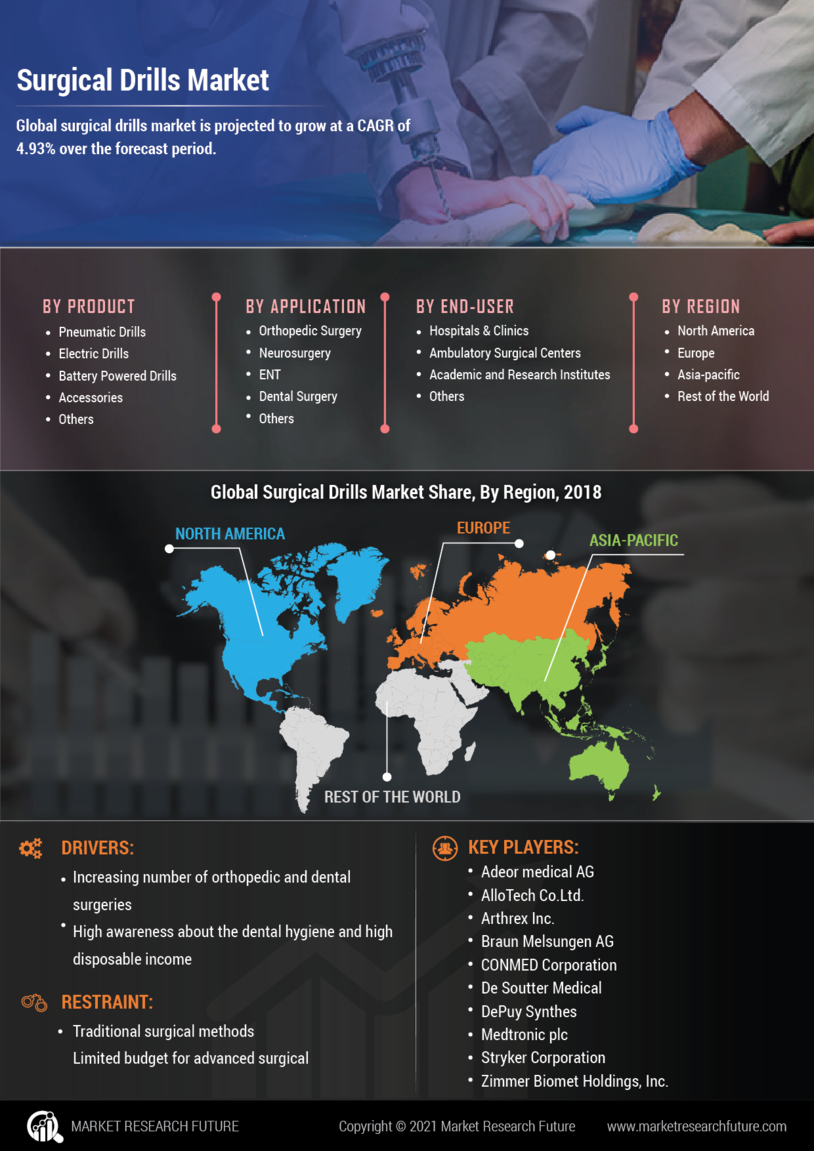

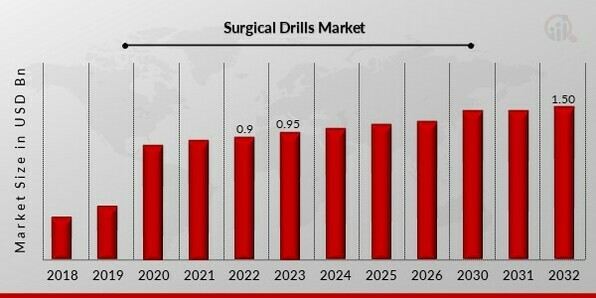

Global Surgical Drills Market Overview

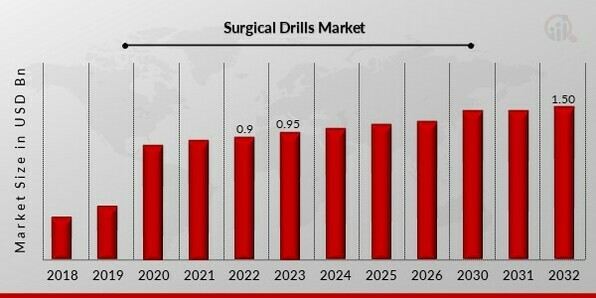

Surgical Drills Market Size was valued at USD 0.9 billion in 2022 and is projected to grow from USD 0.95 Billion in 2023 to USD 1.50 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.9% during the forecast period (2023 - 2032). A growing number of surgical procedures and rising incidence of sports injuries and accidents are some of the market drivers for surgical drills are driving the market. Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

San Francisco will host Zimmer Biomet Holdings, Inc.’s newest product innovations in February 2024. One of them, the ViVi Surgical Helmet System, is designed to provide clear vision and keep doctors cool and comfortable during surgeries. Furthermore, it is the quietest as well as the lightest surgical helmet with an enabled 100,000 Lux light emitting diode.

DePuy Synthes had received FDAs ‘510 clearance’ for TriALTIS™ Spine System & TriALTIS™ Navigation Enabled Instruments according to Johnson & Johnson MedTech announcement dated October 2023.

A medical drill tool known as CD NXT System was launched by Stryker, a pharmaceutical and medical device company in May 2023. Some of its properties include an automatic cortex-to-cortex measurement; digital readout; one-step drilling and compatibility with all legacy cordless driver attachments.

X-Nav Technologies got USFDA approval to expand its use of X-Guide Dynamic Surgical Navigation System targeting dentists delivering minimally invasive endodontic procedures in April 2022.

In May 2022: Adeor Medical AG introduced the Velocity Alpha electric high-speed drill which has unique surgical features. This is facilitated by its simple setup and handling that make it convenient for the operating room staff.

Grage’s team made another innovation called Hubly Surgical—a lightweight neurosurgical drill that is much more beneficial compared to traditional ones in terms of accessing the brain during stroke, aneurysm or emergency cases back in June 2022.

CORI Handheld Robotics was released by Smith and Nephew in November 2021. This particular instrument is meant for total knee arthroplasties(TKA) and partial knee arthroplasties(PKA). It includes a 3D intra-operative imaging device along with an advanced robotic sculpting device which enables surgeons customize knee surgerical operation per patient's anatomy.

Joimax, the market leader in technologies and training methods for full-endoscopic and minimally invasive spinal surgery, on the other hand had announced the introduction of a new generation Shrill, the Shaver Drill System in June 2021. The Joimax Shrill system is also highly effective in treating stenosis, a degenerative spine condition as well as being made for removal of soft tissue and bone.

Medtronic has recently stated successful minimally invasive spinal approaches using navigated disc prep, interbodies, and Midas Rex drills with Mazor Robotic Guidance System in February 2021. These procedures herald a significant move towards reshaping spine surgery by means of increased precision and less intrusive methodologies.

In 2023, Stryker Corporation introduced the CD NXT System which is the most recent power tool product. This unique system tracks the depth of drilling in real-time and allows for instant and accurate digital depth readings during various surgeries.

In April 2022, X-Nav Technologies obtained expanded FDA clearance to enable more dentists to provide minimally invasive endodontic procedures using the X-Guide Dynamic Surgical Navigation System.

In May 2022, Adeor Medical AG launched a first-of-its-kind surgical drill called Velocity Alpha electric high-speed drill. It offers quick setup and the easiest handling that ensures convenience for staff in the operation room.

In June 2022, Grage's team developed Hubly Surgical, which is a light neurosurgical drill with added benefits over conventional drills when accessing the brain during a stroke, aneurysm, trauma, or emergency cases.

Surgical Drills Market Trends

- Rising number of sports Injuries and accidensts to drive market growth

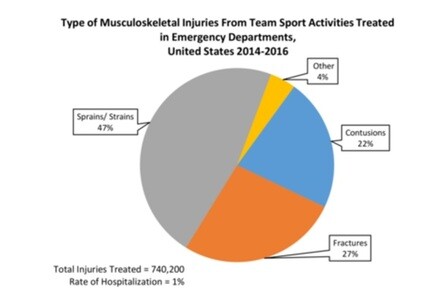

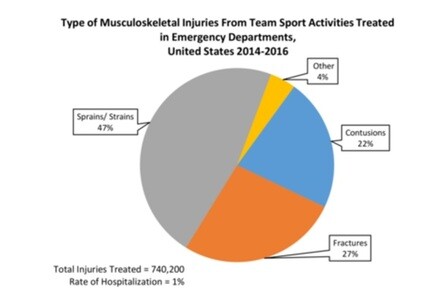

Sports involvement among kids and teenagers has expanded during the previous few decades, especially among younger age groups. Injuries that were previously only seen in more experienced athletes are now more frequently occurring in young athletes. According to Stanford Medicine, Children's Health, Over 3.5 million injuries that result in some loss of playing time are sustained by the approximately 30 million kids and teens participating in organized sports in the U.S. each year. Sports-related injuries account for nearly one-third of all injuries suffered by children. Even though sports-related deaths are uncommon, brain injuries are the most common type of sports-related fatality. Sports and recreational activities cause about 21% of all traumatic brain injuries among American children. Thus, growing sports-related injuries are one of the most common factors driving the market CAGR for surgical drills.

Moreover, road accidents are also a leading cause of fractures and injuries in the population. The World Health Organization (WHO) reports that RTAs are the number one killer of people between the ages of 15 and 29. Additionally, it is anticipated that by 2020 and 2030, fatalities from motor vehicle accidents will rank as the fifth and sixth most common causes of death, respectively. An estimated 1.3 million people per year pass away in traffic accidents. More than 90% of traffic-related fatalities take place in low- and middle-income nations. The rate of fatalities from traffic accidents is highest in Africa and lowest in Europe. Thus, such accidents are fueling the number of surgeries performed globally.

Figure 1: Sports injures in the United States from 2014-2016 Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Bone drilling has become a crucial component of orthopedic surgery as a result of the expanding use of mechanical engineering in the medical field. Recently, more studies, developments, and equipment have been related to drilling into the bone to fix implants or expand the operative field. Surgical drills have developed into a necessary piece of surgical gear. They help reduce treatment times, facilitate handling, improve the accuracy of the intended procedure, and avoid anatomical structures within the bone. Companies in the market are heavily investing in developing surgical equipment, including surgical drills. For instance, in June 2021, German-based Joimax, the industry leader in technologies and training methods for full-endoscopic and minimally invasive spinal surgery, launched Shaver Drill System, a new generation Shrill globally. The joimax Shrill system, which was created for the removal of soft tissue and bone, is also incredibly effective in treating stenosis, a degenerative spine condition. Such initiatives taken by the players in the market are anticipated to accelerate the Surgical Drills market revenue globally..

Surgical Drills Market Segment Insights

Surgical Drills Product Insights

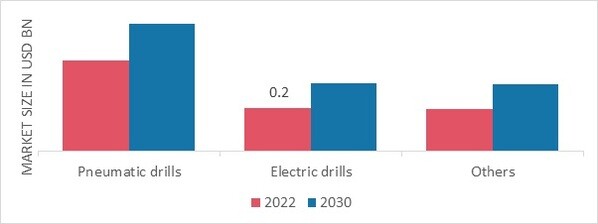

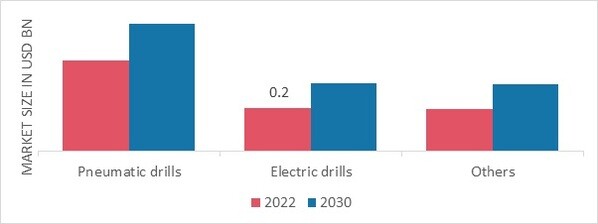

The Surgical Drills Market segmentation, based on product, includes pneumatic drills, electric drills, and others. The pneumatic drills segment held the majority share in 2022 in the Surgical Drills Market data. Oral and dental procedures are being performed more frequently. By using more torque, these drills enable quicker and easier drilling while requiring less time under anesthesia and enabling safer surgical procedures. It is one of the most commonly used equipment in the dental clinic. Thus a growing number of dental procedures are propelling the segment's growth. The electric drills segment is expected to hold the largest CAGR during the forecast period. Electric Ortho drills are also more lightweight and require less maintenance than other drills, particularly pneumatic drills. Despite not giving as much mobility as a battery-operated system, electric drills connected via a power cord are still simple to use. Thus, such advantages are expected to aid the growth of this segment during the forecast period.

April 2021: A Warsaw-based orthopedic startup claims to have a solution for one of the trickiest problems that orthopedic surgeons encounter when treating traumatic injuries like broken tibia or femur, the two main leg bones. To help surgeons "see" where they are drilling for the first time, the company raised USD 400 000 in seed funding for the commercialization of its device.

Figure 2: Surgical Drills Market, by Product, 2022 & 2030 (USD Billion) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Surgical Drills Appilcation Insights

The Surgical Drills Market segmentation, based on application, includes orthopedic surgery, neurosurgery, and dental surgery. The orthopedic surgery segment dominated the market growth for surgical drills in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. In low- and middle-income nations, the orthopedic disease has a significant and rising global burden. The rising geriatric population and the increasing number of orthopedic surgeries are the key drivers of the market. To meet the rising demand for surgeries, surgeons are now taking assistance from advanced devices. According to the American Academy of Orthopaedic Surgeons, Nearly 12% of elective primary total knee arthroplasty (TKA) cases now involve robotic assistance. The results of a similar analysis for primary elective total hip arthroplasty (THA), which uses less technology than TKA, but has an increasing utilization trend, were also noted.

Surgical Drills End-user Insights

The Surgical Drills Market data, based on end-user, include hospitals & clinics and others. The hospitals & clinics segment dominated the Surgical Drills market revenue in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. Rising incidences of orthopedic injuries, an increase in surgical procedures performed, and the availability of prompt, high-quality services in these settings at reasonable costs are among the key factors driving the growth of this segment.

Surgical Drills Regional Insights

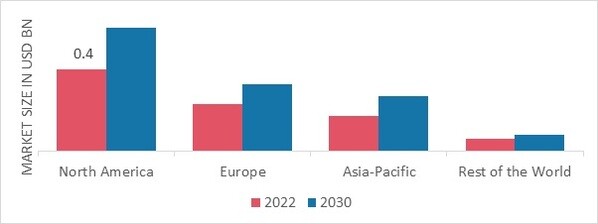

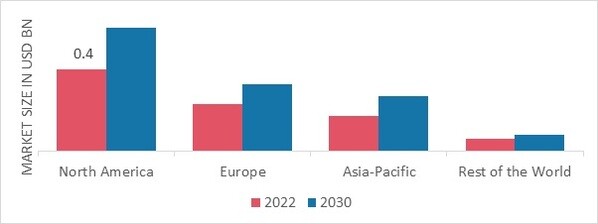

By region, the study provides market insights for surgical drills into North America, Europe, Asia-Pacific, and the Rest of the World. The North America Surgical Drills market accounted for USD 0.4 billion in 2022, with a share of around 45.80%, and is expected to exhibit a significant CAGR growth during the study period. The demand for surgical drills in the region is being driven by the availability of highly skilled surgeons in various fields, an increase in the frequency of auto accidents, and an increase in the need for orthopedic and dental procedures. Additionally, a rise in R&D activities, rapid adoption of cutting-edge technology, and a favorable healthcare infrastructure are significantly fueling the expansion of the regional market as a whole.

Further, the major countries studied in the market report for surgical drills are: The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: SURGICAL DRILLS MARKET SHARE BY REGION 2022 (%) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Surgical Drills market accounts for the second-largest market share. Some key factors propelling the market growth in this region include growing technological innovation and rising R&D investment in the healthcare industry. Further, as the frequency of bone fractures and auto accidents increases, so does the need for orthopedic and dental procedures, leading to more surgeries. Moreover, the Germany Surgical Drills market held the largest market share, and the UK Surgical Drills market was the fastest-growing market in the region.

Asia Pacific Surgical Drills Market is expected to grow at the fastest CAGR from 2022 to 2030. It is projected that a number of factors include the rising incidence of dental issues, sports & orthopedic diseases, and auto accidents. Moreover, the rising disposable incomes and rising consumer awareness of dental hygiene will both influence. Further, the China Surgical Drills market held the largest market share, and the India Surgical Drills market was the fastest-growing market in the region.

Surgical Drills Key Market Players & Competitive Insights

Major market players are investing in the R&D of various products such that they are advanced and low-cost. Market participants frequently use inorganic strategic alliances, such as partnerships, acquisitions, and capacity expansions, in addition to investments, to strengthen their market positions and gain competitive advantages. Competitors in the Surgical Drills industry must offer cost-effective items to survive in an increasingly competitive environment.

One of the key strategies adopted by manufacturers in the global Surgical Drills industry is launching new products in the market. In recent years, the Surgical Drills industry has been collaborating with other companies in the market. The Surgical Drills market major player such as Adeor medical AG, AlloTech Co.Ltd., Arthrex Inc., Braun Melsungen AG, CONMED Corporation, De Soutter Medical, DePuy Synthes, Medtronic plc, Stryker Corporation, Zimmer Biomet Holdings Inc. is working on the development of new products.

Adeor medical AG is a company that provides products that are the preferred tools for surgeons all over the world. The company has extensive experience in the surgical equipment industry. Under the adeor brand, the business provides a variety of cutting-edge tools with a focus on uses in neurosurgery, gynecology, and vascular surgery. In August 2021, adeor medical AG announced a strategic business partnership with ClearPoint Neuro, Inc. for powered neurosurgical drill solutions. According to the contract terms, ClearPoint Neuro will serve as adeor's distributor in the United States for the Velocity Alpha high-speed surgical drills system, which has recently received FDA clearance and is currently used by neurosurgeons in operating rooms for cranial and spinal procedures. Additionally, adeor medical AG consented to create an MRI conditional version for which ClearPoint Neuro will hold exclusive worldwide distribution rights.

Medtronic is a company that provides solutions for the most complex and difficult conditions in the healthcare industry. The company has a presence in more than 150 countries. In December 2019, Medtronic announced that the Stealth Autoguide system, the first cranial robotic platform that integrates with Medtronic's enabling technology portfolio to create an end-to-end procedural solution, has just received FDA clearance. A robotic guidance system called the Stealth Autoguide Platform is designed for the spatial positioning and orientation of tool guides or instrument holders used during neurosurgical procedures.

Key Companies in the Surgical Drills market includes

- Adeor medical AG

- AlloTech Co.Ltd.

- Arthrex Inc.

- Braun Melsungen AG

- CONMED Corporation

- De Soutter Medical

- DePuy Synthes

- Medtronic plc

- Stryker Corporation

- Zimmer Biomet Holdings Inc., among others

Surgical Drills Industry Developments

December 2022: Medtronic plc announced that the U.S. Food and Drug Administration (FDA) approved the use of navigated interbody and Midas Rex high-speed drills with the Mazor Robotic Guidance System earlier than expected. By seamlessly fusing the strength of Midas Rex drills with the industry-leading visibility and navigation provided by the StealthStation software, the Mazor platform now offers surgeons unprecedented procedural integration.

Surgical Drills Market Segmentation

Surgical Drills Product Outlook (USD Billion, 2018-2030)

- Pneumatic drills

- Electric drills

- others

Surgical Drills Application Outlook (USD Billion, 2018-2030)

- Orthopedic surgery

- Neurosurgery

- Dental surgery

Surgical Drills End-user Outlook (USD Billion, 2018-2030)

- Hospitals & clinics

- Others

Surgical Drills Regional Outlook (USD Billion, 2018-2030)

-

North America

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 0.9 billion |

| Market Size 2023 |

USD 0.95 billion |

| Market Size 2032 |

USD 1.50 billion |

| Compound Annual Growth Rate (CAGR) |

5.9% (2023-2032) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2032 |

| Historical Data |

2018 - 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product, Application, End-user and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Adeor medical AG, AlloTech Co.Ltd., Arthrex Inc., Braun Melsungen AG, CONMED Corporation, De Soutter Medical, DePuy Synthes, Medtronic plc, Stryker Corporation, and Zimmer Biomet Holdings Inc. |

| Key Market Opportunities |

Technological advancement |

| Key Market Dynamics |

Growing number of accidenents & sports injury Rising R&D activities |

Surgical Drills Market Highlights:

Frequently Asked Questions (FAQ) :

The Surgical Drills Market size was valued at USD 0.9 Billion in 2022.

The global market for surgical drills is projected to grow at a CAGR of 5.9% during the forecast period, 2023-2032.

North America had the largest share of the global market for surgical drills.

The key players in the market for surgical drills are Adeor medical AG, AlloTech Co.Ltd., Arthrex Inc., Braun Melsungen AG, CONMED Corporation, De Soutter Medical, DePuy Synthes, Medtronic plc, Stryker Corporation, and Zimmer Biomet Holdings Inc.

The pneumatic drills category dominated the market in 2022.

The Hospitals & clinics segment held the largest share of the Surgical Drills Market.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review