Advancements in Semiconductor Technology

The System On Chip Test Equipment Market is significantly influenced by advancements in semiconductor technology. As semiconductor devices become increasingly complex, the testing requirements evolve correspondingly. The market for semiconductors is anticipated to grow at a compound annual growth rate of approximately 5% through 2025, highlighting the necessity for sophisticated testing equipment. System On Chip Test Equipment plays a crucial role in validating the performance and functionality of these advanced semiconductor devices. Manufacturers are compelled to adopt cutting-edge testing solutions to keep pace with rapid technological advancements, ensuring that their products meet the high-performance benchmarks set by the industry.

Increasing Demand for Consumer Electronics

The System On Chip Test Equipment Market is experiencing a surge in demand driven by the proliferation of consumer electronics. As devices such as smartphones, tablets, and wearables become more sophisticated, the need for efficient testing solutions intensifies. In 2025, the consumer electronics sector is projected to reach a valuation of over 1 trillion dollars, necessitating advanced testing equipment to ensure product reliability and performance. This trend compels manufacturers to invest in System On Chip Test Equipment, which can streamline testing processes and enhance product quality. The integration of System On Chip technology in these devices further amplifies the need for specialized testing solutions, as manufacturers seek to meet stringent quality standards and consumer expectations.

Regulatory Compliance and Quality Assurance

The System On Chip Test Equipment Market is increasingly shaped by the need for regulatory compliance and quality assurance. As industries face stringent regulations regarding product safety and performance, manufacturers are compelled to invest in robust testing solutions. The demand for System On Chip Test Equipment is likely to rise as companies seek to ensure that their products adhere to international standards. In 2025, the emphasis on quality assurance is expected to drive a significant portion of the market, as organizations recognize the importance of maintaining high standards to avoid costly recalls and reputational damage. This trend underscores the critical role of testing equipment in achieving compliance and fostering consumer trust.

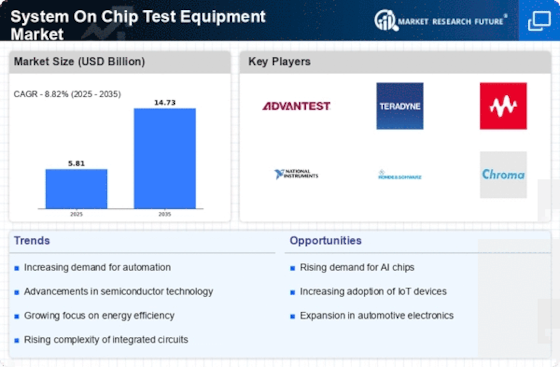

Emergence of Artificial Intelligence in Testing

The System On Chip Test Equipment Market is witnessing a transformative shift with the emergence of artificial intelligence (AI) in testing processes. AI technologies are being integrated into testing equipment to enhance efficiency and accuracy. This integration allows for predictive analytics, enabling manufacturers to identify potential issues before they arise. The AI market in testing is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 20% through 2025. As manufacturers increasingly adopt AI-driven solutions, the demand for advanced System On Chip Test Equipment that incorporates these technologies is likely to rise, thereby revolutionizing traditional testing methodologies and improving overall product quality.

Growing Adoption of Internet of Things (IoT) Devices

The System On Chip Test Equipment Market is poised for growth due to the increasing adoption of Internet of Things (IoT) devices. As IoT technology permeates various sectors, including healthcare, automotive, and smart homes, the demand for reliable testing solutions escalates. The IoT market is projected to reach a valuation of over 1.5 trillion dollars by 2025, driving the need for System On Chip Test Equipment that can efficiently test the myriad of devices connected to the network. This trend necessitates the development of testing equipment that can handle the unique challenges posed by IoT devices, such as low power consumption and connectivity issues, thereby enhancing the overall reliability of IoT ecosystems.