Surgical Gloves Market Summary

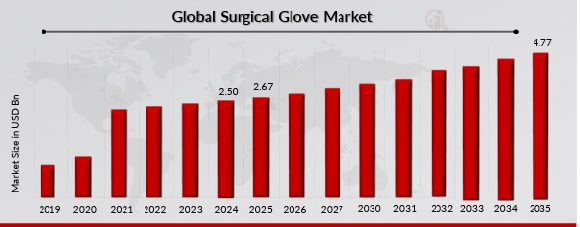

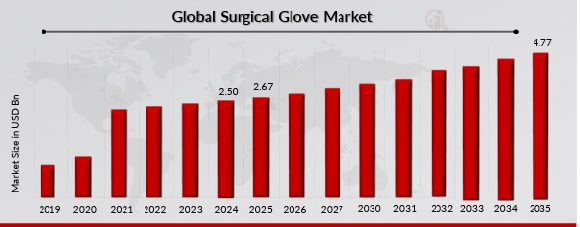

As per Market Research Future Analysis, the Global Surgical Glove market was valued at USD 2.50 billion in 2024 and is projected to grow to USD 4.77 billion by 2035, with a CAGR of 5.98% from 2025 to 2035. The growth is driven by an increasing number of surgical procedures and advancements in surgical glove technology. However, stringent regulatory policies may restrain market growth. Opportunities are anticipated from rising R&D investments in surgical glove development.

Key Market Trends & Highlights

Key trends influencing the surgical glove market include advancements in materials and increasing surgical procedures.

- Natural rubber gloves held the largest market share in 2024.

- Nitrile gloves are the fastest-growing segment during the forecast period (2025-2035).

- The online distribution channel accounted for the largest market in 2024.

- Ambulatory surgical centers are the fastest-growing end-user segment during the forecast period.

Market Size & Forecast

2024 Market Size: USD 2.50 Billion

2035 Market Size: USD 4.77 Billion

CAGR (2025-2035): 5.98%

Largest Regional Market Share in 2024: North America.

Major Players

Top Glove Corporation BHD, Cardinal Health, Ansell Ltd, Medline Industries, LP, Braun SE, Molnlycke Health Care AB, Hartalega Holdings Berhad, Kossan Rubber Industries BHD, Dynarex Corporation, Sempermed.

The growing number of surgical procedures and technologically advanced surgical gloves product launch are the major factors driving the growth of the global surgical glove market. However, the stringent regulatory policies for surgical glove manufacturers are expected to restrain the growth of the global market. Nevertheless, Increasing R&D investments for the development and manufacturing of surgical gloves are anticipated to create lucrative opportunities for the market.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Surgical Glove Market Trends

Growing awareness of Surgical Glove based therapeutics

The growing number of surgical procedures worldwide is a significant driver fueling the expansion of the global surgical gloves market. As healthcare infrastructure continues to improve and access to medical facilities increases, there has been a parallel rise in surgical interventions across various medical specialties. The increasing number of orthopedic surgeries is booming the demand for surgical hospitals in ambulatory surgical centers and hospitals. For instance, in July 2023, Cleveland Clinic (US) reported that approximately 800,000 knee replacements are performed each year in the US.

Moreover, as per the American Association of Hip and Knee Surgeons, prosthetic joint infection (PJI) stands out as a severe issue following total hip arthroplasty (THA), especially when other health conditions are present, which heightens the risk. Furthermore, according to the Organization for Economic Co-operation and Development (OECD), between 2009 and 2019, the number of hip replacements went up by 22%, and knee replacements rose by 35% on average.

This matches the growing occurrence of osteoarthritis, which is influenced by aging populations and increasing rates of obesity in OECD countries. In addition, the countries with the highest rate of hip and knee replacements were Germany, Finland, Belgium, Switzerland, and Austria in 2019.

Surgical Glove Market Segment Insights

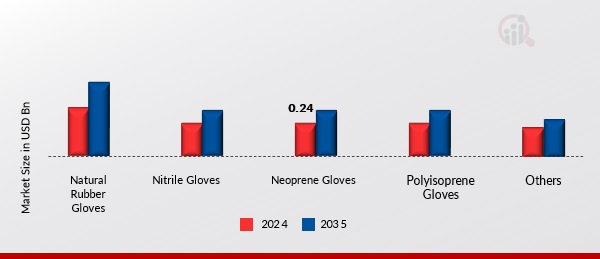

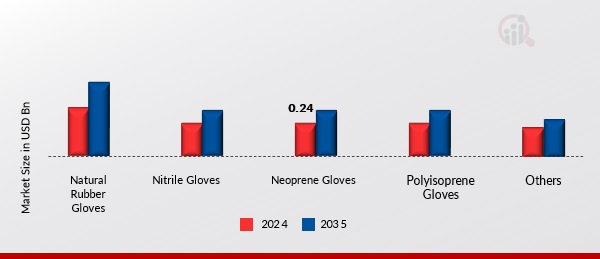

Surgical Glove Market Material Insights

Based on material, the global surgical gloves market has been bifurcated into natural rubber gloves, nitrile gloves, neoprene gloves, polyisoprene gloves, and others. The natural rubber gloves segment held the largest market share in 2024, and the nitrile glove segment is the fastest-growing segment during the forecast period (2025 -2035).

Natural rubber gloves dominate the Surgical Gloves market due to its Tactile in nature, owing to which they are highly preferred in sensitive applications such as surgeries and medical procedures, and ideal for handling water-based or biological materials.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Surgical Glove Market Form Insights

Based on Form, the Global Surgical Gloves Market has been bifurcated into Powdered and Powder-free. The powder-free segment held the largest market in 2024, and the powdered segment is the fastest growing segment during the forecast period.

This rise is due to Increasing demand for skin-friendly gloves, powder-free gloves are highly resistant to allergic reactions and other infections, moreover, other advantages include versatility, chemical, oil and water resistance, reduced risk of contamination, high level of grip, and deftness for handling various medical procedures.

Surgical Glove Market Distribution Channel Insights

Based on the distribution channel, the Global Surgical Gloves Market has been segmented into offline & online. The online segment held the largest market in 2024, and the offline segment is the fastest growing segment during the forecast period.

This rise is due as consumers are increasingly choosing online shopping due to the convenience of doorstep delivery and the availability of a wide choice of products at lower prices, and the online distribution channel enables manufacturers to reduce the expenses connected with products.

Surgical Glove Market End User Insights

Based on end user, the global Surgical Gloves market has been segmented into hospitals and clinics, ambulatory surgical centers, and others. The hospital & clinics segment held the largest market in 2024, and the ambulatory surgical centers segment is the fastest growing segment during the forecast period.

Due to The surge in hospital visits and readmissions owing to chronic diseases is driving up the demand for surgical gloves in hospitals, Growing awareness of the safety and health precautions related to patient treatment and emergency response occurrences has had a major impact on the need for surgical gloves in the healthcare industry, including veterinary and emergency medical services, and The risks associated with the on-the-job transmission of bloodborne diseases and germs have led to the rising usage of surgical gloves among the aforementioned end-users further fueling the market

Surgical Glove Market Regional Insights

By region, the market is divided into North America, Europe, Asia-Pacific, and the Rest of the World. North America accounted for the largest market in 2024, owing to the High prevalence of chronic diseases requiring surgical interventions, Technological innovations emphasizes advanced materials, eco-friendly options, customization, powder-free solutions, and stringent quality assurance measures.

Further, the major countries studied are: The US, Canada, Brazil, Germany, France, the UK, Italy, Spain, China, India, Japan, South Korea, and Australia.

FIGURE 3: GLOBAL SURGICAL GLOVE MARKET, BY REGION, 2024 & 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe accounts for the major share of the market owing to the Rising geriatric population increasing the demand for surgical procedures, and Well-established healthcare infrastructure has fueled the market growth of Europe.

The Asia-Pacific Surgical Glove Market is the fastest growing during the forecast period. Asia-Pacific is further segmented into the China, India, Japan, South Korea, Australia, and Rest of Asia-pacific.

The Surgical Glove market in the Asia-Pacific region is undergoing remarkable growth, fueled by a multifaceted array of drivers that are shaping its landscape. One of the most significant factors is the Surge in the number of surgeries due to a large patient population, Rising awareness regarding healthcare-associated infections, and Expansion of online retail channels for healthcare products. Moreover, China Surgical Glove market held the largest market share in 2024, and India Surgical Glove market is the fastest growing market in the Asia-Pacific region.The rest of the world is further divided into Middle East & Africa and Latin America.

The Surgical Glove market in the Middle East and Africa is experiencing dynamic growth, influenced by a myriad of interrelated factors that are transforming the healthcare landscape. At the forefront is the Rising government support for business establishment of key players, Emerging healthcare markets

Surgical Glove Market Key Market Players & Competitive Insights

The Global Surgical Glove Market is distinguished by the presence of numerous regional and local players catering to the global Surgical Glove products market. Furthermore, rising demands for aesthetic procedures and increasing approval and launch for Surgical Gloves are the major factors driving the growth of the global Surgical Glove market.

The Global Surgical Glove Market is extremely competitive, with players competing and investing heavily in the development of innovative products to gain a significant market share. The market is moderately fragmented with high competition in the market, increasing collaborative partnerships, and other strategic decisions to achieve operational efficiency.

The growth of prominent industry players is dependent on various factors, such as market conditions, product differentiation and innovation, and pricing strategies. It is also projected that a growing geriatric population is anticipated to create lucrative opportunities for the market. The major players have adopted a strategy of obtaining regulatory approval from government agencies for their services and solutions and signing contracts and agreements to broaden their reach.

The merged company will provide customers and patients with a wider range of products and consumables, enhanced clinical training and services, and expanded research and development capabilities. Additionally, it will have an improved geographic presence to better serve a global customer base, along with a strengthened supply chain to ensure seamless continuity of products and services.

Moreover, mergers and collaborations were also observed to expand the company's product, service, and solutions portfolio, as well as introduce new services and solutions. The growth of prominent industry players is dependent on various factors, such as market conditions, government support, and industry development. It is also projected that a rise in the investments in R&D will also boost the market's growth in the upcoming future.

Top Glove Corporation BHD is one of the manufacturers and distributors of rubber gloves. The company offers a variety of gloves, including nitrile, vinyl, latex, surgical, clean room, domestic, polyisoprene, and cast polyethylene gloves. It also provides dual-color nitrile gloves, kids' nitrile gloves, thermo-formed film-packed surgical gloves, long-length or industrial high-risk gloves, and double-donning surgical gloves.

Top Glove supplies the semiconductor, culinary, cosmetics, automotive, aerospace, laboratory, medical, and home care sectors. The business has operations in China, Germany, Thailand, and the US. The company has marketing offices in the USA, Germany, and Brazil and exports to more than 2,000 clients in 195 countries.

Key Companies in the Surgical Glove Market include

- Cardinal Health

- Ansell Ltd

- Medline Industries, LP

- Braun SE

- Molnlycke Health Care AB

- Top Glove Corporation BHD

- Hartalega Holdings Berhad

- Kossan Rubber Industries BHD

- Dynarex Corporation

- Sempermed

Surgical Gloves Industry Developments

January 2021: Ansell LTD acquired Primus Gloves Pvt. Ltd (India). With this acquisition, the company expanded its presence in the global surgical gloves market.

August 2020: Ansell LTD collaborated with Onemed (Sweden) to expand its distribution network in the Nordics to cover Sweden, Denmark, Norway, and Finland. This collaboration included Ansell’s surgical and disposable examination gloves.

Surgical Glove Market Segmentation

Surgical Glove Market Material Outlook

- Natural Rubber Gloves

- Nitrile Gloves

- Neoprene Gloves

- Polyisoprene Gloves

- Others

Surgical Glove Market Form Outlook

Surgical Glove Market Distribution Channel Outlook

Surgical Glove Market End User Outlook

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

Surgical Glove Market Regional Outlook

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Africa

- South America

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 2.50 billion |

| Market Size 2025 |

USD 2.67 billion |

| Market Size 2035 |

USD 4.77 billion |

| Compound Annual Growth Rate (CAGR) |

5.98% (2025-2035) |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Historical Data |

2019 to 2023 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Material, form, distribution channel, end user |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The US, Canada, Brazil, Germany, France, the UK, Italy, Spain, China, India, Japan, South Korea, Australia. |

| Key Companies Profiled |

Cardinal Health, Ansell Ltd, Medline Industries, LP, B.Braun SE, Molnlycke Health Care AB, Top Glove Corporation BHD, Hartalega Holdings Berhad, Kossan Rubber Industries BHD, Dynarex Corporation, Sempermed |

| Key Market Opportunities |

· Increasing R&D investments for the development and manufacturing of surgical gloves |

| Key Market Drivers |

· Growing number of surgical procedures · Technologically advanced surgical gloves product launch |

Frequently Asked Questions (FAQ):

The global Surgical Glove market is anticipated to reach 102.8 billion by 2035 at a CAGR of 8.42% during the forecast period of 2025-2035.

The US held 86.45% share of North America for the Surgical Glove market in 2024.

The global Surgical Glove market is expected to grow at 8.42% CAGR during the forecast period from 2025 to 2035.

The North America region market held the largest market share in the global Surgical Glove market.

The key players include Amgen Inc. (US), Eli Lilly and Company (US), Pfizer Inc. (US), Sun Pharmaceutical (India), Merck KGaA (Germany), Takeda Pharmaceutical Company (Japan), AstraZeneca (UK), Novartis AG (Switzerland), Sanofi (France), and Ironwood Pharmaceuticals, Inc. (US).

The parenteral of route of administration segment led the global Surgical Glove market in 2024.