Regulatory Support

Regulatory support is emerging as a key driver for the Synthetic and Bio Thermoplastic Polyurethane Film Market. Governments are implementing policies that encourage the use of sustainable materials, which is likely to create a favorable environment for the growth of bio-based thermoplastic polyurethanes. For example, initiatives aimed at reducing plastic waste and promoting biodegradable alternatives are gaining traction. This regulatory landscape may lead to increased investments in research and development, fostering innovation within the industry. As a result, the Synthetic and Bio Thermoplastic Polyurethane Film Market could experience accelerated growth, with projections indicating a potential market size increase of 6% by 2027, driven by supportive government policies.

Sustainability Focus

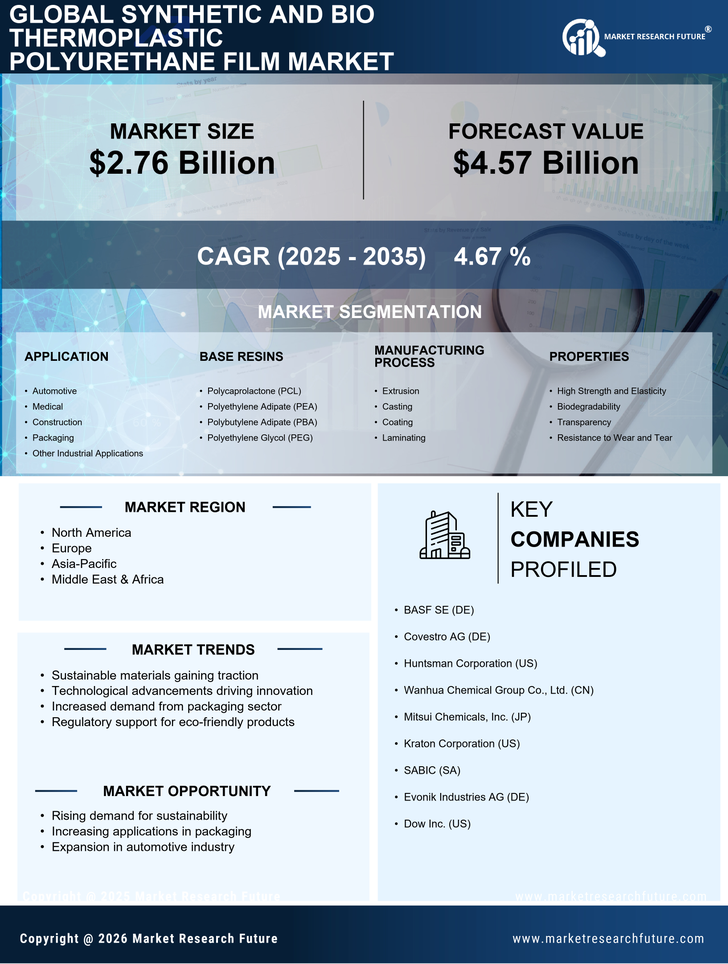

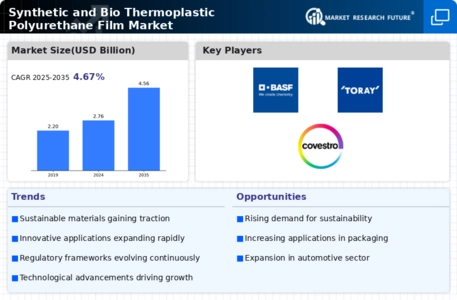

The increasing emphasis on sustainability is a pivotal driver for the Synthetic and Bio Thermoplastic Polyurethane Film Market. As consumers and manufacturers alike prioritize eco-friendly materials, the demand for bio-based thermoplastic polyurethanes is likely to rise. This shift is evidenced by a growing number of companies committing to sustainable practices, which may lead to a projected market growth rate of approximately 5.2% annually over the next five years. The Synthetic and Bio Thermoplastic Polyurethane Film Market is thus positioned to benefit from this trend, as it aligns with the broader movement towards reducing carbon footprints and enhancing recyclability. Furthermore, regulatory frameworks are increasingly favoring sustainable materials, which could further bolster the market's expansion.

Technological Advancements

Technological advancements play a significant role in shaping the Synthetic and Bio Thermoplastic Polyurethane Film Market. Innovations in production techniques and material formulations are enhancing the performance characteristics of thermoplastic polyurethane films. For instance, advancements in extrusion and coating technologies are enabling the creation of films with superior mechanical properties and barrier functionalities. This is particularly relevant in sectors such as food packaging, where the demand for high-performance materials is on the rise. The market is expected to witness a compound annual growth rate of around 4.8% as these technologies continue to evolve, allowing manufacturers to meet the increasing performance demands of various applications within the Synthetic and Bio Thermoplastic Polyurethane Film Market.

Customization and Versatility

Customization and versatility are becoming increasingly crucial in the Synthetic and Bio Thermoplastic Polyurethane Film Market. Manufacturers are responding to diverse consumer needs by offering tailored solutions that cater to specific applications, such as packaging, automotive, and medical sectors. This adaptability is essential, as it allows companies to differentiate their products in a competitive landscape. The market for thermoplastic polyurethane films is projected to reach USD 1.5 billion by 2026, driven by the demand for specialized films that meet unique performance criteria. As industries seek materials that can withstand varying environmental conditions while maintaining functionality, the Synthetic and Bio Thermoplastic Polyurethane Film Market is likely to see a surge in innovative product offerings.

Rising Demand in End-Use Industries

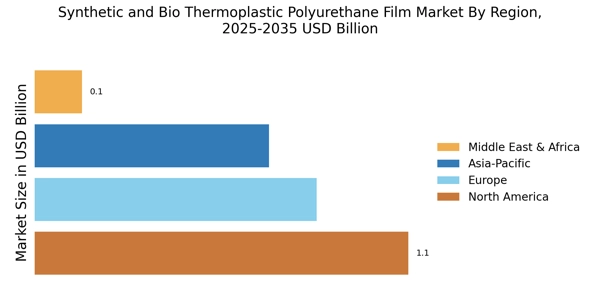

The rising demand in end-use industries is a significant driver for the Synthetic and Bio Thermoplastic Polyurethane Film Market. Sectors such as automotive, healthcare, and packaging are increasingly adopting thermoplastic polyurethane films due to their excellent mechanical properties and versatility. For instance, the automotive industry is leveraging these materials for lightweight components that enhance fuel efficiency. The healthcare sector is also utilizing these films for medical devices and packaging, which require high-performance materials. This trend is expected to propel the market forward, with estimates suggesting a growth trajectory that could see the Synthetic and Bio Thermoplastic Polyurethane Film Market reach USD 2 billion by 2028, reflecting the increasing reliance on these materials across various applications.