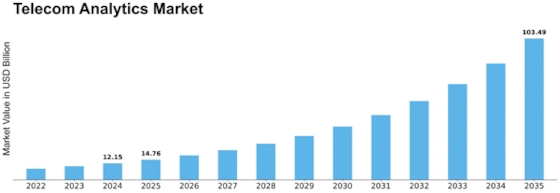

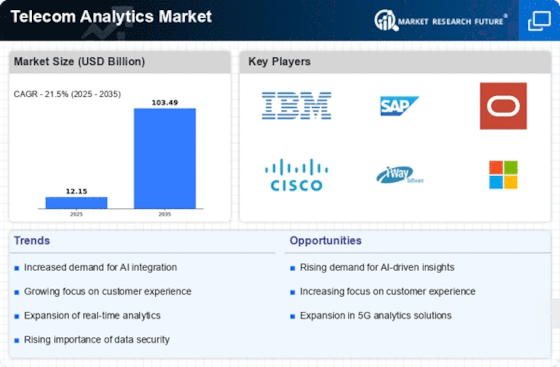

Telecom Analytics Size

Telecom Analytics Market Growth Projections and Opportunities

The Telecom Analytics market is influenced by several key factors that contribute to its growth and development. One primary driver is the exponential increase in data generated within the telecommunications industry. With the proliferation of mobile devices, IoT (Internet of Things) connections, and digital services, telecom companies are inundated with vast amounts of data. This surge in data necessitates advanced analytics solutions to extract meaningful insights, optimize operations, and enhance customer experiences.

Customer experience is another crucial factor shaping the Telecom Analytics market. In an era where customer satisfaction is paramount, telecom companies are turning to analytics to understand and improve the customer journey. Telecom Analytics enables providers to analyze customer behavior, preferences, and feedback, allowing them to tailor services, resolve issues proactively, and ultimately enhance customer satisfaction. As competition in the telecommunications sector intensifies, the focus on delivering an exceptional customer experience becomes a strategic imperative, driving the adoption of Telecom Analytics solutions.

The need for network optimization is a significant market factor influencing the Telecom Analytics sector. Telecommunication networks are becoming increasingly complex, supporting a myriad of services and devices. Telecom Analytics provides operators with the tools to monitor network performance, identify bottlenecks, and optimize resource allocation. This optimization not only enhances network efficiency but also contributes to cost savings and improved quality of service, reinforcing the demand for Telecom Analytics solutions.

The advent of 5G technology is playing a pivotal role in the growth of the Telecom Analytics market. As telecom operators transition to 5G networks, the complexity and speed of data transmission increase exponentially. Telecom Analytics becomes indispensable in managing and optimizing these high-speed networks, ensuring seamless connectivity and efficient resource utilization. The transition to 5G fuels the demand for advanced analytics tools capable of handling the unique challenges posed by the next generation of telecommunications technology.

Security concerns are paramount in the Telecom Analytics market. With the increasing frequency and sophistication of cyber threats, telecom companies are investing in analytics solutions to fortify their cybersecurity measures. Telecom Analytics helps identify and mitigate potential security threats, safeguarding sensitive customer data and maintaining the integrity of communication networks. As security becomes a top priority for telecom operators, the demand for analytics solutions with robust cybersecurity features continues to rise.

Additionally, regulatory compliance is a key factor shaping the Telecom Analytics market. Governments and regulatory bodies impose stringent requirements on telecom companies to ensure data privacy, transparency, and fair business practices. Telecom Analytics solutions that enable operators to adhere to these regulations and demonstrate compliance are in high demand. The ability to navigate the complex regulatory landscape becomes a competitive advantage for telecom providers, driving the adoption of analytics solutions that facilitate adherence to industry standards.

The increasing trend towards digital transformation in the telecommunications industry contributes significantly to the growth of the Telecom Analytics market. Telecom operators are embracing digital technologies to streamline operations, automate processes, and stay ahead in a rapidly evolving market. Telecom Analytics plays a pivotal role in this transformation by providing insights that drive informed decision-making, enabling operators to adapt to market changes, and capitalize on emerging opportunities.

Leave a Comment