Synthetic Monitoring Market Overview

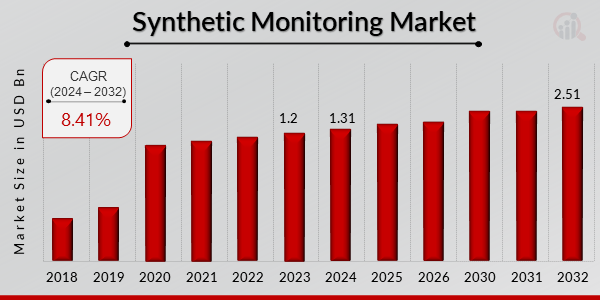

The Synthetic Monitoring Market is projected to grow from USD 1.31 billion in 2024 to USD 2.51 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.41% during the forecast period (2024 - 2032). Additionally, the market size for Synthetic Monitoring was valued at USD 1.2 billion in 2023.

Increased of its advantages, including improved IT operations and the ability for webmasters to check for errors and malfunctions, synthetic monitoring is becoming more and more popular. are the key market drivers enhancing the market growth.

Figure 1: Synthetic Monitoring Market Size, 2024 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Synthetic Monitoring Market Trends

Growing telecommunication industry is driving the market growth

The telecommunication industry is driving Market CAGR for synthetic monitoring. The gap between conventional, on-premises IT systems and modernized services in the IT and telecom industries can be filled by API management. Effective data collection, analysis, and sharing across companies enhance the user experience and boost operational effectiveness. Effective monitoring is necessary to control on-premises, cloud-based, or hybrid infrastructure. Because traditional tools weren't built to manage complex infrastructure landscapes, IT management is getting more challenging, so they are turning to synthetic monitoring.

It takes time and resources for many IT teams to manage complicated networks, suppliers, and deployment types. Active monitoring can aid in minimizing these issues. Web transactions or web browser script records are used for synthetic monitoring when behavioral scripts are written to mimic a user's website navigation. It aids in the performance monitoring of ongoing IT services. By watching affected user transactions, synthetic monitoring guarantees that the faults and issues may be swiftly found and fixed, ideally before users complain or notice.

Businesses worldwide have concentrated on improving the overall user experience to hold onto their consumer base in the face of fierce competition. This trend has greatly influenced the demand for synthetic monitoring systems. Active monitoring is crucial in the complicated infrastructure that many IT teams maintain, where several networks, providers, and apps may eat up IT time and resources. Synthetic monitoring continuously displays what users view to IT personnel, thus aiding in troubleshooting these situations.

Businesses also resort to synthetic monitoring for third-party components like web analytics, social networking, search engine optimization, and others to meet the increased need for sophisticated user experiences. Active monitoring is crucial in the complicated infrastructure that many IT teams maintain, where several networks, providers, and apps may eat up IT time and resources. Synthetic monitoring continuously displays what users view to IT personnel, thus aiding in troubleshooting these situations. Thus, driving the Synthetic Monitoring market revenue.

Synthetic Monitoring Market Segment Insights

Synthetic Monitoring Type Insights

Based on monitoring type, the Synthetic Monitoring market segmentation includes mobile application monitoring, web application monitoring, API monitoring, and SaaS monitoring. The web application monitoring segment dominated the market, accounting for 35% of market revenue. It is feasible to track website traffic and analyze customer purchasing trends by monitoring a website. As more people utilize mobile apps, the need for mobile applications may rise in the upcoming year.

Synthetic Monitoring Deployment Type Insights

Based on deployment type, the Synthetic Monitoring market segmentation includes On-cloud and On-premise. The on-cloud segment dominated the market. Because of their scalability and flexibility, many businesses are using cloud solutions, which is helping them grow. The lowest operating costs, increased operational flexibility, and fewer operational hazards are possible. It offers businesses numerous advantages, including daily, routine data backups, security, quick updates, etc.

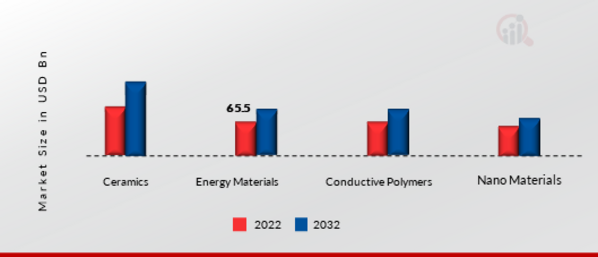

Figure 1: Synthetic Monitoring Market, by Vertical Type, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Synthetic Monitoring Vertical Type Insights

The Synthetic Monitoring market segmentation is based on vertical type, BFSI, retail, government, automotive, it & telecommunication, healthcare, and others. The BFSI generated the most income. Major financial and banking institutions are working harder than ever to tackle issues like mobile device outages and the demand for tighter accountability. This will increase demand for the synthetic monitoring market in the BFSI industry. The need for mobile Deployment Type monitoring is expected to rise as more people use smartphones for various reasons. This will help the market throughout the forecast period to analyze consumer behavior and improve user experience.

Synthetic Monitoring Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North American Synthetic Monitoring market area will dominate this market, As new technologies like DevOps, cloud computing, software-as-a-service (SaaS)-based apps, and bring your device (BYOD) are being adopted more widely; additionally, even in traditional markets in North America, consumers are favoring online platforms for a variety of services; businesses are concentrating on strengthening their application management services.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil..

Figure 2: SYNTHETIC MONITORING MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe's Synthetic Monitoring market accounts for the second-largest market share. As more mobile apps, monitoring websites, API monitoring services, and SaaS-based services are installed. Additionally, the German synthetic monitoring market had the biggest market share, while the UK synthetic monitoring market had the quickest expansion rate on Europe.

The Asia-Pacific Synthetic Monitoring Market is expected to grow at the fastest CAGR from 2023 to 2032 due to the rising demand for contemporary synthetic monitoring systems with real-time analysis, log management, and advanced analytics. The regional governments are also improving service level agreements, written contracts relating to a specific service between two or more parties. These documents provide directions to the supplier and client throughout a specific contract. Moreover, China's Synthetic Monitoring market held the largest market share, and the Indian Synthetic Monitoring market was the fastest-growing market in the Asia-Pacific region.

Synthetic Monitoring Key Market Players & Competitive Insights

Leading market companies are making significant R&D investments to diversify their product offerings, which will drive the Synthetic Monitoring market's expansion. Important market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other organizations. Market participants also engage in several strategic actions to increase their worldwide presence. The market for Synthetic Monitoring industry is becoming more competitive. Therefore, it needs to offer reasonably priced products to grow and thrive.

Manufacturing locally to reduce operating costs is one of the primary business strategies manufacturers employ in the worldwide Synthetic Monitoring industry to assist customers and expand the market sector. The market for Synthetic Monitoring industry has recently provided some of the most important benefits. Major players in the Synthetic Monitoring market, including Broadcom Inc., Contentsquare, and others, are attempting to increase market demand by investing in research and development operations.

Broadcom Inc., a leader in worldwide technology, a Delaware corporation with headquarters in San Jose, California, creates, develops, and provides various semiconductor products and infrastructure software solutions. The crucial markets served by Broadcom's market-leading product range include data centers, networking, corporate software, broadband, wireless, storage, and industrial. Data center networking and storage, mainframe, enterprise, mainframe, and cyber security software emphasizing automation, monitoring, and security, smartphone components, telecoms, and factory automation are just a few of our offerings. In December 2022, A new solution that lets businesses store their mainframe data wherever they want, including the Cloud, was made available by Broadcom Inc. With the help of Broadcom's CA 1 Flexible Storage solution, users may achieve significant cost savings and ransomware protection while storing mainframe data in safe, affordable mainframe solutions for hybrid IT environments.

The ability to make the digital world more human is delivered by Contentsquare. At every stage of the customer experience, our AI-powered platform offers comprehensive and contextual insight into consumer behaviors, feelings, and intent, empowering businesses to develop empathy and make a lasting impression. As the industry pioneer in digital experience analytics, Contentsquare supports brands in every industry in changing how they conduct business, enabling them to act on a large scale while fostering customer confidence through security, privacy, and accessibility.

More than 1000 top brands use Contentsquare to expand their businesses, increase consumer satisfaction, and act more quickly in a continuously changing market. In September 2022, A new feature from Contentsquare has enabled companies to understand better how website speed affects user experience and conversion rates and adjust performance as necessary. The new Digital Experience Monitoring (DEM) solution from Contentsquare combines Real User Monitoring (RUM) and Speed Analysis Synthetic to provide brands with a thorough analysis of speed and user interaction, including Core Web Vital indicators.

Key Companies in the Synthetic Monitoring market include

Synthetic Monitoring Industry Developments

Dynatrace LLC announced the availability of the Dynatrace® platform on Microsoft Azure in UAE in November 2022, thus becoming the very first SaaS-based observability as well as application security platform in this location. Dynatrace® Software Intelligence Platform provides answers and intelligent automation from data at a massive scale by incorporating broad and deep observability, continuous runtime application security, advanced AIOps, and automation.

In December 2022, Broadcom Inc., a global industry leader for wired and wireless communications semiconductors, developed a new technology that allows companies to put mainframe data anywhere, including Cloud environments. With no knowledge of users, ransomware attacks have become increasingly popular because they can easily penetrate computers or other devices that are connected to the internet. These forms of malware pose grave threats globally to governments as well as businesses.

Dynatrace LLC announced its availability of the Dynatrace® platform on Microsoft Azure hosted in UAE in November 2022, making it the first SaaS-based observability and application security platform in this area. This product combines broad and deep observability and continuous runtime application security while leveraging the most advanced AIOps and automation, bringing out insights besides intelligent automation from data on a huge scale. Moreover, by being native to Microsoft Azure hosted in UAE, joint customers will benefit from better-performing applications as well as greater data sovereignty.

June 2022: SmartBear Software announced an addition of web browser testing capabilities into its next-gen mobile app testing platform that provides more reliable cloud-based testing than any other one, giving immediate access to all the latest mobile browsers plus devices for achieving consistent digital customer experience. For instance, BitBar is designed with scalability plus support for modern test automation frameworks; thus, we should expect different languages plus development environments used by software testers today also, tomorrow, or even in the future.

In February 2020, Dynatrace announced a partnership with the U.S. Department of Veterans Affairs (VA) to introduce the Dynatrace software intelligence platform to significantly improve enterprise cloud visibility and support the VA's cloud migration efforts.

Synthetic Monitoring Market Segmentation

Synthetic Monitoring Type Outlook

Synthetic Monitoring Deployment Type Outlook

Synthetic Monitoring Vertical Type Outlook

-

BFSI

-

Retail

-

Government

-

Automotive

-

IT & Telecommunication

-

Healthcare

-

Others

Synthetic Monitoring Regional Outlook

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Rest of Europe

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 1.2 Billion |

| Market Size 2024 |

USD 1.31 Billion |

| Market Size 2032 |

USD 2.51 Billion |

| Compound Annual Growth Rate (CAGR) |

8.41% (2023-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Distribution Channel, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Hewlett Packard Enterprise Company, New Relic Inc, Broadcom Inc. AppDynamics IBM Corporation BMC Software Splunk Inc Riverbed Technology Dell Technologies Inc Microsoft Corporation Intel Corporation |

| Key Market Opportunities |

Increase the market growth in the review period |

| Key Market Dynamics |

The rise in need for customer experience management |

Synthetic Monitoring Market Highlights:

Frequently Asked Questions (FAQ) :

The Synthetic Monitoring market size was valued at USD 1.2 Billion in 2023.

The market is projected to grow at a CAGR of 9.61% during the forecast period, 2023-2032.

North America had the largest share in the market

The key players in the market are Hewlett Packard Enterprise Company, New Relic Inc, Broadcom Inc, AppDynamics, IBM Corporation, BMC Software.

The On-cloud dominated the market in 2023.

The BFSI had the largest share in the market.