Rising Electric Vehicle Adoption

The Synchronous Electric Motors Market is poised for growth due to the rising adoption of electric vehicles (EVs). As governments and consumers increasingly prioritize sustainable transportation solutions, the demand for electric vehicles is surging. Synchronous electric motors are preferred in EV applications due to their high efficiency and performance characteristics. Recent statistics indicate that the electric vehicle market is projected to grow at a compound annual growth rate of over 20% in the next decade. This growth is likely to drive the demand for synchronous motors, as automakers seek to enhance vehicle performance and range. Consequently, manufacturers in the synchronous electric motors market are expected to focus on developing motors that meet the specific requirements of the automotive industry.

Increased Focus on Energy Efficiency

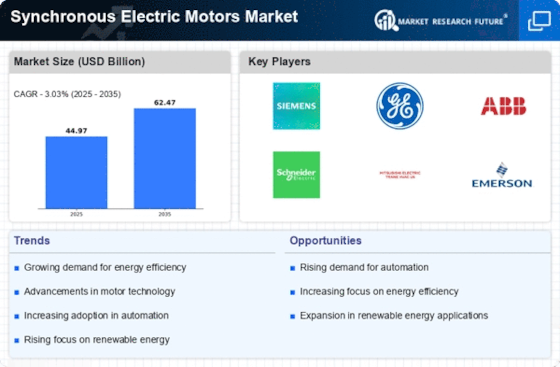

The Synchronous Electric Motors Market is benefiting from an increased focus on energy efficiency across various sectors. As energy costs continue to rise, industries are seeking solutions that minimize energy consumption while maximizing output. Synchronous electric motors are recognized for their superior efficiency compared to traditional induction motors, making them an attractive option for energy-conscious businesses. Recent studies suggest that implementing synchronous motors can lead to energy savings of up to 30% in certain applications. This emphasis on energy efficiency aligns with regulatory frameworks aimed at reducing energy consumption and greenhouse gas emissions. As a result, the demand for synchronous electric motors is expected to grow, as companies strive to comply with energy efficiency standards and reduce operational costs.

Shift Towards Renewable Energy Sources

The Synchronous Electric Motors Market is significantly influenced by the global shift towards renewable energy sources. As countries aim to reduce their carbon footprints, there is an increasing investment in wind and solar energy systems, where synchronous motors are extensively utilized. These motors are integral to the operation of generators in wind turbines, providing efficient energy conversion. The International Energy Agency has reported a substantial increase in renewable energy capacity, which is expected to continue growing. This trend not only supports the demand for synchronous electric motors but also encourages manufacturers to innovate and develop motors that are compatible with renewable technologies. The alignment of synchronous motors with sustainable energy initiatives positions them favorably in the market.

Growing Demand for Automation in Industries

The Synchronous Electric Motors Market is witnessing a growing demand for automation across various sectors, including manufacturing, logistics, and energy. As industries strive for enhanced productivity and efficiency, the reliance on automated systems has intensified. Synchronous electric motors play a crucial role in automation, providing precise control and high torque at low speeds, which is essential for robotic applications and conveyor systems. According to recent data, the automation market is expected to grow at a compound annual growth rate of over 10% in the coming years, further driving the demand for synchronous motors. This trend indicates a robust opportunity for manufacturers to cater to the evolving needs of automated systems, thereby expanding their market presence.

Technological Advancements in Synchronous Electric Motors

The Synchronous Electric Motors Market is experiencing a surge in technological advancements that enhance motor efficiency and performance. Innovations such as improved rotor designs and advanced control systems are being integrated into synchronous motors, leading to higher power density and reduced energy consumption. For instance, the introduction of permanent magnet synchronous motors (PMSMs) has revolutionized applications in various sectors, including industrial automation and renewable energy. These advancements are projected to drive the market, as manufacturers seek to optimize their operations and reduce operational costs. Furthermore, the increasing focus on energy efficiency regulations is likely to propel the adoption of these advanced synchronous electric motors, as they offer significant advantages over traditional induction motors.

.png)