Market Share

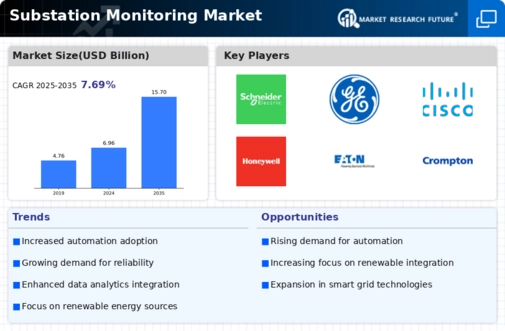

Substation Monitoring Market Share Analysis

Technological advances and power sector demands are changing the Substation Monitoring market. Advanced substation monitoring technologies are becoming more popular. Real-time substation performance visibility is needed as power networks become increasingly sophisticated and interconnected. Substation monitoring systems provide voltage, current, temperature, and device condition data. This trend is significant for utilities and operators looking to improve substation reliability, efficiency, and resilience. The Substation Monitoring industry is also seeing a rise in digitization and IoT integration. Smart sensors and communication technologies are helping utilities construct sophisticated substation monitoring systems. These technologies provide remote monitoring, predictive maintenance, and data analytics for enhanced decision-making. IoT technology improve substation efficiency and power distribution network optimization. Cybersecurity in substation monitoring is another development. As electricity infrastructure digitizes, the requirement to defend key assets from cyberattacks grows. Substation monitoring systems use strong cybersecurity to prevent unwanted access, data breaches, and power supply interruptions. As cyberattacks target the energy industry, substation monitoring infrastructure must be protected. The Substation Monitoring industry is also moving toward cloud-based solutions. Utility companies may handle and analyze massive substation data on cloud systems because to its scalability, flexibility, and accessibility. Cloud-based substation monitoring solutions provide remote monitoring, real-time analytics, and collaborative decision-making. This trend follows the industrial transition toward cloud computing and its data storage, processing, and accessibility benefits. Due to aged infrastructure, retrofitting and updating substations with contemporary monitoring methods is in demand. Many utilities are retrofitting their aged substations to improve performance and longevity. The need to manage aged equipment, comply with changing requirements, and maximize substation efficiency drives this development. Regulations and sustainability objectives affect the Substation Monitoring business. Governments and regulators are setting criteria to assure electricity infrastructure dependability and sustainability. Compliance with these rules shapes substation monitoring system development and acceptance. Energy-efficient monitoring systems and eco-friendly production materials are being developed to promote sustainability. Finally, sophisticated monitoring solutions, IoT integration, cybersecurity, cloud-based systems, retrofitting infrastructure, and regulatory compliance define the Substation Monitoring market. Companies in this sector must follow these trends to fulfill utilities' and power operators' changing demands. The Substation Monitoring market must adapt to these transformations to expand and compete and build more robust, secure, and sustainable power distribution infrastructure.

Leave a Comment