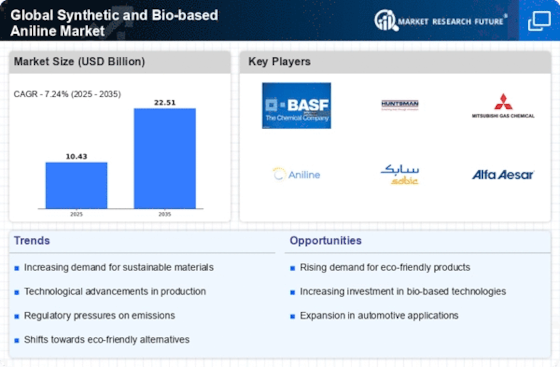

Top Industry Leaders in the Synthetic Bio-Based Aniline Market

The global aniline market, encompassing both synthetic and bio-based variants, is a dynamic space with fierce competition in play. Understanding the current landscape, key strategies employed by players, and recent developments is crucial for anyone navigating this ever-evolving arena. So, let's dive into the aromatic depths of this industry.

The global aniline market, encompassing both synthetic and bio-based variants, is a dynamic space with fierce competition in play. Understanding the current landscape, key strategies employed by players, and recent developments is crucial for anyone navigating this ever-evolving arena. So, let's dive into the aromatic depths of this industry.

Market Share Marvels:

-

Global Giants: Chemical behemoths like BASF, Huntsman, and China Petroleum & Chemical Corporation hold significant market shares, leveraging economies of scale and established distribution networks. BASF alone boasts a 20% share, making them the undisputed king of the aniline castle.

-

Regional Retainers: Regional players like GNFC (India) and Borsodchem (Hungary) carve out niches by catering to specific needs and regulations within their geographical confines.

-

Bio-Based Budding: While still nascent, bio-based aniline producers like BioAmber and EcoSynthetics are making inroads, capitalizing on rising sustainability concerns and offering eco-friendly alternatives.

Strategic Maneuvers:

-

Product Prowess: Differentiation through product innovation is key. BASF, for instance, offers high-purity grades for pharmaceutical applications, while Huntsman focuses on cost-effective options for dyes and rubber production.

-

Vertical Integration: Expanding upstream and downstream in the value chain secures supply and cost advantages. Companies like Covestro invest in both benzene production and downstream polymer manufacturing, creating a tight-knit ecosystem.

-

Sustainability Swagger: The green wave is washing over the market. Investments in bio-based technologies, eco-efficient production processes, and partnerships with recycling initiatives are becoming strategic imperatives.

Key Players

- BASF SE (Germany)

- Huntsman International LLC. (U.S.)

- (India)

- China Petroleum & Chemical Corporation (China)

- Sumitomo Chemical Co., Ltd. (Japan)

- Tosoh Corporation (Japan)

- Covestro AG (Germany)

- Borsodchem Mchz S.R.O. (Czech Republic)

- SP Chemicals Holdings Ltd. (Singapore)

- Arrow Chemical Group Corp. (China)

- DowDuPont Inc. (U.S.)

Recent Developments :

July 2023: Rising benzene prices, a key raw material for synthetic aniline, lead to price hikes across the board, squeezing profit margins for manufacturers and impacting downstream industries.

September 2023: A fire at a major Chinese aniline plant disrupts supply chains and triggers temporary shortages, prompting a scramble for alternative sources and highlighting the vulnerability of geographically concentrated production.

November 2023: A breakthrough in enzyme technology enables efficient conversion of biomass into aniline, potentially paving the way for a more sustainable and cost-competitive bio-based industry.