Growing Focus on Automation

The growing focus on automation within various industries is significantly influencing the Surface Vision Inspection Equipment Market. As manufacturers strive to enhance productivity and reduce labor costs, the adoption of automated inspection systems is becoming more prevalent. Automation not only streamlines the inspection process but also minimizes human error, leading to improved product quality. Industries such as electronics and automotive are particularly inclined towards automation, as they require high precision and consistency in their production processes. The market for surface vision inspection equipment is likely to benefit from this trend, with an increasing number of companies investing in automated solutions. This shift towards automation is expected to drive innovation and create new opportunities within the market, potentially leading to a more competitive landscape.

Rising Demand for Quality Assurance

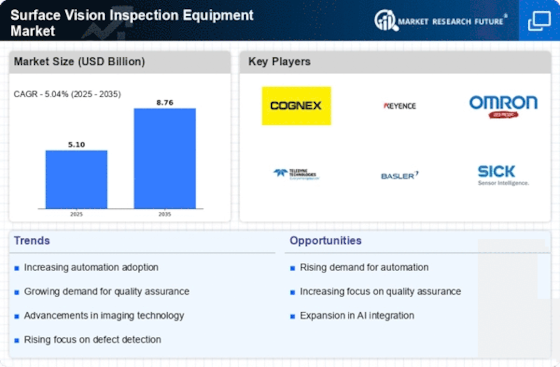

The Surface Vision Inspection Equipment Market is experiencing a notable increase in demand for quality assurance across various sectors. Industries such as automotive, electronics, and pharmaceuticals are prioritizing quality control to meet stringent regulatory standards. This trend is driven by the need to minimize defects and enhance product reliability. As a result, manufacturers are investing in advanced inspection technologies to ensure compliance with industry standards. The market for surface vision inspection equipment is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is indicative of the industry's commitment to maintaining high-quality production processes, thereby reinforcing the importance of surface vision inspection equipment in achieving operational excellence.

Expansion of Manufacturing Facilities

The expansion of manufacturing facilities is a significant driver for the Surface Vision Inspection Equipment Market. As companies scale their operations to meet rising consumer demand, the need for efficient quality control systems becomes paramount. New manufacturing plants are increasingly being equipped with state-of-the-art inspection technologies to ensure that production lines operate smoothly and meet quality standards. This trend is particularly evident in sectors such as food and beverage, where compliance with health regulations is critical. The investment in surface vision inspection equipment is likely to increase as manufacturers recognize the value of integrating these systems into their production processes. Consequently, this expansion is expected to contribute to the overall growth of the market, with projections indicating a steady rise in equipment adoption over the next few years.

Increasing Regulatory Compliance Requirements

Increasing regulatory compliance requirements are a critical driver for the Surface Vision Inspection Equipment Market. As industries face heightened scrutiny from regulatory bodies, the need for reliable inspection systems becomes essential. Companies are compelled to adopt advanced inspection technologies to ensure adherence to safety and quality standards. This trend is particularly pronounced in sectors such as pharmaceuticals and food processing, where compliance with stringent regulations is non-negotiable. The demand for surface vision inspection equipment is likely to rise as organizations seek to mitigate risks associated with non-compliance. Furthermore, the potential for penalties and reputational damage associated with regulatory failures underscores the importance of investing in effective inspection solutions. As a result, the market is expected to witness sustained growth driven by the imperative to meet evolving regulatory demands.

Technological Advancements in Inspection Systems

Technological advancements are playing a pivotal role in shaping the Surface Vision Inspection Equipment Market. Innovations such as high-resolution imaging, real-time data processing, and machine learning algorithms are enhancing the capabilities of inspection systems. These advancements enable manufacturers to detect defects with greater accuracy and speed, thereby reducing waste and improving efficiency. The integration of smart technologies is expected to drive the market forward, as companies seek to leverage these tools for competitive advantage. Furthermore, the increasing complexity of products necessitates sophisticated inspection solutions, which could lead to a surge in demand for advanced surface vision inspection equipment. As industries evolve, the need for cutting-edge inspection technologies becomes more pronounced, suggesting a robust growth trajectory for the market.