-

Executive Summary

-

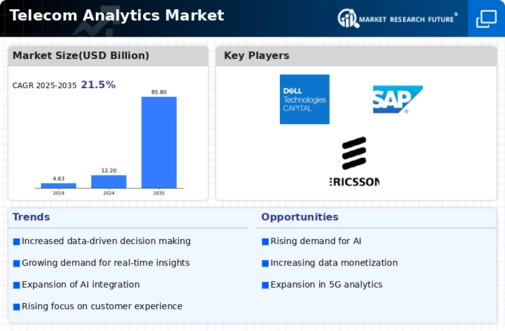

Market Summary 16

-

Market Introduction

-

Definition 19

-

Scope Of The Study 19

-

List

-

Of Assumptions 20

-

Market Structure 20

-

Research Methodology

-

Research Process 22

-

Forecast Model 26

-

Market

-

Dynamics

-

Introduction 28

-

Drivers 29

- Drivers Impact

-

4.2.1

-

Increasing Demand For Revenue Management And Churn Prevention 29

-

4.2.2

-

Growing Need To Reduce The Risk Of Telecom Frauds 29

-

Analysis 30

-

Restraints 30

- Lack Of Awareness And

- High Maintenance Cost Required For

- Restraints Impact Analysis

-

Increasing Security Risks 30

-

Retaining Quality Of Service (QoS) 30

-

31

-

Opportunities 31

- Increasing Adoption Of PBX System

- Upgrades In Up-Selling Techniques To Retain Customers

-

By Enterprises 31

-

31

-

Challenges 32

- Concerns Regarding Data Integration

-

32

-

Market Factor Analysis

-

Value Chain Analysis 34

- Analytics Software Developers 34

- Network Equipment

- Service/System Integrators 35

- End-Users

-

Providers 35

-

35

-

Porter’s Five Forces Model 36

- Threat Of

- Bargaining Power Of Suppliers 36

- Bargaining Power Of Buyers 37

- Intensity Of Rivalry High 37

-

New Entrants 36

-

5.2.3

-

Threat Of Substitutes Low 37

-

Market Trends

-

Impact

- Artificial Intelligence (AI) On Telecom

- Internet Of Things (IoT) On Telecom Analytics 39

-

Of Emerging Technologies 39

-

Analytics 39

-

Use Cases And Best Practices 40

- Use Cases 40

- Best Practices

-

40

-

40

-

40

-

Customer Experience 40

-

To Improve VoLTE Customer Experience 41

-

Key Investments In Telecom

-

Analytics 42

-

Global Telecom Analytics Market, By Analytics Type

-

Overview 44

-

Customer Analytics 44

-

Network

-

Analytics 44

-

Subscriber Analytics 44

-

Location Analytics

-

45

-

Price Analytics 45

-

Service Analytics 45

-

Global Telecom Analytics Market, By Component

-

Overview 48

-

Solution 48

- Customer Management 48

- Marketing Management 48

- Others 49

-

8.2.2

-

Network Management 48

-

8.2.4

-

Sales & Distribution 48

-

Services 49

- Professional Services 49

- Managed Services 50

-

Global Telecom Analytics Market,

-

By Deployment

-

Overview 54

-

Cloud 54

-

9.3

-

On-Premise 54

-

Global Telecom Analytics Market, By Region

-

Introduction 57

- North America 58

- Asia-Pacific 79

- Rest Of The World 90

-

62

-

10.1.2

-

Europe 67

-

10.1.2.3

-

France 75

-

10.1.3.2

-

Japan 85

-

95

-

Competitive Landscape

-

Competitive Overview 99

-

Company Profiles

-

Huawei

- Company Overview 102

- Product/Solution/Service Offerings 103

- Key Developments 103

- SWOT Analysis 103

- Key Strategy 103

-

Technologies Co. Ltd 102

-

12.1.2

-

Financial Overview 102

-

Amdocs, Inc. 104

- Company

- Financial Overview 104

- Product/Solution/Service

- Key Developments 105

- SWOT Analysis

- Key Strategy 105

-

Overview 104

-

Offerings 105

-

105

-

Cisco Systems, Inc. 106

- Company Overview 106

- Financial Overview 106

- Product/Solution/Service Offerings 107

- Key Developments

- SWOT Analysis 107

- Key Strategy 107

-

107

-

Nokia Networks 108

- Company Overview 108

- Product/Solution/Service Offerings 108

- Key Developments 109

- SWOT Analysis 109

- Key Strategy 109

-

12.4.2

-

Financial Overview 108

-

Vizualytics 110

- Company

- Product/Solution/Service Offerings 110

- Company Overview

- Financial Overview 111

- Product/Solution/Service

- Key Developments 112

- SWOT Analysis

- Key Strategy 112

-

Overview 110

-

12.6

-

International Business Machine Corporation 111

-

111

-

Offerings 112

-

112

-

Dell Technologies Inc. 113

- Company Overview 113

- Financial Overview 113

- Product/Solution/Service Offerings 114

- Key Developments

- SWOT Analysis 114

- Key Strategy 114

-

114

-

SAP SE 115

- Company Overview 115

- Financial

- Product/Solution/Service Offerings 116

- SWOT Analysis 117

- Key Strategy

-

Overview 116

-

12.8.4

-

Key Developments 117

-

117

-

Oracle Corporation 118

- Company Overview 118

- Financial Overview 118

- Product/Solution/Service

- Key Developments 119

- SWOT Analysis

- Key Strategy 119

-

Offerings 118

-

119

-

Hewlett Packard Enterprise

- Company Overview 120

- Financial

- Product/Solution/Service Offerings 121

- Key Developments 121

- SWOT Analysis 121

-

Development LP 120

-

Overview 120

-

12.10.6

-

Key Strategy 121

-

Ericsson 122

- Company Overview

- Financial Performance 122

- Products/Services/Solutions

- Key Developments 123

- SWOT Analysis

- Key Strategy 123

-

122

-

Offerings 123

-

123

-

Teradata 124

- Financial Performance 124

- Key Developments 125

- SWOT Analysis 125

- Key Strategy 125

-

12.12.1

-

Company Overview 124

-

12.12.3

-

Products/Services/Solutions Offerings 125

-

-

List Of Tables

-

MARKET SYNOPSIS 17

-

TABLE

-

LIST OF ASSUMPTIONS 20

-

KEY INVESTMENTS IN TELECOM ANALYTICS,

-

GLOBAL TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE,

-

GLOBAL TELECOM ANALYTICS MARKET, BY

-

COMPONENT, 2023-2030 (USD MILLION) 50

-

GLOBAL TELECOM ANALYTICS

-

MARKET, BY SOLUTION, 2023-2030 (USD MILLION) 51

-

GLOBAL TELECOM

-

ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION) 51

-

GLOBAL

-

TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 52

-

GLOBAL TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

-

55

-

GLOBAL TELECOM ANALYTICS MARKET, BY REGION, 2023-2030 (USD

-

MILLION) 57

-

NORTH AMERICA TELECOM ANALYTICS MARKET, BY COUNTRY,

-

NORTH AMERICA TELECOM ANALYTICS

-

MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 59

-

NORTH

-

AMERICA TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 59

-

NORTH AMERICA TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

-

60

-

NORTH AMERICA TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030

-

(USD MILLION) 61

-

NORTH AMERICA TELECOM ANALYTICS MARKET, BY

-

PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 61

-

NORTH AMERICA

-

TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION) 62

-

TABLE

-

US TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 62

-

US TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

62

-

US TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD

-

MILLION) 63

-

US TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030

-

(USD MILLION) 63

-

US TELECOM ANALYTICS MARKET, BY PROFESSIONAL

-

SERVICES, 2023-2030 (USD MILLION) 63

-

US TELECOM ANALYTICS MARKET,

-

BY DEPLOYMENT, 2023-2030 (USD MILLION) 63

-

CANADA TELECOM ANALYTICS

-

MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 64

-

CANADA

-

TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 64

-

TABLE

-

CANADA TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION) 64

-

CANADA TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION)

-

64

-

CANADA TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES,

-

CANADA TELECOM ANALYTICS MARKET,

-

BY DEPLOYMENT, 2023-2030 (USD MILLION) 65

-

MEXICO TELECOM ANALYTICS

-

MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 65

-

MEXICO

-

TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 65

-

TABLE

-

MEXICO TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION) 66

-

MEXICO TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION)

-

66

-

MEXICO TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES,

-

MEXICO TELECOM ANALYTICS MARKET,

-

BY DEPLOYMENT, 2023-2030 (USD MILLION) 66

-

EUROPE TELECOM ANALYTICS

-

MARKET, BY COUNTRY, 2023- 2030 (USD MILLION) 67

-

EUROPE TELECOM

-

ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 68

-

TABLE

-

EUROPE TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 68

-

EUROPE TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

-

69

-

EUROPE TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD

-

MILLION) 70

-

EUROPE TELECOM ANALYTICS MARKET, BY PROFESSIONAL

-

SERVICES, 2023-2030 (USD MILLION) 70

-

EUROPE TELECOM ANALYTICS

-

MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION) 71

-

GERMANY TELECOM

-

ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 71

-

TABLE

-

GERMANY TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 72

-

GERMANY TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

-

72

-

GERMANY TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD

-

MILLION) 72

-

GERMANY TELECOM ANALYTICS MARKET, BY PROFESSIONAL

-

SERVICES, 2023-2030 (USD MILLION) 72

-

GERMANY TELECOM ANALYTICS

-

MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION) 73

-

UK TELECOM

-

ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 73

-

TABLE

-

UK TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 73

-

UK TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION) 74

-

UK TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION)

-

74

-

UK TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030

-

(USD MILLION) 74

-

UK TELECOM ANALYTICS MARKET, BY DEPLOYMENT,

-

FRANCE TELECOM ANALYTICS MARKET,

-

BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 75

-

FRANCE TELECOM

-

ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 75

-

FRANCE

-

TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION) 75

-

TABLE

-

FRANCE TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION) 75

-

FRANCE TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030

-

(USD MILLION) 76

-

FRANCE TELECOM ANALYTICS MARKET, BY DEPLOYMENT,

-

SPAIN TELECOM ANALYTICS MARKET, BY

-

ANALYTICS TYPE, 2023-2030 (USD MILLION) 76

-

SPAIN TELECOM ANALYTICS

-

MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 76

-

SPAIN TELECOM

-

ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION) 77

-

SPAIN

-

TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION) 77

-

TABLE

-

SPAIN TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION)

-

77

-

SPAIN TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030

-

(USD MILLION) 77

-

REST OF EUROPE TELECOM ANALYTICS MARKET, BY

-

ANALYTICS TYPE, 2023-2030 (USD MILLION) 78

-

REST OF EUROPE TELECOM

-

ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 78

-

REST

-

OF EUROPE TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION) 78

-

REST OF EUROPE TELECOM ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION)

-

78

-

REST OF EUROPE TELECOM ANALYTICS MARKET, BY PROFESSIONAL

-

SERVICES, 2023-2030 (USD MILLION) 79

-

REST OF EUROPE TELECOM

-

ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION) 79

-

TABLE 73

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY COUNTRY, 2023- 2030 (USD MILLION) 79

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2030

-

(USD MILLION) 80

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY COMPONENT,

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET,

-

BY SOLUTION, 2023-2030 (USD MILLION) 81

-

ASIA-PACIFIC TELECOM

-

ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION) 82

-

ASIA-PACIFIC

-

TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 83

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030

-

(USD MILLION) 83

-

CHINA TELECOM ANALYTICS MARKET, BY ANALYTICS

-

TYPE, 2023-2030 (USD MILLION) 84

-

CHINA TELECOM ANALYTICS MARKET,

-

BY COMPONENT, 2023-2030 (USD MILLION) 84

-

CHINA TELECOM ANALYTICS

-

MARKET, BY SOLUTION, 2023-2030 (USD MILLION) 84

-

CHINA TELECOM

-

ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION) 84

-

CHINA

-

TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 85

-

CHINA TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

-

85

-

JAPAN TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2030

-

(USD MILLION) 85

-

JAPAN TELECOM ANALYTICS MARKET, BY COMPONENT,

-

JAPAN TELECOM ANALYTICS MARKET, BY

-

SOLUTION, 2023-2030 (USD MILLION) 86

-

JAPAN TELECOM ANALYTICS

-

MARKET, BY SERVICE, 2023-2030 (USD MILLION) 86

-

JAPAN TELECOM

-

ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 86

-

JAPAN TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

-

87

-

INDIA TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2030

-

(USD MILLION) 87

-

INDIA TELECOM ANALYTICS MARKET, BY COMPONENT,

-

INDIA TELECOM ANALYTICS MARKET, BY

-

SOLUTION, 2023-2030 (USD MILLION) 88

-

INDIA TELECOM ANALYTICS

-

MARKET, BY SERVICE, 2023-2030 (USD MILLION) 88

-

INDIA TELECOM

-

ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 88

-

INDIA TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

-

88

-

REST OF ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY ANALYTICS

-

TYPE, 2023-2030 (USD MILLION) 89

-

REST OF ASIA-PACIFIC TELECOM

-

ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 89

-

TABLE 100

-

REST OF ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

-

89

-

REST OF ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY SERVICE,

-

REST OF ASIA-PACIFIC TELECOM ANALYTICS

-

MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 90

-

TABLE 103

-

REST OF ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION)

-

90

-

REST OF THE WORLD TELECOM ANALYTICS MARKET, BY COUNTRY,

-

REST OF THE WORLD TELECOM ANALYTICS

-

MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 91

-

REST

-

OF THE WORLD TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION) 92

-

REST OF THE WORLD TELECOM ANALYTICS MARKET, BY SOLUTION, 2023-2030

-

(USD MILLION) 92

-

REST OF THE WORLD TELECOM ANALYTICS MARKET,

-

BY SERVICE, 2023-2030 (USD MILLION) 93

-

REST OF THE WORLD TELECOM

-

ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 94

-

REST OF THE WORLD TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030

-

(USD MILLION) 94

-

MIDDLE EAST & AFRICA TELECOM ANALYTICS

-

MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 95

-

MIDDLE

-

EAST & AFRICA TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

-

95

-

MIDDLE EAST & AFRICA TELECOM ANALYTICS MARKET, BY SOLUTION,

-

MIDDLE EAST & AFRICA TELECOM

-

ANALYTICS MARKET, BY SERVICE, 2023-2030 (USD MILLION) 95

-

MIDDLE

-

EAST & AFRICA TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030

-

(USD MILLION) 96

-

MIDDLE EAST & AFRICA TELECOM ANALYTICS

-

MARKET, BY DEPLOYMENT, 2023-2030 (USD MILLION) 96

-

LATIN AMERICA

-

TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE, 2023-2030 (USD MILLION) 96

-

LATIN AMERICA TELECOM ANALYTICS MARKET, BY COMPONENT, 2023-2030 (USD

-

MILLION) 96

-

LATIN AMERICA TELECOM ANALYTICS MARKET, BY SOLUTION,

-

LATIN AMERICA TELECOM ANALYTICS

-

MARKET, BY SERVICE, 2023-2030 (USD MILLION) 97

-

LATIN AMERICA

-

TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023-2030 (USD MILLION) 97

-

LATIN AMERICA TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023-2030

-

(USD MILLION) 97

-

-

List Of Figures

-

FIGURE

-

GLOBAL TELECOM ANALYTICS MARKET: MARKET STRUCTURE 20

-

TOP DOWN

-

& BOTTOM UP APPROACH 25

-

DROC ANALYSIS OF GLOBAL TELECOM

-

ANALYTICS MARKET 28

-

DRIVERS IMPACT ANALYSIS: GLOBAL TELECOM

-

ANALYTICS MARKET 30

-

RESTRAINTS IMPACT ANALYSIS: GLOBAL TELECOM

-

ANALYTICS MARKET 31

-

VALUE CHAIN: TELECOM ANALYTICS MARKET 34

-

PORTER'S FIVE FORCES ANALYSIS OF THE GLOBAL TELECOM ANALYTICS MARKET

-

36

-

GLOBAL TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE, 2023

-

VS 2030 (USD MILLION) 46

-

GLOBAL TELECOM ANALYTICS MARKET, BY

-

COMPONENT, 2023 VS 2030 (USD MILLION) 50

-

GLOBAL TELECOM ANALYTICS

-

MARKET, BY SOLUTION, 2023 VS 2030 (USD MILLION) 50

-

GLOBAL TELECOM

-

ANALYTICS MARKET, BY SERVICE, 2023 VS 2030 (USD MILLION) 51

-

FIGURE 12

-

GLOBAL TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023 VS 2030 (USD MILLION)

-

52

-

GLOBAL TELECOM ANALYTICS MARKET, BY SOLUTION, 2023 VS 2030

-

(USD MILLION) 54

-

GLOBAL TELECOM ANALYTICS MARKET, BY REGION,

-

NORTH AMERICA TELECOM ANALYTICS

-

MARKET, BY COUNTRY, 2023 VS 2030 (USD MILLION) 58

-

NORTH AMERICA

-

TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE, 2023 V/S 2030 (USD MILLION) 58

-

NORTH AMERICA TELECOM ANALYTICS MARKET, BY COMPONENT, 2023 V/S 2030

-

(USD MILLION) 59

-

NORTH AMERICA TELECOM ANALYTICS MARKET, BY

-

SOLUTION, 2023 V/S 2030 (USD MILLION) 60

-

NORTH AMERICA TELECOM

-

ANALYTICS MARKET, BY SERVICE, 2023 V/S 2030 (USD MILLION) 60

-

FIGURE 20

-

NORTH AMERICA TELECOM ANALYTICS MARKET, BY PROSFESSIONAL SERVICES, 2023 V/S 2030

-

(USD MILLION) 61

-

NORTH AMERICA TELECOM ANALYTICS MARKET, BY

-

DEPLOYMENT, 2023 V/S 2030 (USD MILLION) 61

-

EUROPE TELECOM ANALYTICS

-

MARKET, BY COUNTRY, 2023 VS 2030 (USD MILLION) 67

-

EUROPE TELECOM

-

ANALYTICS MARKET, BY ANALYTICS TYPE, 2023 V/S 2030 (USD MILLION) 67

-

FIGURE

-

EUROPE TELECOM ANALYTICS MARKET, BY COMPONENT, 2023 V/S 2030 (USD MILLION) 68

-

EUROPE TELECOM ANALYTICS MARKET, BY SOLUTION, 2023 V/S 2030 (USD

-

MILLION) 69

-

EUROPE TELECOM ANALYTICS MARKET, BY SERVICE, 2023

-

V/S 2030 (USD MILLION) 69

-

EUROPE TELECOM ANALYTICS MARKET,

-

BY PROFESSIONAL SERVICES, 2023 V/S 2030 (USD MILLION) 70

-

EUROPE

-

TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023 V/S 2030 (USD MILLION) 71

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY COUNTRY, 2023 VS 2030 (USD

-

MILLION) 79

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY ANALYTICS

-

TYPE, 2023 V/S 2030 (USD MILLION) 80

-

ASIA-PACIFIC TELECOM ANALYTICS

-

MARKET, BY COMPONENT, 2023 V/S 2030 (USD MILLION) 80

-

ASIA-PACIFIC

-

TELECOM ANALYTICS MARKET, BY SOLUTION, 2023 V/S 2030 (USD MILLION) 81

-

FIGURE

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY SERVICE, 2023 V/S 2030 (USD MILLION)

-

82

-

ASIA-PACIFIC TELECOM ANALYTICS MARKET, BY PROFESSIONAL SERVICES,

-

ASIA-PACIFIC TELECOM ANALYTICS

-

MARKET, BY DEPLOYMENT, 2023 V/S 2030 (USD MILLION) 83

-

REST

-

OF THE WORLD TELECOM ANALYTICS MARKET, BY COUNTRY, 2023 VS 2030 (USD MILLION) 90

-

REST OF THE WORLD TELECOM ANALYTICS MARKET, BY ANALYTICS TYPE,

-

REST OF THE WORLD TELECOM ANALYTICS

-

MARKET, BY COMPONENT, 2023 V/S 2030 (USD MILLION) 91

-

REST OF

-

THE WORLD TELECOM ANALYTICS MARKET, BY SOLUTION, 2023 V/S 2030 (USD MILLION) 92

-

REST OF THE WORLD TELECOM ANALYTICS MARKET, BY SERVICE, 2023 V/S

-

-

REST OF THE WORLD TELECOM

-

ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023 V/S 2030 (USD MILLION) 93

-

REST OF THE WORLD TELECOM ANALYTICS MARKET, BY DEPLOYMENT, 2023 V/S

-

KEY PLAYERS MARKET SHARE ANALYSIS, 2023

-

(%) 100

Leave a Comment