Tablet Pc Size

Tablet PC Market Growth Projections and Opportunities

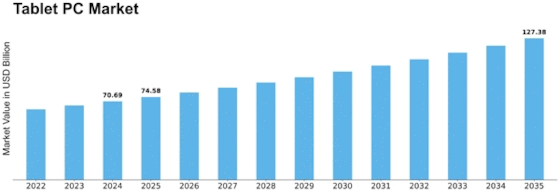

The global Tablet PC market is experiencing exponential growth, projected to reach USD 97,474.5 million by 2030, driven by a CAGR of 5.7% during the forecast period, 2022-2030. This growth is fuelled by continuous innovation, the rise of hybrid devices, and the acceleration of digitization. Consumer demand is shaping the evolution of tablet designs, with manufacturers introducing lighter tablets, larger screens, improved graphics for gaming and streaming video, and applications for bill payment and device syncing.

Additionally, the development of new gadgets with enticing features is expected to further propel market growth. Government regulations favouring the use of tablets in educational settings and the increasing adoption of hybrid tablets in businesses are opening up new opportunities for tablet PC manufacturers. The corporate sector's rapid expansion, rising demand for hybrid devices, and growing consumer preference for tablets are propelling the market's expansion.

The global Tablet PC market is segmented into Operating System, Distribution Channel, End-User, and Region. Android, iOS, and Windows are the dominant operating systems in the market. Supermarkets/hypermarkets, independent retailers, and online sales are the primary distribution channels. Individual users, corporate users, schools & colleges, and others are the key end-users of tablet PCs.

North America, Europe, Asia-Pacific, Middle East & Africa, and South America are the major regional markets. MRFR's analysis of the global Tablet PC market highlights the significant contributions of major players, including Apple Inc., Samsung Electronics Co. Ltd., Lenovo Group Limited, Microsoft Corporation, and Huawei Technologies Co. Ltd. These companies are constantly innovating their products and services, investing in research and development to deliver cost-effective tablet PCs with cutting-edge features.

Strategic partnerships, mergers & acquisitions, product developments & enhancements, global expansion initiatives, and client base strengthening are key strategies employed by these players to gain a competitive edge. The future of the global Tablet PC market is bright, with the acceleration of digitization, technological advancements, and improving internet connectivity expected to drive further growth. Tablet PCs are poised to play an increasingly prominent role in various aspects of life, from personal entertainment and education to business productivity and healthcare monitoring.

Leave a Comment