Research Methodology on Surgical Robots Market

INTRODUCTION

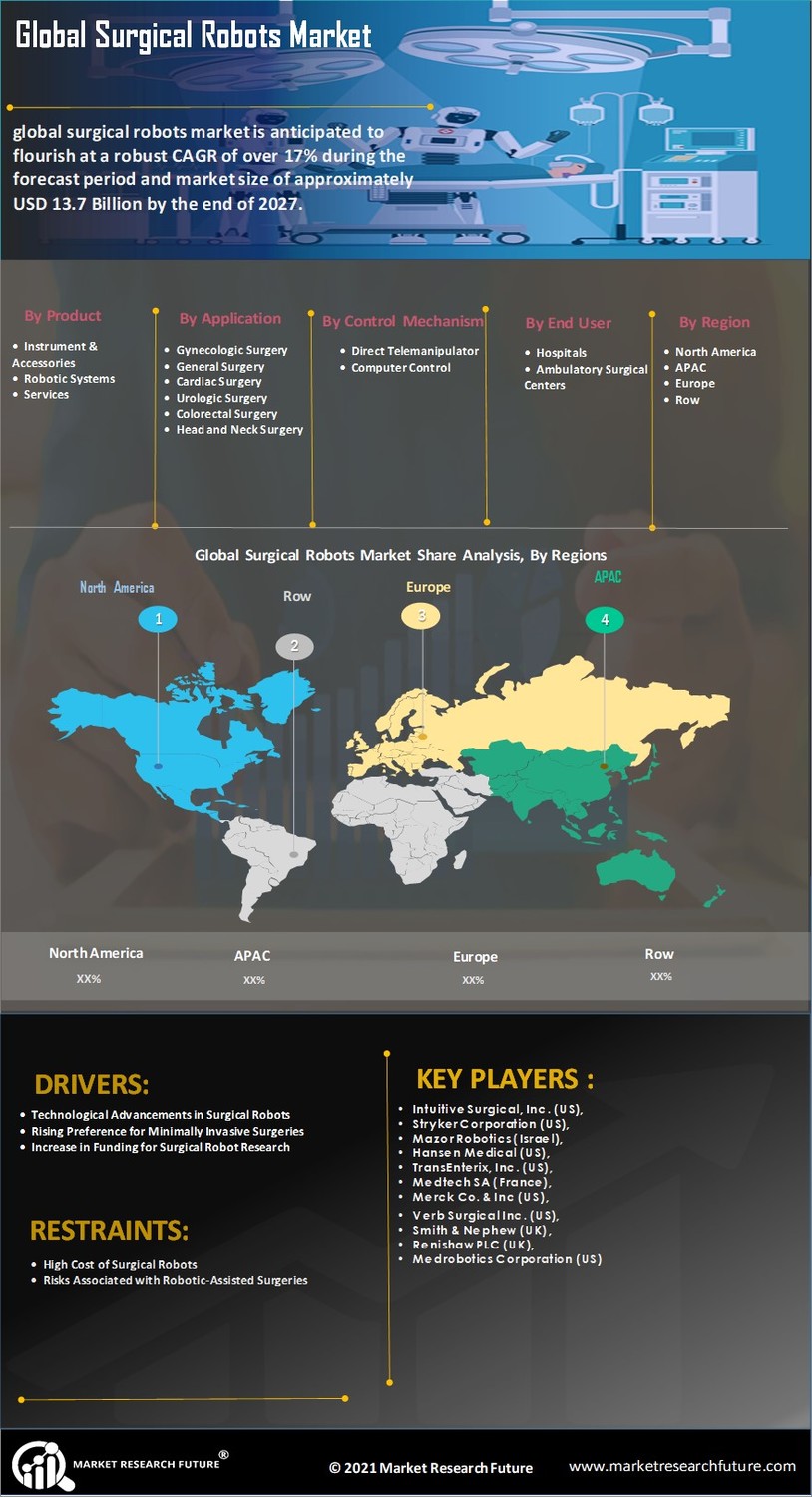

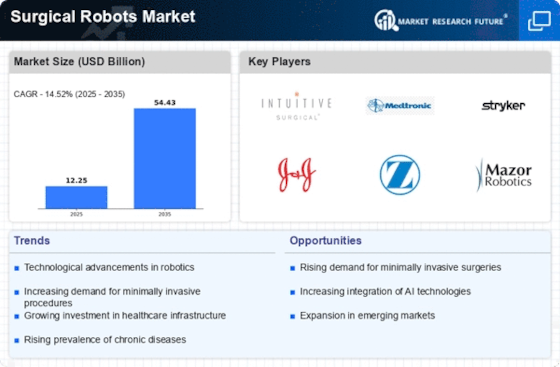

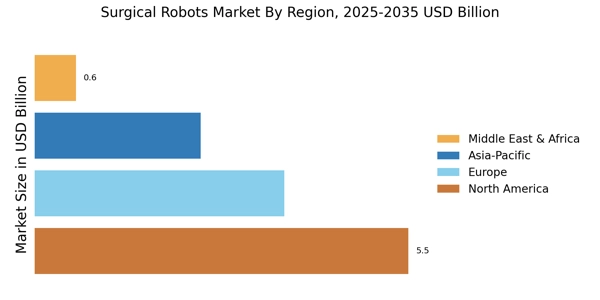

This research aims to analyze the current status and future prospects of the surgical robots market and provide an in-depth understanding of the roles of robotic technologies in surgical applications. Surgical robots are used in both laparoscopic and open surgeries for several decades, although their use has recently become more widespread.

The market for surgical robots is expected to expand in the coming years, as new advancements in technologies and designs allow for increased adoption of robots in surgical settings. In particular, the development of autonomous robots allows for increased robot use in operating rooms and the overall market is expected to show steady growth.

This research project utilizes both primary and secondary methodologies to obtain data and information on the current and future state of the surgical robotics market. This research includes interviews with key industry experts, market research, and extensive reviews of available literature to provide an in-depth analysis of the market. A study of the historical trends and technological advancements in the field of robotics surgery provides valuable insight into current market trends and future prospects.

OBJECTIVE

The primary objective of this research is to analyze the current and future prospects of the surgical robots market. This research provides an in-depth understanding of the roles of robotic technologies in surgical applications, as well as an analysis of the market’s growth potential.

RESEARCH QUESTIONS

- What is the current status of the surgical robots market?

- What are the major factors driving the growth of the market?

- What technological advancements have enabled the increased use of robots in surgical settings?

- What is the future potential for the market?

RESEARCH METHODOLOGY

This research uses both primary and secondary sources of data and information to understand the current and future prospects of the surgical robots market. Primary sources include interviews with key industry experts and market surveys. Interviews with key players in the industry will provide valuable insight into the market and its dynamics. Interviews focus on topics such as current market trends, technological advancements, and prospects. Market surveys allow for the collection of detailed information on current market structure and trends and focus on issues such as regional differences and market forecasts.

Secondary sources of data and information include published papers, journals, and online resources. Extensive reviews of available literature provide an understanding of the advancements and trends in the robotic surgery field which is used to analyze current market trends and future potential. These reviews focus on understanding the scope of the surgical robots market and their applications, as well as the major technological advancements and developments.

SAMPLE SIZE

This research will include a sample size of 50 people for the survey part of the data collection. The sample size for interviews will depend on the availability of key industry experts and may vary from 10-15.

DATA ANALYSIS

Data collected through primary and secondary sources is analyzed using descriptive and predictive analytics methodologies. Descriptive analyses provide an understanding of the current state of the market and include topics such as market size, growth rate, and major market players. The predictive analysis aims to provide a forecast of the future direction of the market and include topics such as potential technological advancements and market opportunities.

CONCLUSION

The published research report aims to provide an in-depth analysis of the current and prospects of the surgical robots market. Understanding the roles of robotic technologies in surgical applications, as well as analyzing the technological advancements that have enabled the increased use of robotics in surgery is crucial for understanding the market’s potential for growth. By using primary and secondary data collection methods and conducting interviews with key industry experts, this research provides an understanding of current market trends and future potential.