. Substation Monitoring systems help the electricity grid stay efficient, reliable, and sustainable as the sector changes. The market adjusts by inventing and offering solutions that meet grid operators' and the energy industry's changing demands.

Leave a Comment